Overview

At its meeting on 11 September 2025, the Governing Council decided to keep the three key ECB interest rates unchanged. Inflation is currently at around the 2% medium-term target and the Governing Council’s assessment of the inflation outlook is broadly unchanged.

The September 2025 ECB staff macroeconomic projections for the euro area present a picture of inflation similar to that projected in June. They see headline inflation averaging 2.1% in 2025, 1.7% in 2026 and 1.9% in 2027. For inflation excluding energy and food, they expect an average of 2.4% in 2025, 1.9% in 2026 and 1.8% in 2027. The economy is projected to grow by 1.2% in 2025, revised up from the 0.9% expected in June. The growth projection for 2026 is now slightly lower, at 1.0%, while the projection for 2027 is unchanged at 1.3%.

The Governing Council is determined to ensure that inflation stabilises at its 2% target in the medium term. It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook and the risks surrounding it, in light of the incoming economic and financial data, as well as the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

Economic activity

The economy grew by 0.7% in cumulative terms over the first half of 2025, on account of the resilience in domestic demand. The quarterly pattern showed stronger growth in the first quarter and weaker growth in the second quarter, partly reflecting an initial frontloading of international trade ahead of expected tariff increases and then a reversal of that effect.

Survey indicators suggest that both manufacturing and services continue to grow, signalling some positive underlying momentum in the economy. Even if demand for labour is softening, the labour market remains a source of strength, with the unemployment rate at 6.2% in July 2025. Over time, this should boost consumer spending, especially if, as foreseen in the September 2025 projections, people save less of their income. Consumer spending and investment should benefit from the Governing Council’s past interest rate cuts feeding through to financing conditions. Investment should also be underpinned by substantial government spending on infrastructure and defence.

Trade tariffs and related uncertainty contributed to strong fluctuations in economic activity during the first half of 2025, with frontloading of activity, especially in Ireland. The unwinding of these factors in the second half of the year is expected to entail further volatility, blurring signals of the underlying momentum of the euro area economy. In fact, looking through the volatility caused by the fluctuations in Irish data, economic growth in the rest of the euro area was more stable, and it is expected to remain so in the second half of the year. Although the new US-EU trade agreement implies higher tariffs on euro area exports to the United States, it has helped to reduce trade policy uncertainty. The overall impact of the change in the global policy environment will only become clear over time. Later in the horizon economic growth in the euro area is projected to strengthen, supported by several factors. Rising real wages and employment, together with new government spending on infrastructure and defence, mainly in Germany, should bolster euro area domestic demand. Furthermore, less restrictive financing conditions – mainly reflecting recent monetary policy decisions – and a rebound in foreign demand in 2027 are also seen to support the growth outlook.

Annual average real GDP growth is projected to be 1.2% in 2025, 1.0% in 2026 and 1.3% in 2027. Compared with the June 2025 projections, the outlook for GDP growth has been revised up by 0.3 percentage points for 2025, reflecting better than expected incoming data and a carry-over effect from revisions to historical data. As not all of the data surprises relate to stronger than previously assumed frontloading of activity, they are only seen to be partly offset in the second half of the year. The appreciation of the euro and weaker foreign demand (in part related to somewhat higher tariffs than assumed in the June projections) have resulted in a 0.1 percentage point downward revision for 2026. The projection for 2027 remains unchanged.

The Governing Council considers it crucial to urgently strengthen the euro area and its economy in the present geopolitical environment. Fiscal and structural policies should make the economy more productive, competitive and resilient. One year on from the release of Mario Draghi’s report on the future of European competitiveness, it remains essential to follow up on its recommendations with further concrete action and to accelerate implementation, in line with the European Commission’s roadmap. Governments should prioritise growth-enhancing structural reforms and strategic investment, while ensuring sustainable public finances. It is critical to complete the savings and investments union and the banking union, to an ambitious timetable, and to rapidly establish the legislative framework for the potential introduction of a digital euro.

Inflation

Annual inflation remains close to the Governing Council’s target, edging up to 2.1% in August 2025 from 2.0% in July. Energy price inflation was -1.9%, after -2.4% in July, while food price inflation declined to 3.2% from 3.3%. Inflation excluding energy and food stayed constant at 2.3%. Services inflation edged down to 3.1%, from 3.2% in July, while goods inflation was unchanged at 0.8%.

Indicators of underlying inflation remain consistent with the Governing Council’s 2% medium-term target. Year-on-year growth in compensation per employee was 3.9% in the second quarter, down from 4.0% in the previous quarter and 4.8% in the second quarter of 2024. Forward-looking indicators, including the ECB’s wage tracker and surveys on wage expectations, suggest that wage growth will moderate further. Along with productivity gains, this will help keep a lid on domestic price pressures, even as profits recover from low levels.

The new ECB staff projections present a picture of inflation similar to that projected in June. Headline inflation, as measured by the Harmonised Index of Consumer Prices (HICP), is projected to move sideways, at around 2%, for the rest of 2025, and then to drop to an average of 1.7% in 2026 before recovering to 1.9% in 2027. The drop in 2026 reflects a further gradual easing in the non-energy components, while energy inflation is expected to remain volatile, but to rise over the projection horizon, in part because of the start of the EU Emissions Trading System 2 in 2027. Food inflation is expected to remain elevated initially, as lagged effects from past price increases in international food commodities feed through, but to moderate to rates somewhat above 2% in 2026 and 2027.

HICP inflation excluding energy and food is expected to fall from 2.4% in 2025 to 1.9% in 2026 and 1.8% in 2027, as wage pressures recede and services inflation moderates, while the appreciation of the euro feeds through the pricing chain and curbs goods inflation. Lower wage growth, as past real wage losses have been recouped, coupled with a recovery in productivity growth, is expected to lead to significantly slower unit labour cost growth.

Compared with the June 2025 projections, the outlook for headline HICP inflation has been revised up by 0.1 percentage points for both 2025 and 2026. This is on account of higher energy commodity price outcomes and assumptions, as well as lagged effects from higher international food commodity prices, which more than offset the effects of the appreciation of the euro. For 2027, the lagged effects of the appreciation of the euro are seen to predominate, resulting in a 0.1 percentage point downward revision.

Most measures of longer-term inflation expectations continue to stand at around 2%, supporting the stabilisation of inflation around the Governing Council’s target.

Risk assessment

Risks to economic growth have become more balanced. While recent trade agreements have reduced uncertainty, a renewed worsening of trade relations could further dampen exports and drag down investment and consumption. A deterioration in financial market sentiment could lead to tighter financing conditions, greater risk aversion and weaker growth. Geopolitical tensions, such as Russia’s unjustified war against Ukraine and the tragic conflict in the Middle East, remain a major source of uncertainty. By contrast, higher than expected defence and infrastructure spending, together with productivity-enhancing reforms, would add to growth. An improvement in business confidence could stimulate private investment. Sentiment could also be lifted and activity spurred if geopolitical tensions diminished, or if the remaining trade disputes were resolved faster than expected.

The outlook for inflation remains more uncertain than usual, as a result of the still volatile global trade policy environment. A stronger euro could bring inflation down further than expected. Moreover, inflation could turn out to be lower if higher tariffs lead to lower demand for euro area exports and induce countries with overcapacity to further increase their exports to the euro area. Trade tensions could lead to greater volatility and risk aversion in financial markets, which would weigh on domestic demand and would thereby also lower inflation. By contrast, inflation could turn out to be higher if a fragmentation of global supply chains pushed up import prices and added to capacity constraints in the domestic economy. A boost in defence and infrastructure spending could also raise inflation over the medium term. Extreme weather events, and the unfolding climate crisis more broadly, could drive up food prices by more than expected.

