President Donald Trump’s tariffs are raising government revenues, but how much is the US Treasury actually collecting from US importers after the starts, stops, delays, exclusions, and other factors? And what products and countries are hit? This monthly tracker measures tariff revenues in practice over time.

Tariffs are taxes collected by the US government from US businesses when they import goods. The tariff revenues are expressed as a percentage of monthly total import values that US businesses pay (monthly tariff revenue divided by monthly import value, by category or country), including shipping and insurance. These percentages are generally lower than press reports of headline tariff rates because the headline rates do not take exemptions or delays into account. For example, in August 2025, Trump exempted aircraft from the general 15 percent tariff on imports from the European Union agreed at that time.

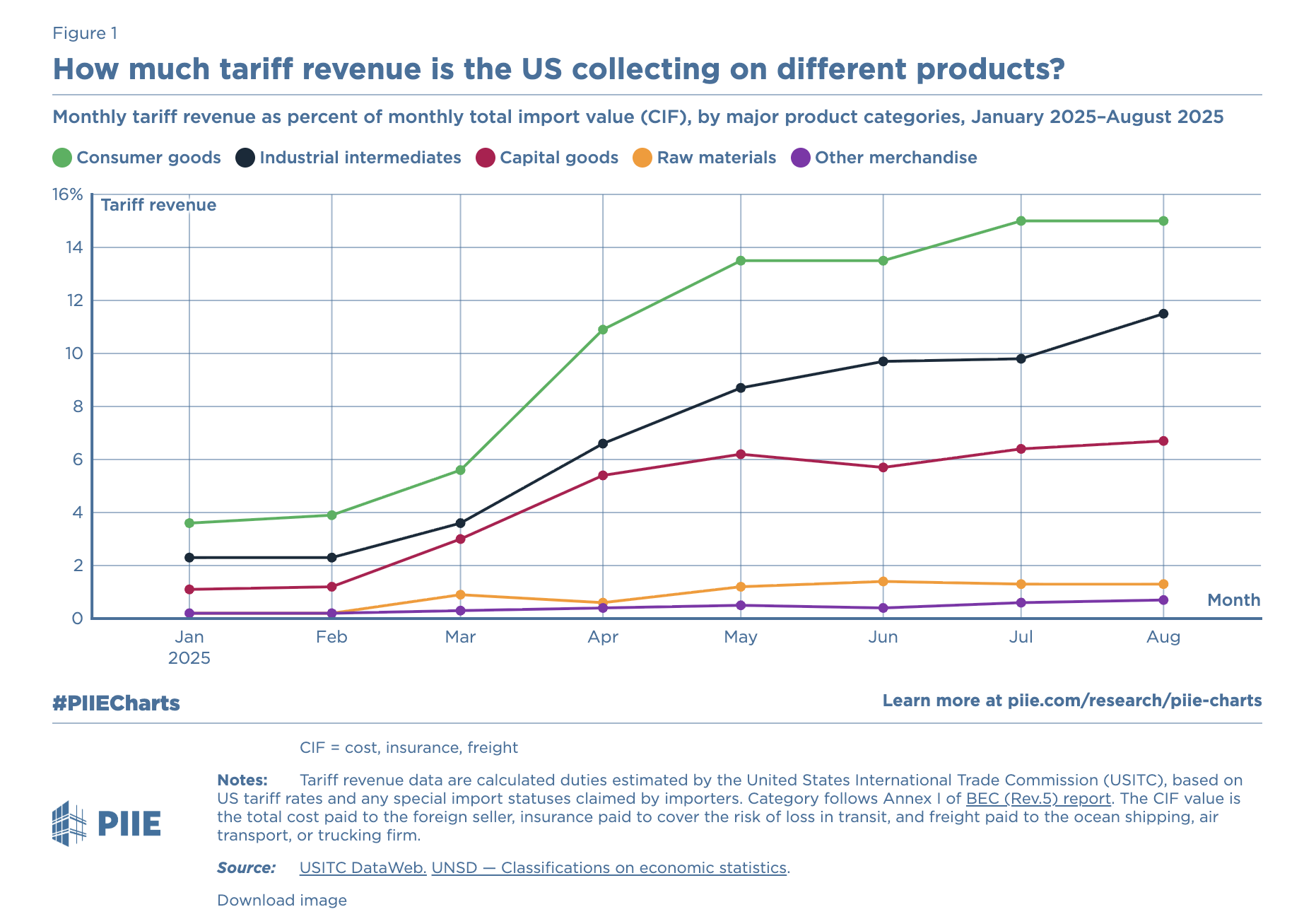

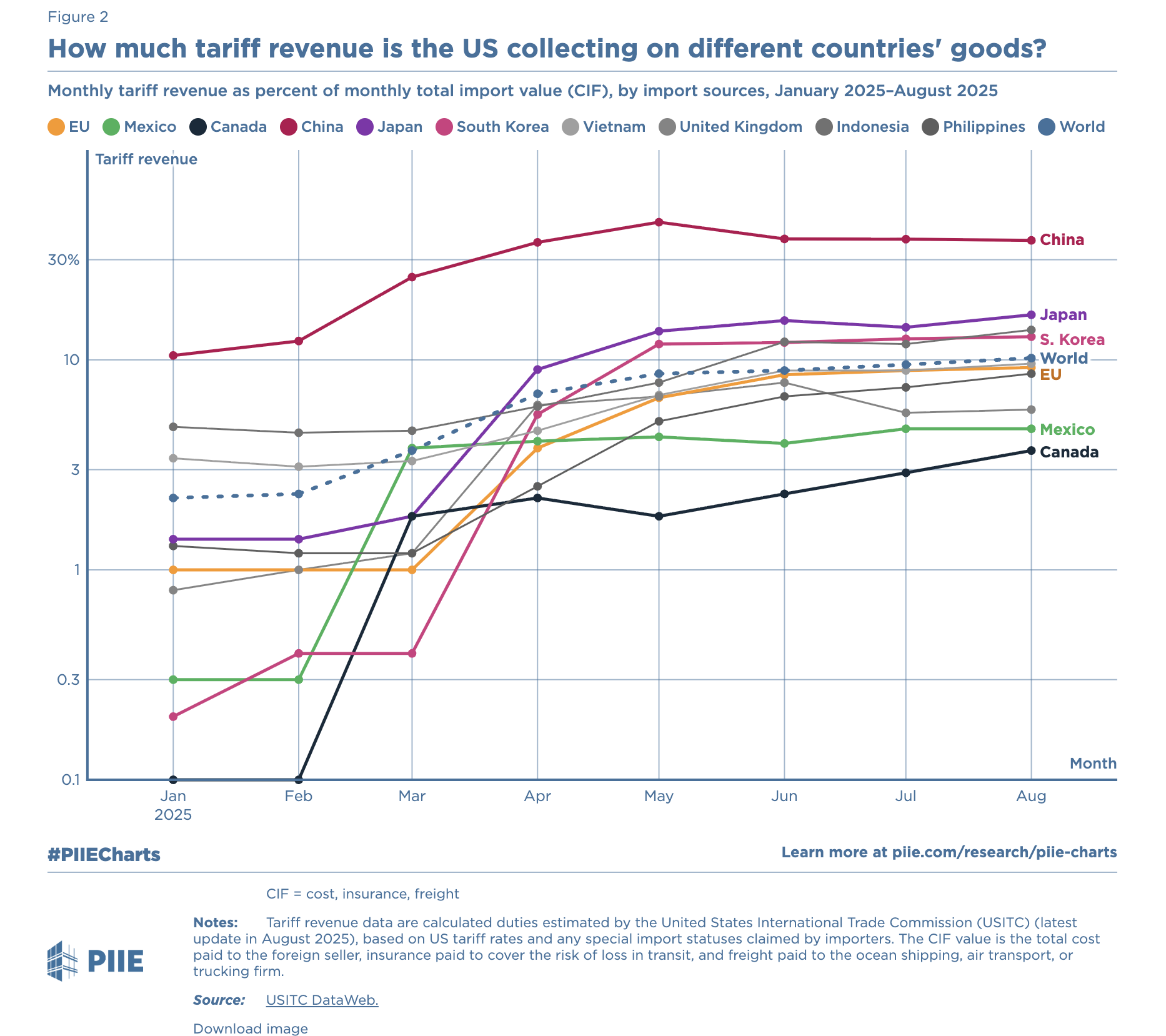

