Key messages

An increasing number of people are using crypto-assets. Crypto-assets present opportunities to people with regard to the diversification of investment portfolios, higher returns on their investments, or cheaper and faster cross-border remittances and payments.

At the same time, given the high price volatility of many crypto-assets and the limited application of some financial consumer and/or investor protection provisions, individuals with low digital financial literacy, and limited financial resilience may be more vulnerable to the risks.

A significant percentage of adults using crypto-assets do not display basic digital financial literacy. In 2023, on average, across 39 economies worldwide, only 29% of adults (34% across OECD countries) scored the minimum target digital financial literacy score (at least 70 points out of 100). Only 55% of crypto-asset holders understood that such assets are not legal tender in their jurisdiction.

Higher levels of digital financial literacy can provide individuals with the knowledge and skills to safely use crypto-assets in accordance with their individual risk appetite and raise awareness of their specific risks.

Policy makers and financial literacy stakeholders should explicitly address the characteristics, opportunities and risks of crypto-assets as part of financial literacy policies and initiatives, ensuring they reach younger generations in particular.

Crypto-assets can present opportunities to consumers but also expose them to risks

Crypto-assets1 can present opportunities to individuals with regard to the diversification of investment portfolios, higher returns on their investments (proportional to their level of risk), and cheaper and faster cross-border remittances and payments (OECD, 2019[1]; 2024[2]; Auer, Lewrick and Paulick, 2025[3]). In addition, interest in crypto-assets can be leveraged to attract new retail investors to mainstream capital markets (OECD, 2023[4]; 2024[5]).

Alongside these opportunities, the high price volatility of unbacked crypto-assets and the limited application of some financial consumer and/or investor protection provisions (U.S. Securities and Exchange Commission, 2024[6]; Financial Stability Board, 2023[7]; 2023[8]; IOSCO, 2023[9]), can increase the financial vulnerability of individuals with low digital financial literacy and limited financial resilience.

Users of crypto-assets are increasing globally, especially among new retail investors and younger generations

The results of the OECD/INFE 2023 International Survey of Adult Financial Literacy (OECD, 2023[10]), a global study coordinated by the OECD International Network on Financial Education covering 39 economies, show that, on average, across participating economies, 41% of adults are aware of crypto‑assets (49% across participating OECD countries). In the same study, 3.2% of adults reported owning crypto-assets (3.8% across participating OECD countries). Over 5% of adults in Luxembourg (11%), Finland (9%), Ireland (8%), Estonia (6%), the Netherlands (6%) and Sweden (6%) reported holding crypto-assets.

The number of individuals who own crypto-assets is increasing. Results from a survey conducted in 2023 by the International Organization of Securities Commissions (IOSCO) among 24 member jurisdictions indicated that in 15, 6-10% of retail investors owned crypto-assets, compared to 1%-5% in 12 jurisdictions in 2020 (IOSCO, 2024[11]).

Evidence also suggests that holders of crypto-assets tend to be younger and less experienced in financial markets than holders of traditional financial investments (ASIC, 2022[12]; OECD, 2023[4]). For example, in Australia, a 2022 study showed that investors who started to invest in 2020 were more than twice as likely to report holding at least one type of crypto-asset in their portfolio (55%), compared to more experienced investors (22%) (ASIC, 2022[12]). In France, a 2023 survey showed that crypto-assets were held by 54% of those who started to invest after 2020 and by 25% of experienced investors (OECD, 2023[4]). With regard to age, in the United States, 44% of Generation Z (born between 1997 and 2012) made their first investment by investing in crypto-assets, compared to 35% of Millennials (born between 1981 and 1996) and Generation X (born between 1965 to 1980). Crypto-assets were also the most common first investment for Generation Z investors in Canada (35%) and the United Kingdom (43%) (FINRA, 2023[13]).

Current levels of digital financial literacy are not sufficient to ensure an informed use of crypto‑assets

Digital financial literacy is a combination of knowledge, skills, attitudes and behaviours necessary for individuals to be aware of and safely use digital financial services and digital technologies with a view to contributing to their financial well-being (OECD, 2022[14]; 2024[15]). Individuals who do not have adequate levels of digital financial literacy to ensure an informed use of crypto-assets might underestimate their riskiness. This can lead to negative financial outcomes, which are compounded by behavioural biases (Hayashi and Routh, 2024[16]; Chui and Lau, 2023[17]).

Results from the OECD/INFE 2023 International Survey of Adult Financial Literacy indicated that the average digital financial literacy score across all participating countries and economies was 53 out of 100 points (55 out of 100 across participating OECD countries), and that 71% of adults (66% across OECD countries) did not possess basic levels of digital financial literacy (i.e. scoring less than 70 points out of 100). Understanding of crypto-assets was generally low: only 55% of holders of crypto-assets understood that such assets are not legal tender in their jurisdiction (see Figure 1) (OECD, 2023[10]). National surveys also highlight these low levels. In Canada, for example, one third of Bitcoin owners have a low understanding of crypto-assets (Balutel et al., 2023[18]).