Financial and monetary conditions

Since the Governing Council’s monetary policy meeting in July 2025 short-term market rates have increased, while longer-term rates have remained broadly unchanged. However, the Governing Council’s past interest rate cuts continued to lower corporate borrowing costs in July. The average interest rate on new loans to firms moved down to 3.5% in July, from 3.6% in June. The cost of issuing market-based debt was unchanged, at 3.5%. Loans to firms grew by 2.8%, slightly more strongly than in June, while the growth of corporate bond issuance rose to 4.1% from 3.4%. The average interest rate on new mortgages was again unchanged at 3.3% in July, while growth in mortgage lending picked up to 2.4%, from 2.2%.

Monetary policy decisions

The interest rates on the deposit facility, the main refinancing operations and the marginal lending facility were kept unchanged at 2.00%, 2.15% and 2.40% respectively.

The asset purchase programme and pandemic emergency purchase programme portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

Conclusion

At its meeting on 11 September 2025, the Governing Council decided to keep the three key ECB interest rates unchanged. The Governing Council is determined to ensure that inflation stabilises at its 2% target in the medium term. It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. The Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook and the risks surrounding it, in light of the incoming economic and financial data, as well as the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

In any case, the Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises sustainably at its medium-term target and to preserve the smooth functioning of monetary policy transmission.

1 External environment

Global economic activity is expected to remain steady but subdued in the near term following stronger than expected growth in the first half of 2025 that is unlikely to be sustained. Global import growth is expected to decline, as the frontloading-related surge observed earlier in the year in anticipation of tariff increases is expected to fade away. Higher US tariffs and still elevated uncertainty are reshaping global trade flows and posing a risk to logistics, although global supply chain pressures appear to be contained so far. Disinflation seems to have paused in some advanced economies, with core goods inflation showing renewed momentum, particularly in the United States. Against this background, the September 2025 ECB staff macroeconomic projections for the euro area foresee a weaker global growth outlook going forward. Nevertheless, the slowdown in global activity is expected to be less steep than predicted in the June 2025 Eurosystem staff macroeconomic projections, reflecting positive data surprises, while fiscal expansion in the United States, receding trade policy uncertainty and easing global financial conditions are expected to cushion the impact of newly announced tariffs. Globally, headline consumer price index (CPI) inflation is expected to moderate over the projection horizon, notwithstanding the projected pick-up in headline CPI inflation in the United States in 2026 on account of tariffs, fiscal expansion and the depreciation of the US dollar.

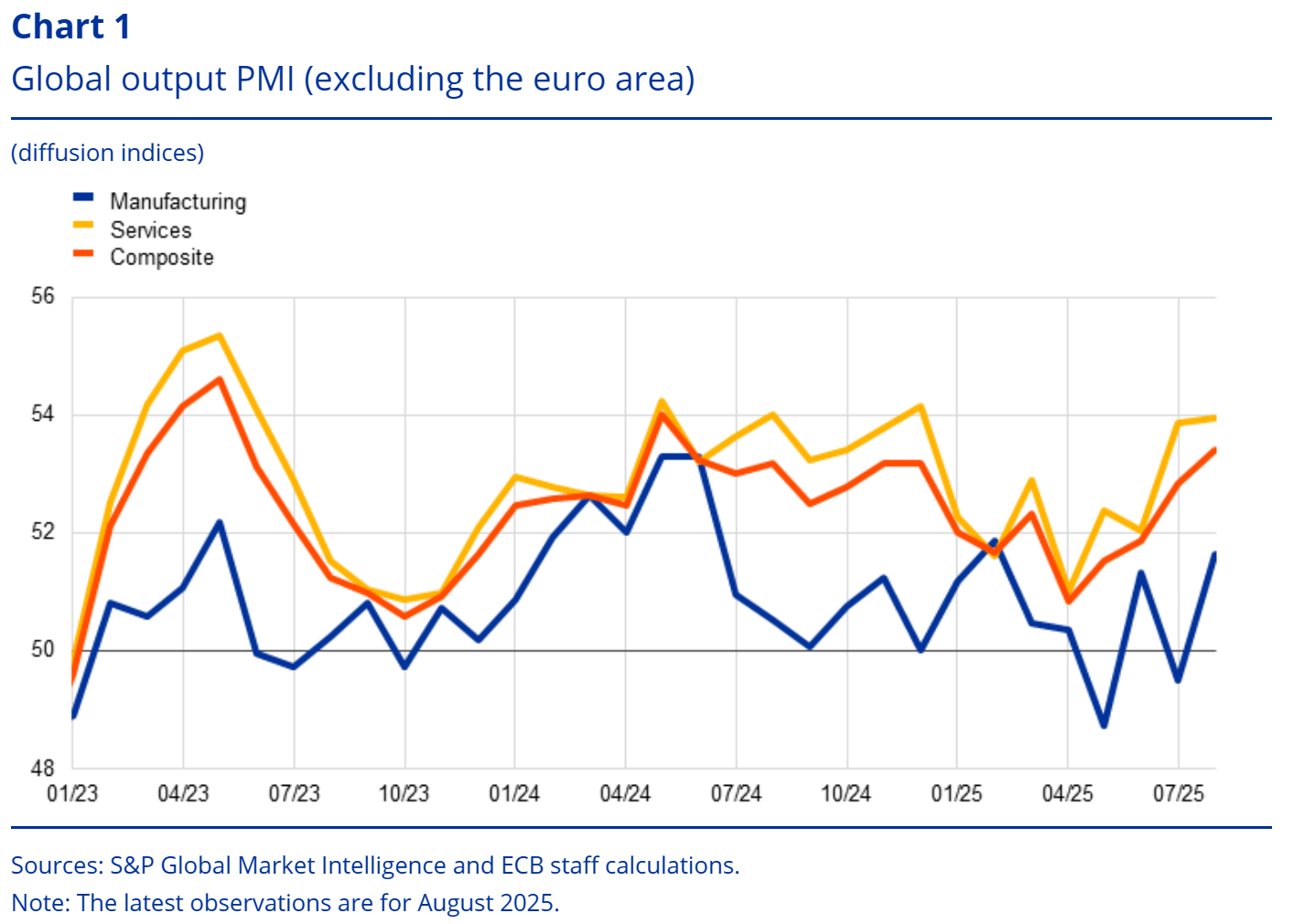

Global growth (excluding the euro area) is expected to remain subdued but steady over the near term. Global GDP grew by 0.9% quarter-on-quarter in the second quarter, up from 0.7% in the first quarter. While activity surprised on the upside in major economies, such as the United States and China, it reflected large swings in net exports and inventories rather than underlying strength in the global economy. These frontloading-related distortions – due to precautionary behaviour by firms and consumers ahead of tariffs – are expected to fade gradually, meaning their temporary boost to activity is unlikely to be sustained into the second half of the year. Recent data support this assessment, with the ECB staff nowcasting model pointing to weaker real GDP growth in the third quarter. The global composite output Purchasing Managers’ Index (PMI) improved in August, supported by the manufacturing sector rebounding out of contraction territory to 51.6, while services output remained broadly stable at 54.0 (Chart 1).