This measure of tariff revenues is significant for three reasons. First, in light of Trump’s varied tariffs on individual sectors and new country-specific tariff rates, the measure summarizes the effective impact of tariffs on a given class of goods (figure 1) or an individual country’s goods (figure 2). For example, consumer goods accounted for some $89 billion worth of imports in January 2025, with $3.2 billion estimated tariff revenue, meaning the tariff revenue equaled 3.6 percent of the total import value (3.2 divided by 89). Similarly, imports from China amounted to $43 billion in January 2025, and the $4.5 billion tariff revenue is roughly 10.5 percent (4.5 divided by 43) of the import value.

Second, this tracker shows the delay in costs paid by US importers. Many importers do not pass the rising cost of new tariffs on to their customers until inventory used for production bears the higher cost. In other words, old inventory is not marked up to reflect the tariff cost of new inventory. Given that practice, the impact of higher tariffs on consumer prices (measured by the consumer price index [CPI] or the personal consumption expenditures [PCE] price index) is delayed for several months after the tariff announcement. The delay is still longer if importers choose to absorb the tariff for a while.

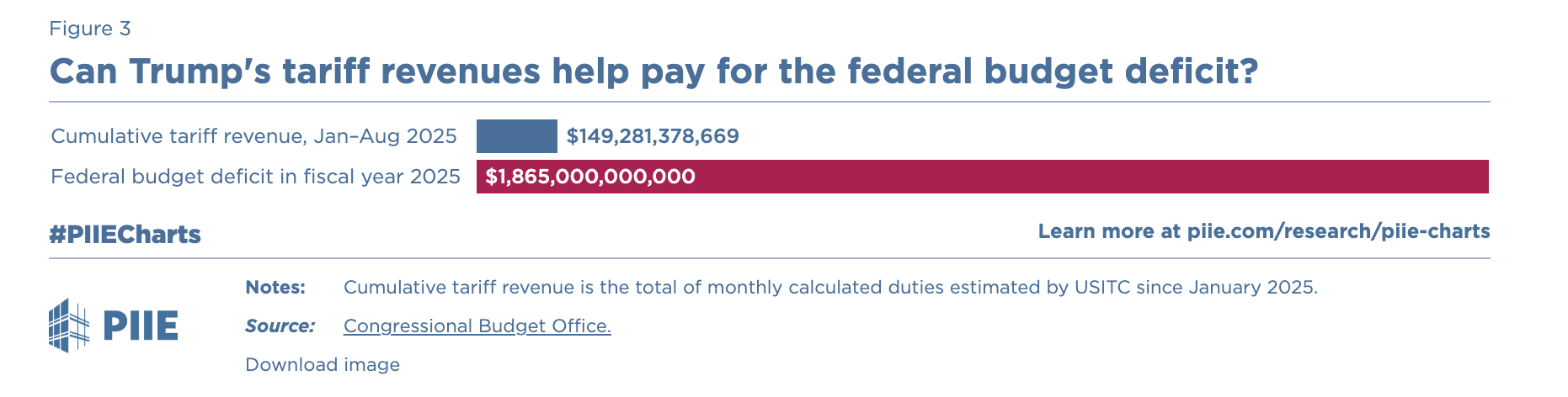

Third, Trump claims that tariffs can make an outsize fiscal contribution. This claim can be put in perspective by comparing actual tariff revenues with the size of the projected budget deficit (figure 3). The Congressional Budget Office projected the federal budget deficit in fiscal year 2025 will be $1.9 trillion. As of August 2025, tariff revenues since January 2025 totaled $149 billion, contributing just 8 percent of the projected deficit. It is worth noting that federal revenues collected during the fiscal year-to-date (October 2024 to August 2025) are $299 billion higher than the same period in the previous fiscal year, while the federal deficit is $76 billion larger. But tariff revenues since January 2025 are still only 2.9 percent of the projected total federal revenue in fiscal year 2025 of $5.2 trillion.

click here to read more