President Donald Trump promised during his recent campaign to impose steep tariffs on other countries, assuring voters that the cost would be paid by foreign sellers, not Americans. In September 2024, for example, Trump told supporters:

“We’re going to be a tariff nation. It’s not going to be a cost to you. It’s going to be a cost to another country…. I heard Kamala the other day, Comrade Kamala. She said, 'Oh, if you do that, he’s raising your taxes.' No. No. No. I’m not raising your taxes. I’m raising China and all of these countries in Asia and all over the world, including the European Union by the way, which is one of the most egregious.”

Following his inauguration in January, Trump made similar claims as he issued multiple executive orders slapping tariffs on merchandise imports from countries near and far.

But the data suggest that US businesses have absorbed most of the tariff costs through July 2025, not foreign sellers.

This blog post explores the effects of Trump’s tariffs on import prices for these five broad product categories to identify who has borne the costs so far. After all, the tariffs paid by the importers of record have to show up in one of three places: lower prices paid to foreign sellers, smaller spreads earned by US firms between the cost of imported goods and their selling prices, or higher prices paid by US households.

The US government has collected growing revenue from the tariffs paid by US importers, but the prices paid to foreign sellers for many imported consumer goods have changed very little. Meanwhile, American consumers have not yet seen much change in retail prices for most imported goods.