The global growth outlook is expected to weaken, although less sharply than envisaged in the June 2025 Eurosystem staff macroeconomic projections. Global growth is projected to slow over the projection horizon, drifting below its pre-pandemic average (3.6%), as tariffs and policy uncertainty weigh on consumption and erode investment prospects. According to the September 2025 ECB staff macroeconomic projections, global real GDP is projected to grow at 3.3% in 2025 (down from 3.6% in 2024), with growth decreasing further to 3.1% in 2026 before recovering modestly to 3.3% in 2027.[1] While real GDP growth surprised on the upside in the second quarter of 2025 across major economies (e.g. in the United States, China and the United Kingdom), recent economic data point to a slowdown in activity in the second half of the year, notably amid weakening labour demand in the United States and decelerating retail sales and investment in China. Risks surrounding the global outlook remain tilted to the downside, as a re-escalation of the trade war could dampen activity. In addition, fiscal sustainability concerns in large advanced economies may trigger excessive financial market volatility and negative spillovers globally. On the upside, successful trade negotiations – particularly between the United States and China – could avert a major escalation of tariffs and help reduce global policy uncertainty.

Global trade dynamics are expected to weaken amid higher tariffs and persistent trade policy uncertainty, the apparent resilience in the first half of 2025 notwithstanding. Global trade slowed in the second quarter and is expected to soften further, offsetting the surge observed in the first quarter. The ECB trade tracker, which is based on incoming high-frequency indicators, points to subdued trade dynamics in the third quarter with the momentum still negative in July and August. According to the September 2025 ECB staff macroeconomic projections, global import growth is expected to decline significantly from 4.2% in 2024 to 2.8% in 2025 and 1.5% in 2026, before recovering to 3.1% in 2027. The sharp slowdown going forward reflects the unwinding of earlier frontloading, the impact of tariffs and elevated trade policy uncertainty, which dampens investment, leading to a less trade-intensive composition of global demand. As US imports are expected to rebound after contracting in 2026, global trade is expected to recover somewhat in 2027, although at a slower pace than global real GDP growth. Compared with the June 2025 Eurosystem staff macroeconomic projections, global import growth has been revised down, largely due to newly implemented tariffs compounded by a downward reassessment of the import intensity of growth in China. Finally, while tariffs can pose challenges for logistics, broad-based global supply chain pressures are currently contained. Some signs of strain are visible in sectors such as aluminium, steel and textiles, but these remain far more muted than the disruptions observed during the post-pandemic period.

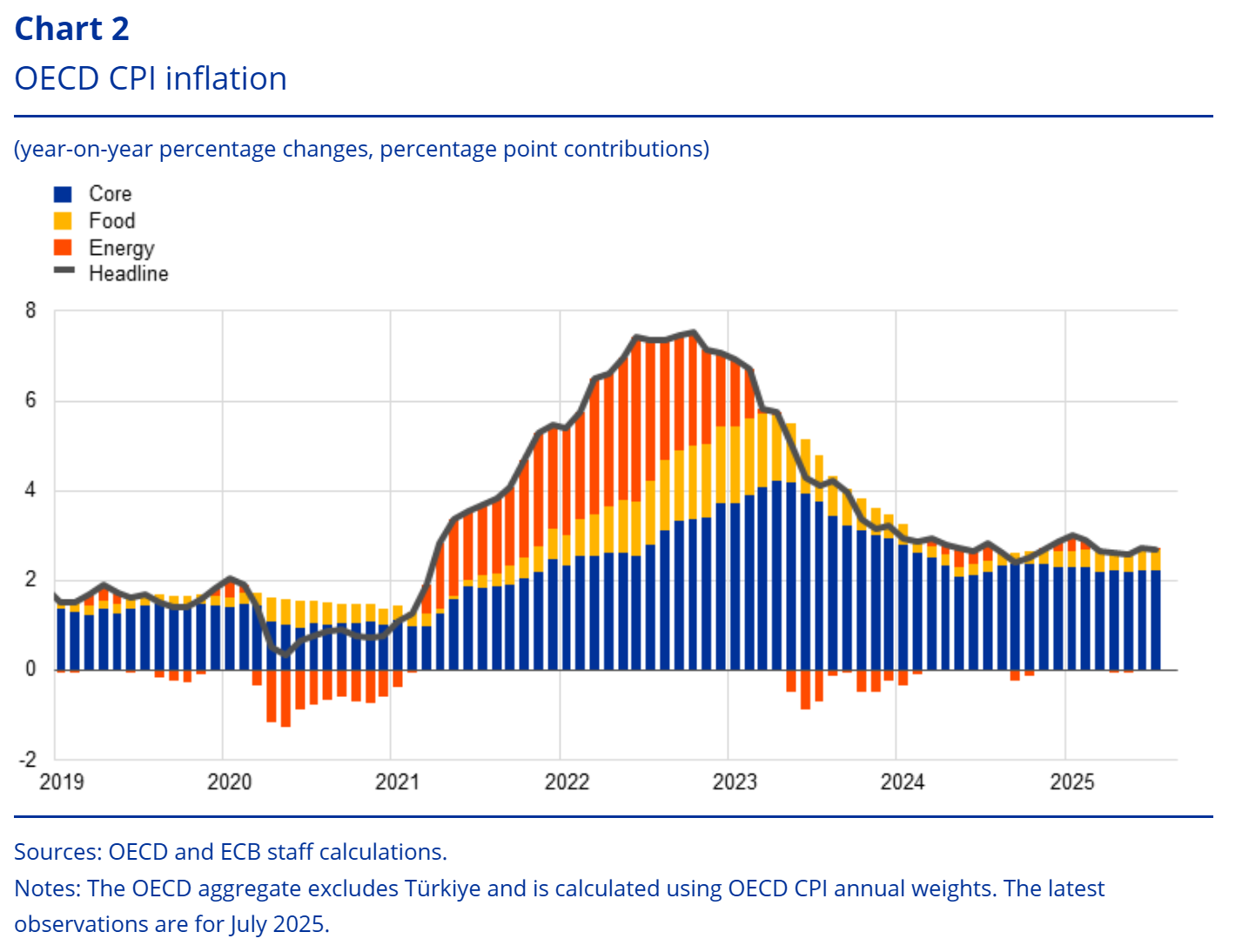

Headline inflation across Organisation for Economic Co-operation and Development (OECD) members remained above 2% and core inflation increased slightly in July. Excluding Türkiye, annual CPI inflation across the OECD remained stable at 2.7% in July (Chart 2). While both energy and food price inflation receded in July (by 0.6 percentage points compared with June to 0.2% for energy, and by 0.1 percentage points to 3.4% for food), core inflation increased slightly to 3.1%, up from 3.0% in both May and June. Looking forward, PMI surveys on input and output prices are signalling a slight acceleration over the near term in advanced economies, mostly driven by developments in the United States.