The consequences of low levels of digital financial literacy can be compounded by the self-directed use of crypto-assets and by behavioural biases. On the one hand, compared to other financial products, crypto‑asset use is usually self-directed, i.e. without the intermediation of traditional financial services providers (IOSCO, 2020[19]; Ontario Securities Commission, 2022[20]), and users of crypto-assets often make financial decisions based on informal sources of information, including social media and “finfluencers”, rather than on formal and reputable sources (FINRA, 2023[13]; ASIC, 2022[12]). On the other hand, behavioural biases, in particular “fear of missing out” and herding behaviour, can drive crypto-asset ownership (Gerrans, Abisekaraj and Zhangxin, 2023[21]; Almeida and Gonçalves, 2023[22]). This is further exacerbated by reliance on heuristics such as anchoring or overconfidence, which can increase risks for individuals, particularly in highly volatile markets (Chui and Lau, 2023[17]).

Individuals should understand the characteristics of crypto-assets and their risks

Along with the opportunities crypto-assets offer to individuals, they can also present risks beyond those associated with traditional financial products. Risks linked to the use of crypto-assets include:

High volatility of many crypto-assets, which might be excessive in relation to the risk appetite of some retail investors, with a risk of losing significant amounts of money (IOSCO, 2024[11]; U.S. Securities and Exchange Commission, 2023[23]). This can be especially detrimental for consumers with low levels of financial resilience and limited ability to withstand losses.

Limited application of financial consumer and/or investor protection measures, such as investor compensation schemes, limited application of suitability requirements, or the absence of reporting requirements by providers towards their clients as well as an uneven regulatory framework across jurisdictions (ESMA, 2024[24]; Financial Stability Board, 2023[7]; 2023[8]; IOSCO, 2023[9]).

Technological and operational risks:

Cybersecurity risks stemming notably from attacks targeting crypto-assets intermediaries (OECD, 2022[25]; Financial Stability Board, 2023[26]; IOSCO, 2023[9]).

Risks related to the unique features of blockchain technology, such as the irreversibility of transactions, and data protection risks. The use of blockchain technology means that transactions are irreversible, with no possibility of recovering funds in case of mistakes, scams or frauds. Moreover, transactions on most blockchains are pseudonymous but not fully anonymous, creating data protection risks (U.S. Commodity Futures Trading Commission, 2024[27]; European Data Protection Supervisor, 2021[28]).

Digital literacy risks, such as retail investors not knowing or understanding how to access and safely manage their crypto-assets, using wallets or private keys, a unique alphanumeric code which cannot be recovered if lost or compromised.

Figure 1. Holding crypto-assets and digital financial literacy

Percentage of adults who hold crypto-assets, and their digital financial literacy knowledge

Note: These results should be interpreted with caution, as they are based on a small number of observations. The results for Jordan, Mexico and Saudi Arabia should be interpreted with caution as the national samples may not be representative of the entire adult population.

Source OECD, (2023[10]), OECD/INFE Survey of Adult Financial Literacy, https://doi.org/10.1787/56003a32-en.

Individuals should be equipped with adequate levels of digital financial literacy to use crypto-assets in informed ways

Equipping individuals with adequate levels of digital financial literacy is necessary to help them understand the characteristics and risks of crypto-assets. Box 1 presents selected examples of financial literacy initiatives on crypto-assets.

Box 1. Selected examples of financial literacy initiatives on crypto-assets

In France, the Financial Markets Authority (AMF) created a website for new retail investors which also addresses crypto-assets through videogames, games and infographics. The website reproduces Investipolis, i.e. the city of investments, in the form of cartoons.

In Italy, the Italian Companies and Exchange Commission (CONSOB) developed a financial literacy initiative on crypto-assets The moment is cri(p)tic, part of CONSOB’s edutainment programme mixing theatre play and education.

In Portugal, the central bank published several videos on its YouTube channel as well as an episode of the central bank’s podcast with information on the characteristics of crypto-assets, their risks, and on the difference between crypto-assets and central bank digital currencies. The securities commission made available on its YouTube channel general information on crypto-assets and on the effects of the European Union Markets in Crypto-assets Regulation (MiCA), and explained the use of distributed ledger technology and the effects of MiCA in an episode of its podcast.

In the United Kingdom, the Financial Conduct Authority (FCA) launched the InvestSmart campaign to warn of the risks associated with investing in ‘high-risk, high-return’ assets, including crypto-assets. The initiative uses a gaming thematic.

In the United States, the Securities and Exchange Commission offers resources through its website for individuals considering investment opportunities involving crypto-assets, focusing in particular on understanding crypto investments and watching out for scams.