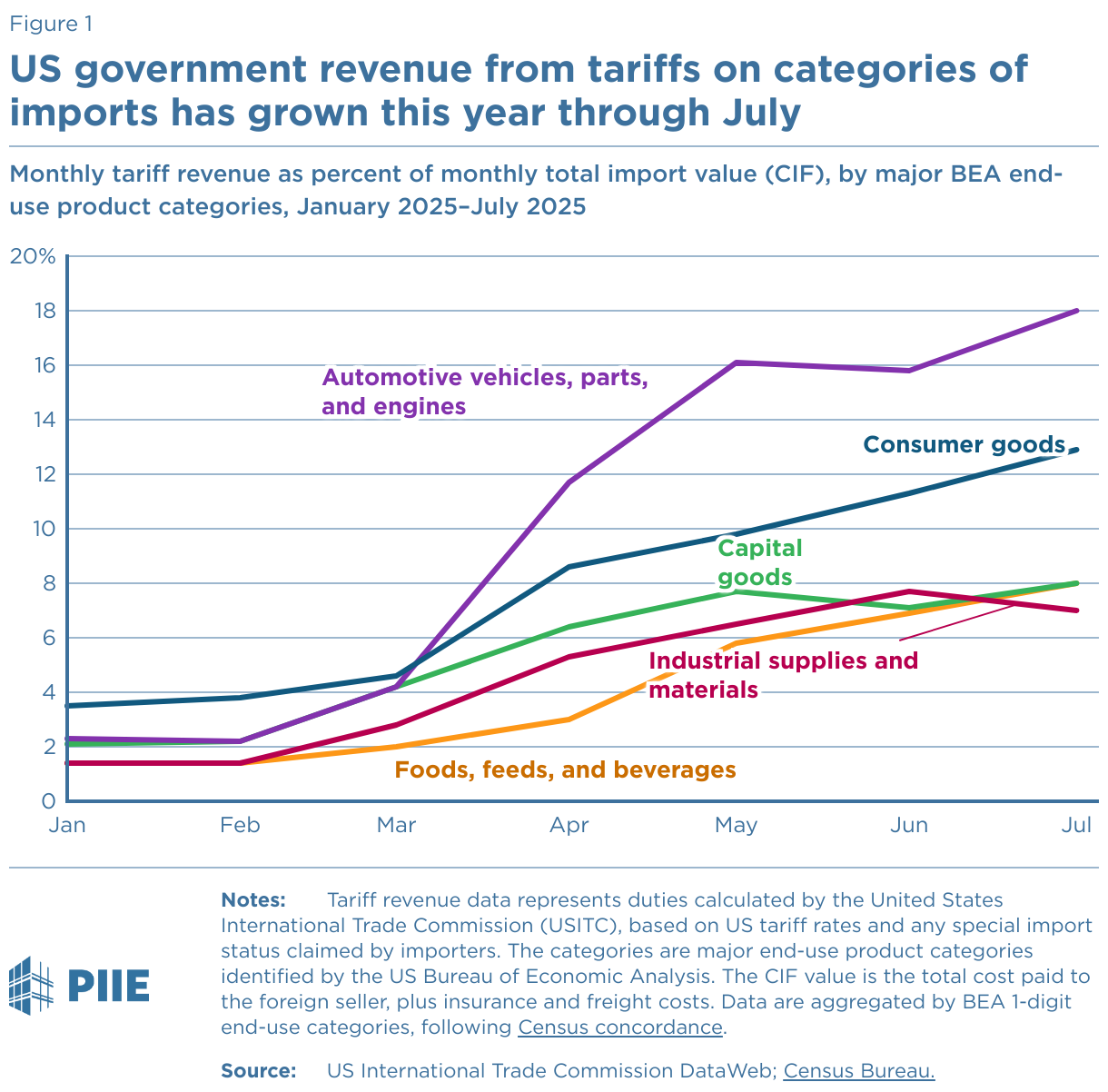

As depicted in figure 1, revenue from US tariffs on five broad categories of imported products, expressed as a percentage of import value, have progressively increased this year through July. The categories are automotive vehicles, parts, and engines; consumer goods; non-auto capital goods; foods, feeds, and beverages; and industrial supplies and materials.

Three scholars—Cavallo, Llamas, and Vazquez—have documented the short-term price behavior of thousands of individual retail items following the imposition of Trump’s tariffs. They found that average retail prices for imported items increased more than average retail prices for domestic items following tariffs imposed on March 4, 2025 (see their figure 2). Moreover, through August 2025, they found that retail prices of domestic items that were close substitutes to imported items increased almost as much as retail prices of imported items.

But there’s an important qualification. According to Cavallo et al., average retail prices for imported items were just 2 percent higher in August 2025 than in October 2024. By comparison, we calculate that tariff revenue on imported consumer goods as percent of monthly total import value amounted to about 13 percent in July 2025 (figure 1). This indicates that Trump’s tariffs on imported consumer goods were far from completely reflected in retail prices as of August 2025.