Annual headline CPI inflation across a broad group of advanced economies and emerging markets is projected to moderate further over the projection horizon, notwithstanding inflationary pressures in the United States. Compared with the June 2025 Eurosystem staff macroeconomic projections, inflation has been revised downwards slightly for 2025 across large economies, such as the United States, China and India, owing to lower than expected data outturns in the second quarter. By contrast, inflation projections across a broad group of advanced economies and emerging markets have been revised upwards for 2026, as higher tariffs and fiscal expansion are projected to intensify inflationary pressures in the United States. This also partly reflects a delayed pass-through of tariffs, since duties primarily affected goods located upstream in supply chains and earlier frontloading allowed firms to build up inventories of tariffed goods. Globally, the upward revision of US headline CPI inflation in 2026 is partly offset by downward revisions across emerging market economies, reflecting in particular the weaker-than-expected inflation momentum in China and India. According to the September 2025 ECB staff macroeconomic projections, a global composite of headline CPI inflation across advanced and emerging economies is projected to moderate from 4.0% in 2024 to 3.2% in 2025, before easing further to 2.9% in 2026 and 2.5% in 2027.[2]

Oil prices increased owing to geopolitical tensions in the Middle East, while gas prices declined following peace talks between Russia and Ukraine. Oil prices rose by 1.4% over the review period (5 June to 10 September), driven by a sharp increase following Israeli and US military strikes on Iran in mid-June. The initial rise was, however, partly reversed, as the risk of further escalation subsided. Additional downward pressure came from two successive OPEC+ decisions to raise output, completing the unwinding of the 2.2 million barrels per day production cuts introduced by the cartel in November 2023 at a pace that has surprised markets. European gas prices initially came under pressure from abundant liquified natural gas supply and subdued domestic demand, which kept gas storage on track to reach adequate levels ahead of next winter. Prices fell further following the resumption of peace talks between Russia and Ukraine, reaching their lowest level in more than a year and declining by 14.6% over the review period. Metal prices increased by 1%, led by copper as markets anticipated the implementation of US tariffs on that commodity. However, initial gains were later partially reversed after the United States unexpectedly excluded refined copper from the measures, restricting its tariffs to semi-finished products. Food prices declined by 7.7%, mainly due to a drop in cocoa prices, which experienced volatile movements over the period owing to weather-related factors.

In the United States, core GDP components (private consumption and investment) decelerated in the first half of 2025, while inflation picked up partly due to tariffs. While real GDP growth rebounded to 0.7% quarter-on-quarter in the second quarter (after a 0.1% contraction in GDP in the previous quarter), it was driven by a strong net trade contribution and falling inventories largely offsetting earlier tariff-related trade dynamics. By contrast, real final sales to private domestic purchasers (excluding government expenditure, net trade and inventories) continued to decelerate in the second quarter. Activity is expected to moderate in the second half of the year as tariffs, weak confidence and slowing real disposable income growth weigh on consumption and investment. This is consistent with signs of weakening labour demand as non-farm payrolls surprised on the downside in July and August, with sizeable downward revisions for previous months as well. On the nominal side, headline personal consumption expenditure (PCE) inflation remained unchanged at 2.6% in July, while core PCE inflation increased to 2.8% (up 0.1 percentage points compared with the previous month) amid signs that tariffs are starting to feed through to core goods prices, especially in categories closely linked to tariffed imports (e.g. household furnishings, recreation goods). While US producers and retailers may currently be absorbing most of the tariff increases – with high corporate profits and pre-emptive inventory accumulation acting as temporary buffers – the pass-through of higher tariffs to consumer prices is expected to increase over time. Against this background, and with inflationary pressures triggered by US fiscal expansion and US dollar depreciation, the September 2025 ECB staff macroeconomic projections foresee headline CPI inflation rising to 3.3% in 2026, markedly up from 2.8% in 2025. In his Jackson Hole speech on 22 August, Federal Reserve Chair Jerome Powell acknowledged that “downside risks to employment are rising” and noted that the balance of risks may warrant policy adjustment.

In China, export growth remained resilient, while domestic demand weakened further. The economy stayed broadly robust in the first half of 2025 amid strong export growth, but momentum slowed in the third quarter as July data on retail sales, industrial production and fixed asset investment all surprised on the downside. Beyond policy-supported sectors, domestic demand remains weak with a persistently soft housing market and subdued consumer spending outside of subsidised goods. Exports, however, continued to perform strongly in July and should remain resilient in the near term, supported by the extension of the US-China tariff pause to November. Inflationary pressures remained muted in July, with consumer prices flat at 0.0% year-on-year (down 0.1 percentage points from the previous month) and producer prices deeply in negative territory at -3.6% year-on-year (unchanged from the previous month). In response, authorities stepped up the “anti-involution” campaign in mid-2025, introducing stronger measures to curb predatory price competition and excess capacity, especially in green sectors, such as solar, batteries and electric vehicles. However, it remains unclear whether these initiatives will be sufficient to materially ease deflationary pressures going forward.

In the United Kingdom, real GDP growth moderated in the second quarter while inflation continued to increase. Output grew by 0.3% quarter-on-quarter in the second quarter, surprising on the upside but slowing from the first quarter when activity had been strongly supported by the frontloading of demand ahead of tariffs and tax measures. Looking ahead, activity is expected to remain moderate in the near term amid global headwinds and uncertainty surrounding the Autumn Budget, with anticipated tax increases likely to weigh on confidence. Annual headline inflation rose further to 3.8% in July (up 0.2 percentage points from the previous month), driven by persistent services inflation, with transport – especially volatile air fares – being the largest contributor. Inflation is projected to peak in the third quarter on account of regulated energy price changes, before gradually easing towards target. Against this backdrop, the Bank of England lowered its Bank Rate by 25 basis points to 4% in August.

2 Economic activity

Tariffs and related uncertainty contributed to strong fluctuations in economic activity during the first half of 2025, with frontloading of activity, especially in Ireland. Following the strong first-quarter outcome of 0.6%, real GDP growth slowed in the second quarter, edging up by 0.1%, quarter on quarter. Employment rose by 0.1% in the second quarter, at the same rate as GDP. From a sectoral perspective, the services sector was the main contributor to growth in the second quarter, growing at a similar pace to the first quarter. Meanwhile, growth in industry slowed vis-à-vis the first quarter as frontloading effects unwound, tariffs increased and geopolitical and trade policy uncertainty remained elevated. Survey data are sending somewhat mixed signals, but overall point to a continued modest expansion in activity in the third quarter of 2025. While uncertainty declined after the US-EU trade deal, it remains elevated by historical standards; this, combined with higher tariffs, the appreciation of the euro and increased global competition, is weighing on the short-term outlook, especially for the manufacturing sector. At the same time, growth in services is expected to remain the main driver of growth as consumers signal continued spending on services. While the labour market has softened over recent months, it remains a source of strength. Looking ahead, increased consumer spending, especially if people save less of their income, together with new government spending on infrastructure and defence, should bolster domestic demand in the euro area. Furthermore, less restrictive financing conditions – mainly reflecting recent monetary policy decisions – should also support a gradual recovery.

This outlook is reflected in the baseline scenario of the September 2025 ECB staff macroeconomic projections for the euro area, which foresee annual real GDP growth of 1.2% in 2025, 1.0% in 2026 and 1.3% in 2027. Compared with the June 2025 Eurosystem staff macroeconomic projections, the outlook for GDP growth has been revised up for 2025 by 0.3 percentage points, reflecting better than expected incoming data and a carry-over effect from revisions to historical data. In addition, the appreciation of the euro and weaker foreign demand have led to a small downward revision of 0.1 percentage points to GDP growth for 2026, while the outlook for 2027 remained unchanged.

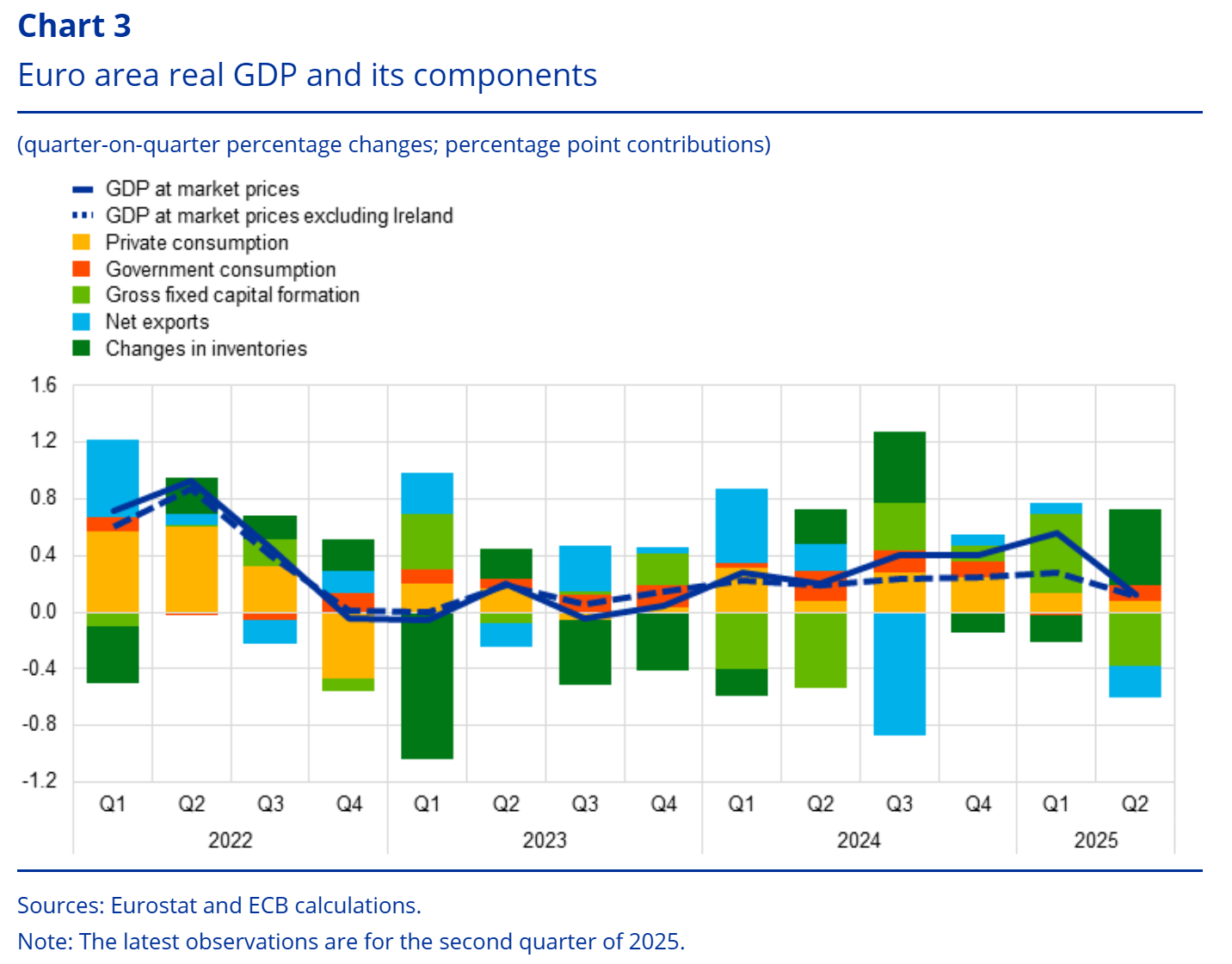

Real GDP growth slowed in the second quarter of 2025 amid persistent geopolitical and trade policy uncertainty (Chart 3). Following the strong first-quarter outcome, which was partly driven by firms frontloading exports ahead of the expected tariff hikes, GDP growth slowed in the second quarter, edging up by 0.1%, quarter on quarter, reflecting the unwinding of these effects (see Box 3 on how frontloading and uncertainty shaped recent developments). Despite higher volatility in the past two quarters (largely related to the impact from Irish data), the latest outcome marks the seventh consecutive quarter of positive growth in the euro area. The moderate expansion in euro area real GDP in the second quarter was supported by private and public consumption as well as changes in inventories. At the same time, exports and investment contracted – the latter on the back of a relatively large drop in non-construction investment, driven by developments in Irish intellectual property products. As imports displayed zero growth, net trade contributed negatively to growth in the second quarter. From a sectoral perspective, the services sector was the main contributor to growth, expanding at a similar pace to the first quarter. Meanwhile, growth in industry slowed vis-à-vis the first quarter, reflecting the unwinding of frontloading effects and tariff increases. Furthermore, value added in construction fell, amply offsetting the strong rise seen in the first quarter.