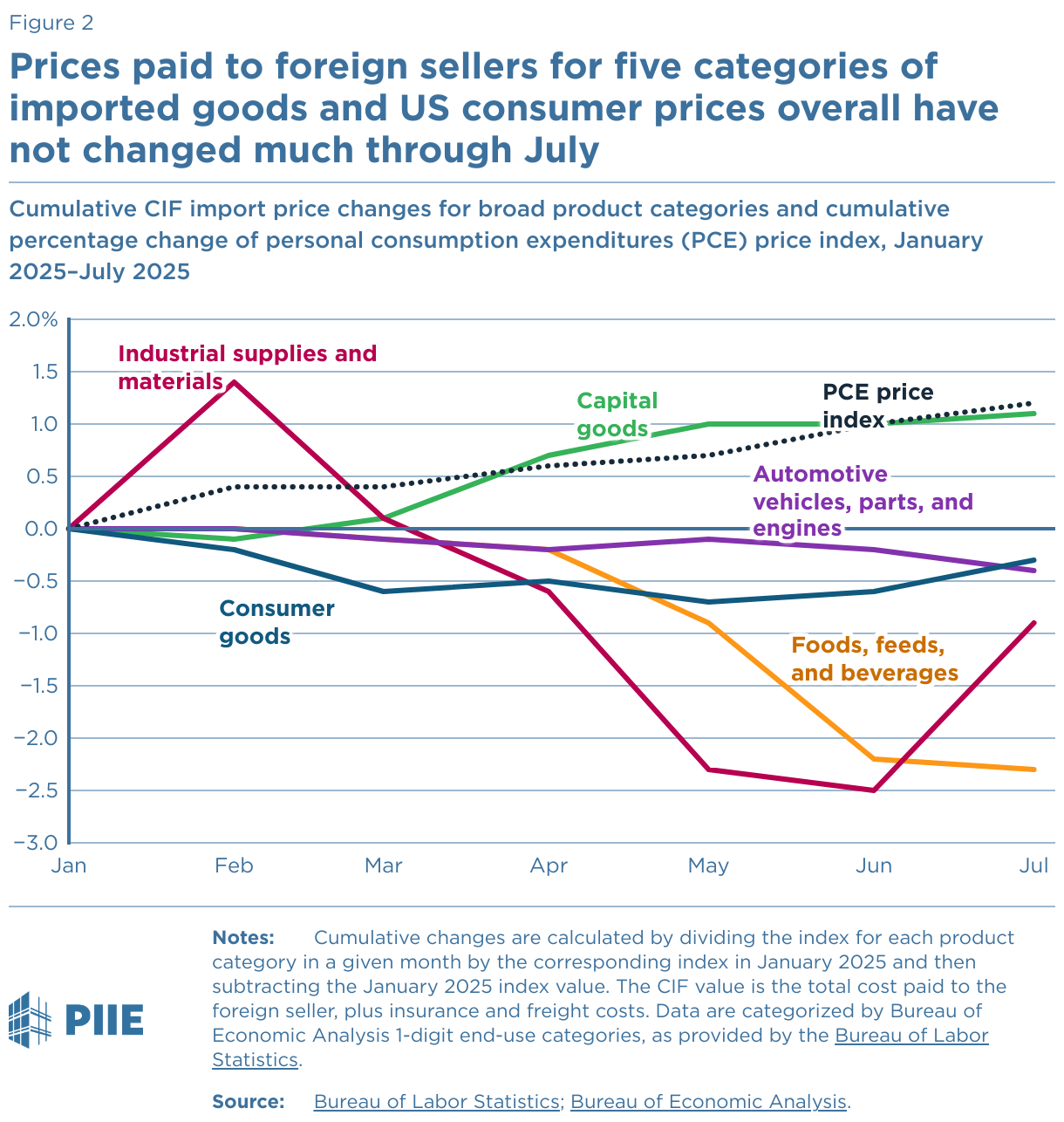

Figure 2 shows cumulative changes in import prices paid to foreign sellers—including the cost of the goods, plus insurance and freight (CIF)—starting in January 2025 for the five broad product categories depicted in figure 1. The import price experience for the broad category of consumer goods imports through July 2025 roughly resembles the average retail price experience for imported consumer items reported by Cavallo et al. In other words, neither the prices paid to the sellers nor the prices paid by consumers changed much. Moreover, the general price experience of all five broad product categories through July 2025 is much the same: The maximum price decline has been around 2.5 percent, and most categories’ prices have declined far less.

Figure 2 thus provides very little support for Trump’s thesis that foreign sellers are absorbing tariffs by lowering their prices on US imports.

Yet, as figure 1 shows, tariff revenue expressed as a percentage of the total CIF import values escalated sharply for all five product categories starting in March 2025.

The study by Cavallo et al. shows that households are so far bearing only a small part of the tariff burden on consumer goods. Comparable studies of granular item prices are not available for the other broad product categories, and it is possible that firms and households are already paying somewhat higher prices for these items. A recent study by the Budget Lab estimates that the consumer passthrough on imported goods was roughly 70 percent as of June 2025.

However, the overall impact on the US Commerce Department’s price index for personal consumption expenditures (PCE) thus far remains limited. As of July 2025, the PCE price index had only increased by around 1.2 percent compared to January 2025. In other words, through the middle of 2025, American consumers were not bearing much of the tariff burden.

The logical conclusion is that, at least through July 2025, US firms were absorbing most of the tariff burden through compressed spreads between the cost of imported goods paid by the firms and the selling prices they received. Many firms probably based their selling prices on the historic cost of inventory imported prior to Trump’s tariffs, thereby delaying the impact on consumers.

Meanwhile, Trump’s tariffs imposed while citing the International Emergency Economic Powers Act of 1977 (IEEPA) have been rejected by both the US Court of International Trade and the US Federal Circuit Court of Appeals. A final appeal to the Supreme Court is underway.

If the Supreme Court affirms the lower courts’ decisions, the federal government could have to refund much of the tariff revenue collected this year. But if the Supreme Court reverses the lower courts and affirms IEEPA tariffs, US firms may start passing the added costs to households. While the tariffs have so far had a modest effect on inflation, eventually consumers could see higher prices.

Data Disclosure

The data underlying this analysis can be downloaded here [zip].

Related Documents