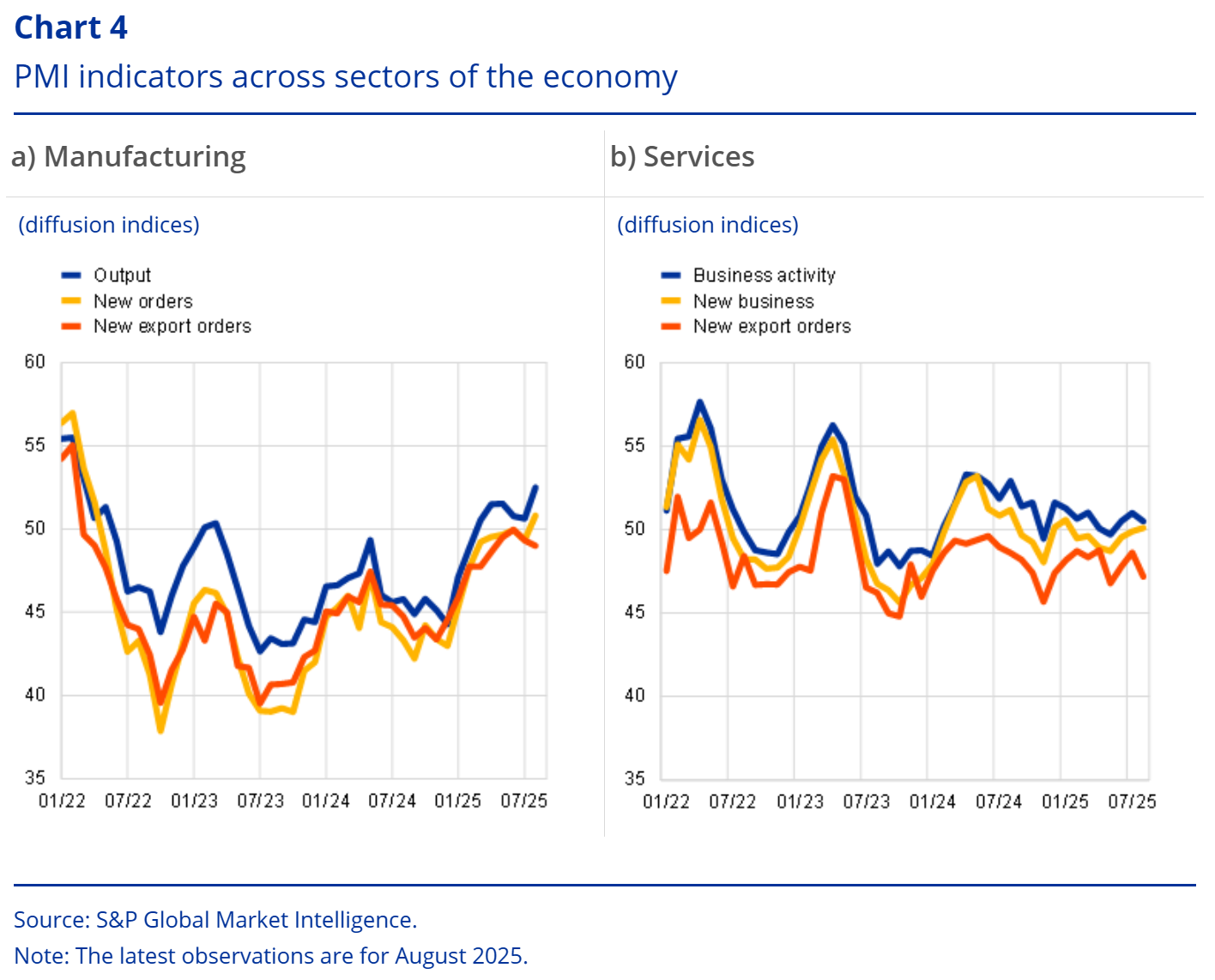

Survey data are sending somewhat mixed signals, but overall point to a continued modest expansion in activity in the third quarter of 2025. The still elevated level of uncertainty, higher tariffs and the appreciation of the euro are weighing on the short-term outlook. The composite output Purchasing Managers’ Index (PMI) rose to 51.0 on average in July and August (from 50.4 in the second quarter), indicating slow growth at around the same rate as in the second quarter. While growth in services is assessed to have slowed, it is still expected to be the main driver of growth, chiefly reflecting its larger size compared with the industrial sector. Meanwhile, activity in the manufacturing sector, which was more dynamic at the beginning of the year owing to the frontloading of exports in advance of higher tariffs, is expected to be more muted in the near term – although the latest readings show some improvement (Chart 4). The PMI for new orders portrays a similar picture, with overall slow dynamics. However, this indicator, which is more forward looking by nature, shows a somewhat more subdued improvement going into the fourth quarter of the year.

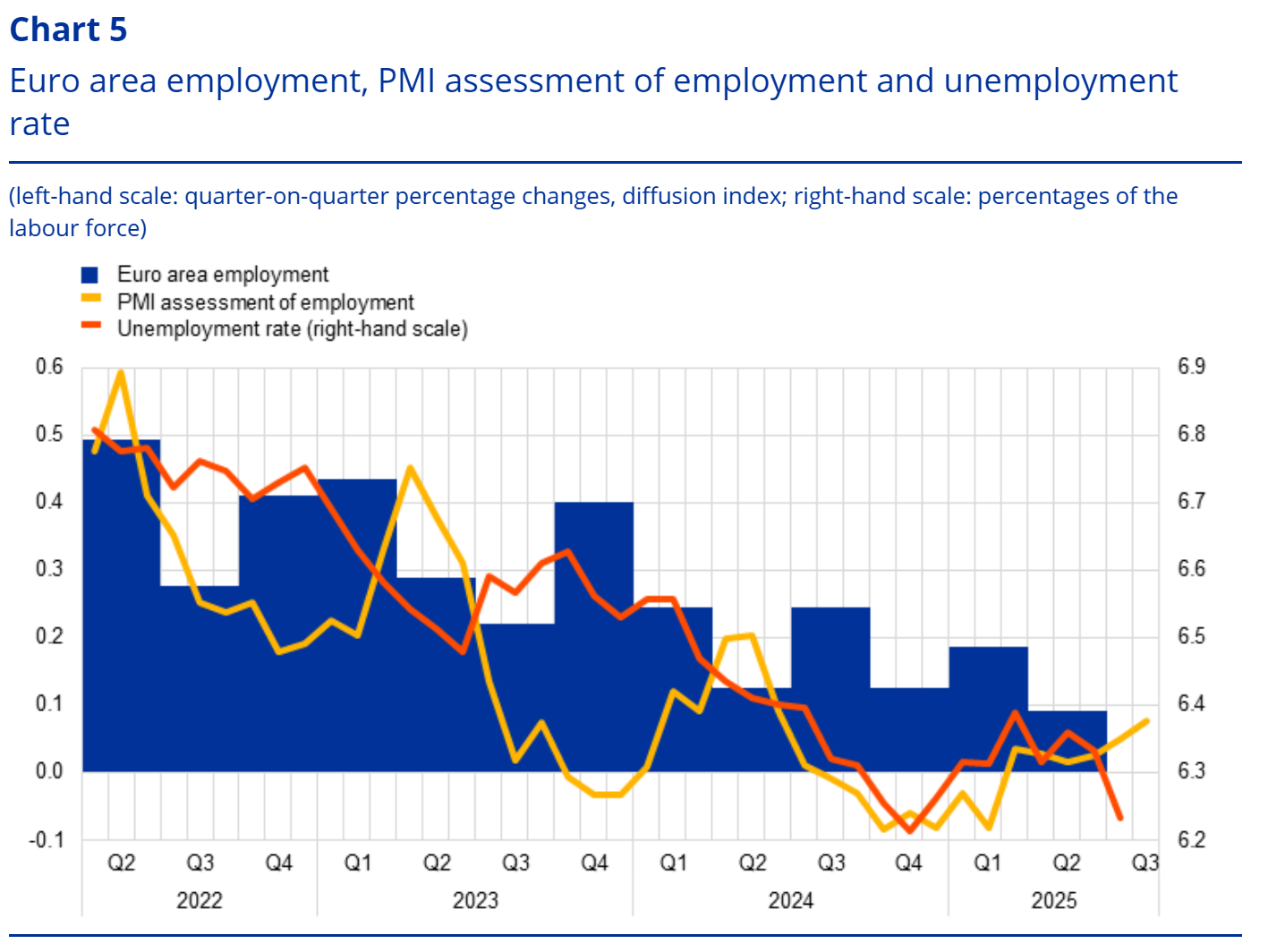

Employment increased by 0.1% in the second quarter of 2025. After rising by 0.2% in the first quarter of 2025, employment growth slowed in the second quarter of the year, standing at 0.1% (Chart 5). This expansion masks diverging trends across the euro area. Among the largest euro area economies, employment growth was mainly driven by Spain while it was largely unchanged or slightly negative in Germany, France and Italy. At the same time, the euro area unemployment rate fell to 6.2% in July, remaining broadly stable at this level since mid-2024. Labour demand declined further, with the job vacancy rate falling to 2.3% in the second quarter, the same level seen in the fourth quarter of 2019.

Sources: Eurostat, S&P Global Market Intelligence and ECB calculations.

Notes: The two lines indicate monthly developments, while the bars show quarterly data. The PMI is expressed in terms of the deviation from 50, then divided by 10 to gauge the quarter-on-quarter employment growth. The latest observations are for the second quarter of 2025 for euro area employment, August 2025 for the PMI assessment of employment and July 2025 for the unemployment rate.

Short-term labour market indicators point to modest employment growth in the third quarter.

Short-term labour market indicators point to modest employment growth in the third quarter. The monthly composite PMI employment indicator increased from 50.5 in July to 50.8 in August, suggesting modest employment growth in the third quarter. The PMI employment indicator for services rose from 50.9 in July to 51.2 in August, while the PMI employment indicator for manufacturing edged down from 49.5 to 49.4.

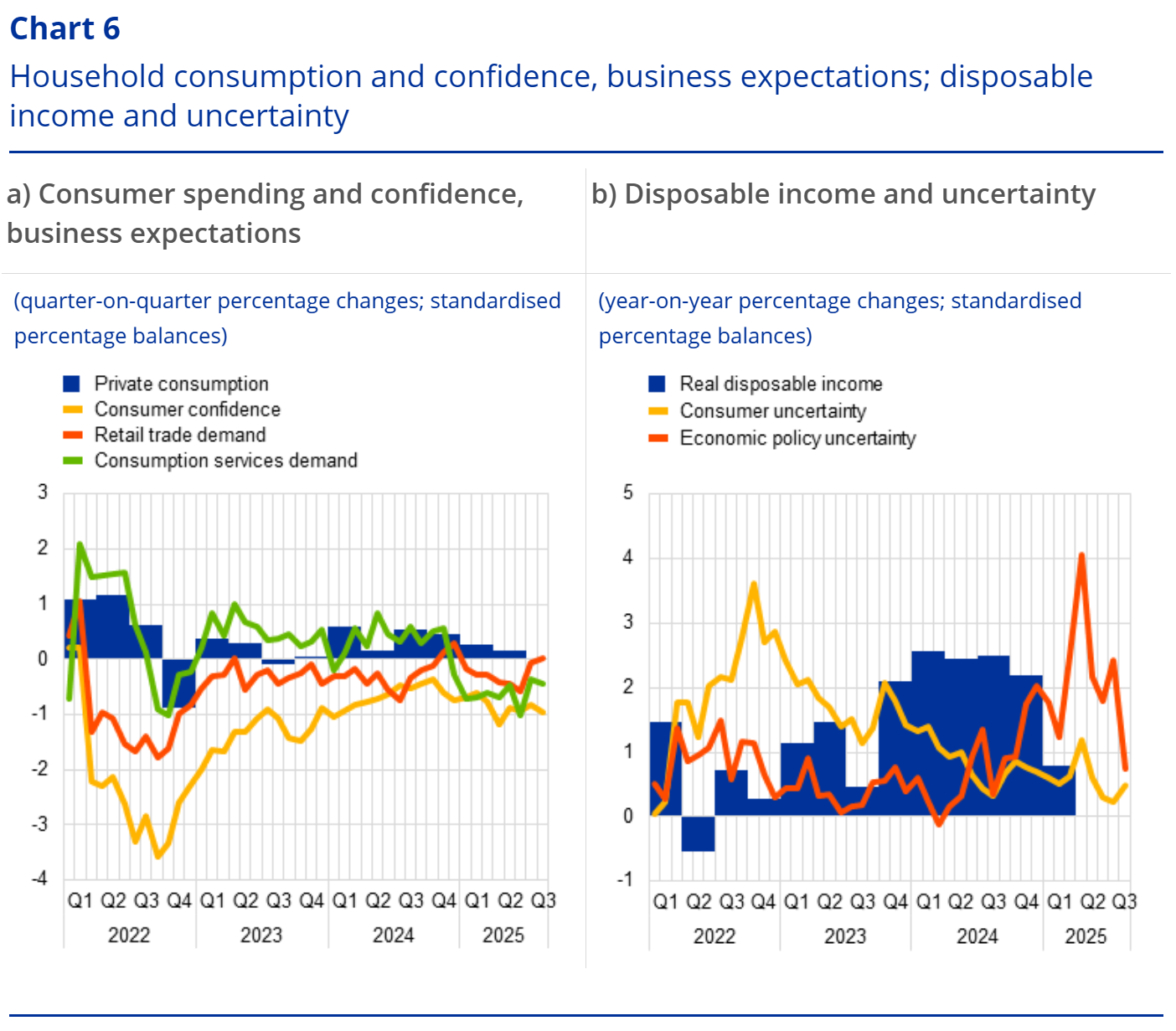

Private consumption growth moderated in the second quarter of 2025, with survey data pointing to some improvement in spending momentum in the third quarter. Private consumption expanded by 0.1%, quarter on quarter, in the second quarter of 2025 (Chart 6, panel a), after increasing by 0.3% in the first quarter of the year. Household spending on services continued to increase, but goods consumption stagnated, as spending on non-durable goods dropped. Incoming data point to improving momentum in household spending growth in the near term, with sectoral differences persisting. While the European Commission’s consumer confidence indicator remains subdued following a downtick in August, its average level for July and August is higher than in the second quarter. Retail trade fell in July. However, the European Commission’s indicators of business expectations for demand in retail trade and in consumption-weighted services have improved notably since the second quarter (Chart 6, panel a), as activity in consumer services recovered (see Box 3). Consistent with the improvement in consumer expectations for major purchases in the next 12 months seen in July and August, the ECB’s latest Consumer Expectations Survey also indicates that expectations for holiday-related purchases remain strong. Looking ahead, consumption growth should continue to benefit from past purchasing power gains, amid more favourable financing conditions and a notable easing in households’ uncertainty about their financial situation after the peak in late 2022 (Chart 6, panel b). However, despite the improvement in August, the still elevated broader economic policy uncertainty in relation to global developments, particularly the recent trade tensions, is likely to continue to weigh on consumption growth as households adjust their spending habits by reducing overall spending or switching away from US products (see Box 2).

Sources: Eurostat, European Commission and ECB calculations.

Notes: Business expectations for demand in retail trade (excluding motor vehicles) and for demand in consumption-weighted services refer to the next three months. “Consumption services demand” is based on the expected sectoral demand indicators of the European Commission’s business survey of services, weighted according to the sectoral shares in domestic private consumption from the FIGARO input-output tables for 2022. The consumption services demand series is standardised for the period from 2005 to 2019, consumer uncertainty and economic policy uncertainty are standardised for the period from April 2019 to August 2025 with respect to their averages for 2019, owing to data availability, while all other series are standardised for the period from 1999 to 2019. The economic policy uncertainty indicator is the GDP-weighted average of the standardised country series for Germany, France, Italy and Spain. The latest observations are for the second quarter of 2025 for private consumption, the first quarter of 2025 for real disposable income and August 2025 for all other items.

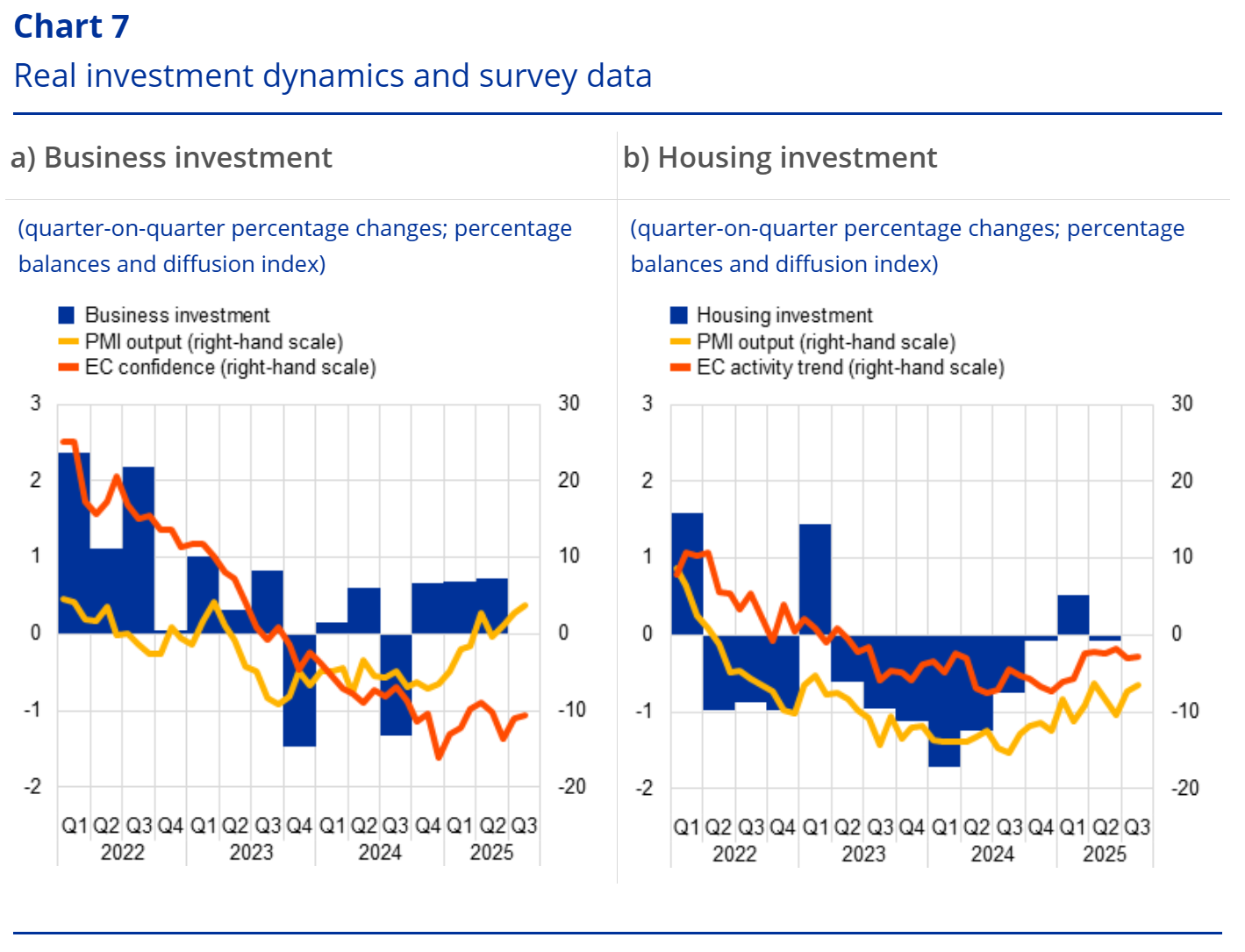

Business investment grew robustly in the second quarter of 2025 but is expected to slow in the second half of the year. Following growth of 0.7%, quarter on quarter, in both the first and the second quarter of 2025, euro area non-construction investment (excluding Irish intangibles) is expected to be muted in the coming quarters. Capital goods surveys available up to August are somewhat mixed, with PMI output moving further above 50, yet the European Commission’s sentiment index points to weak activity. While domestic demand is supportive, other drivers of investment confirm the short-term weakness. For instance, uncertainty has remained elevated despite declining somewhat after the US-EU trade deal at the end of July and the non-financial corporate gross operating surplus rose modestly in the first quarter after seeing negative rates last year. In addition to higher tariffs, earnings calls reveal some possible adverse impact of the euro’s appreciation on firms’ profits. These factors could dampen investment depending on how firms hedge against currency risk, diversify activity and adjust their margins. In this context, euro area bankruptcies rose further in the second quarter of 2025, standing about 25% above their 2019 level. This reflects both a necessary market adjustment in a period of structural change – as business registrations also grew to levels considerably above pre-pandemic levels – and weaker economic conditions. Beyond the short term, higher demand and spillovers from rising defence spending are seen to spur investment.

Sources: Eurostat, European Commission (EC), S&P Global Market Intelligence and ECB calculations.

Notes: The lines indicate monthly developments, while the bars refer to quarterly data. The PMIs are expressed in terms of the deviation from 50. In panel a), business investment is measured by non-construction investment excluding Irish intangibles. Short-term indicators refer to the capital goods sector. In panel b), the line for the European Commission’s activity trend indicator refers to the weighted average of the building and specialised construction sectors’ assessment of the trend in activity compared with the preceding three months. The line for PMI output refers to housing activity. The latest observations are for the second quarter of 2025 for investment and August 2025 for all other items.

Housing investment declined slightly in the second quarter of 2025.

Housing investment declined slightly in the second quarter of 2025. Housing investment contracted by 0.1%, quarter on quarter, in the second quarter of 2025, following an expansion of 0.5% in the first quarter. Meanwhile, building construction production and specialised construction activities grew by 1.3% on average, compared with an increase of 0.6% in the first quarter. Looking ahead, survey-based activity indicators are presenting mixed signals about the short-term outlook for housing investment. The European Commission’s trend indicator for building construction output and specialised construction activities edged down slightly on average in July and August, whereas the PMI for residential construction output registered a notable improvement (Chart 7, panel b). Although both indicators remained in negative growth territory, housing investment is expected to recover moderately in the near term. This outlook is supported by a continued rise in building permits for residential buildings, which increased by 1.1% on average in April and May compared with their first-quarter average, following gains in the previous two quarters. Even though permits are still at relatively low levels, the sustained upward trend signals strengthening demand for new residential buildings, which is expected to underpin the momentum of housing investment going forward.

The surge in euro area exports stemming from frontloading was partly reversed in the second quarter of 2025 and exports have likely been subdued over the summer. Exports of goods and services declined by 0.5% in the second quarter of 2025. Similar to the increase in the first quarter, about half of the fall in goods exports was related to pharmaceutical products, mainly from Ireland. Survey indicators point to subdued exports over the summer. While the US-EU agreement has reduced some of the trade policy uncertainty by setting a ceiling on the US import tariff at 15% for most EU goods exports, the appreciation of the euro will weigh on exports further ahead. On the imports side, volumes of goods and services remained anaemic overall in the second quarter of 2025 (+0.0%), with rising imports from the United States and China offsetting weaker imports from the rest of the world.

Compared with the June 2025 Eurosystem staff macroeconomic projections, the outlook for GDP growth has been revised up for 2025. This partly reflects better than expected incoming data. At the same time, the growth outlook for 2026 has been revised down slightly owing to the decline in competitiveness stemming from the appreciation of the euro and weaker foreign demand. Annual average real GDP growth is now expected to be 1.2% in 2025, 1.0% in 2026 and 1.3% in 2027. Tariffs and related uncertainty contributed to fluctuations in economic activity during the first half of the year and are expected to limit growth in the short term. However, as exporters adapt to the new US-EU trade agreement and trade policy uncertainty lessens, growth is likely to recover. Looking ahead, rising real wages and employment as well as new government spending on infrastructure and defence should bolster euro area domestic demand. Less restrictive financing conditions – mainly reflecting recent monetary policy decisions – and the expected rebound in foreign demand later in the horizon should also support economic activity.

Click to read more