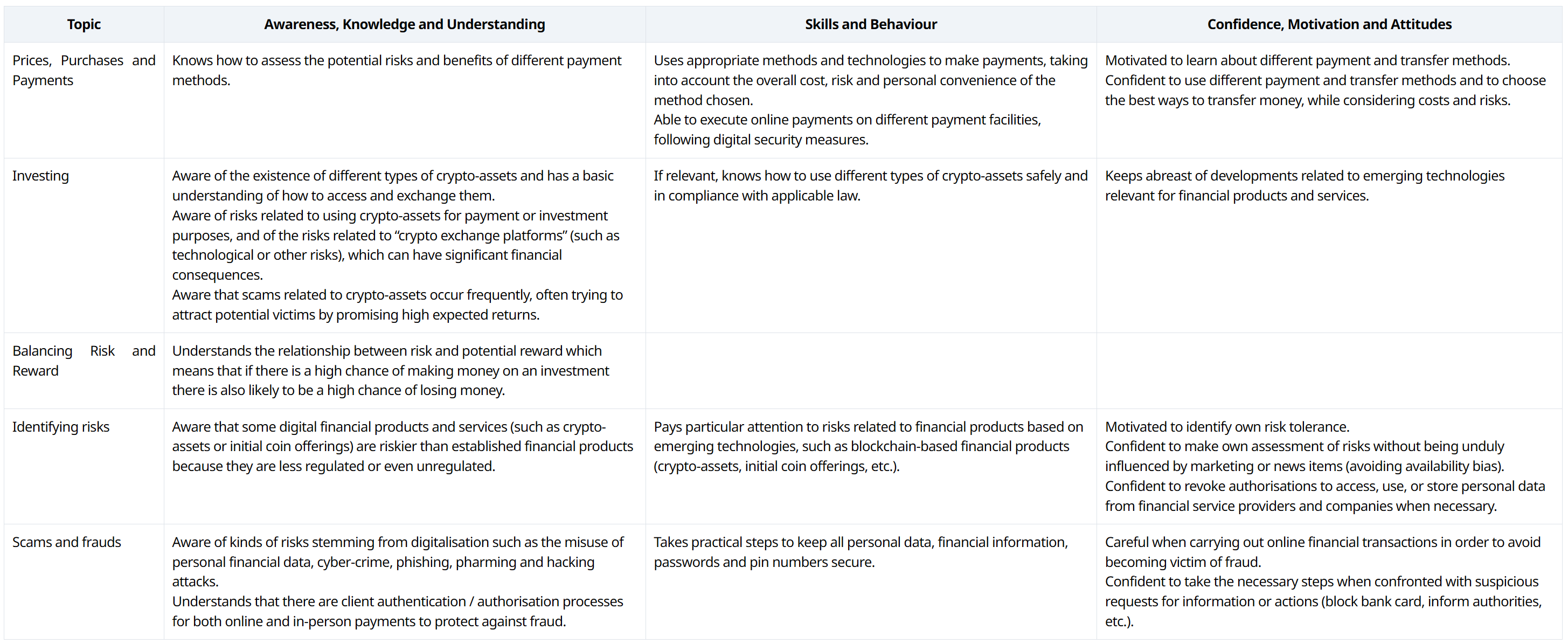

Table 1 provides an overview of some key financial competencies that individuals should have to use crypto-assets in an informed manner, based on the Financial competence framework for adults in the European Union (European Union/OECD, 2022[29]). Crypto-assets are also addressed by the Financial competence framework for children and youth in the European Union (European Union/OECD, 2023[30]) which, for 11-15 years-old, includes the understanding of the concept of gamification and its impact on investment decisions and, for 16-18 years-old, the awareness that crypto-assets can be very risky, and that certain crypto-assets may not be regulated, together with the need to take into account gamification features when investing through trading platforms and apps.

These competence frameworks promote a shared understanding of the financial competencies adults need to make sound decisions when it comes to crypto-assets, and should inform the design of public policies, financial literacy programmes and educational materials.

Table 1. Financial literacy competencies supporting an informed use of crypto-assets

Source: European Union/OECD, (2022[29]), Financial competence framework for adults in the European Union, https://www.oecd.org/finance/financial-competence-framework-for-adults-in-the-European-Union.htm

What can policymakers and other stakeholders working on financial literacy do?

Digital financial literacy can help individuals understand the characteristics, opportunities and risks of crypto-assets. Policy makers, regulators and other stakeholders should explicitly address crypto-assets as part of broader financial literacy policies and initiatives.

Policy makers and other stakeholders working on financial literacy should, in particular:

Raise awareness about the characteristics, opportunities, and risks of crypto-assets, especially with regard to volatility, and technological and operational risks.

Address crypto-assets as part of existing and new financial literacy initiatives, particularly those addressed at younger generations who are more likely to invest in crypto-assets as their first investment.

Focus on the development of specific competencies to help individuals understand the implications of the use of crypto-assets, their characteristics and risks, as well as the relationship between risk and return.

Prompt individuals intending to use crypto-assets to consider whether this is in line with their digital financial literacy, risk appetite, and ability to withstand losses.

Encourage those who may be already investing in crypto-assets to consider more diversified and less risky investments.

Continue to collect evidence on the digital financial literacy of potential and existing users of crypto-assets, using internationally recognised instruments.

References

[22] Almeida, J. and T. Gonçalves (2023), “A systematic literature review of investor behavior in the cryptocurrency markets”, Journal of Behavioral and Experimental Finance, Vol. 37, p. 100785, https://doi.org/10.1016/J.JBEF.2022.100785.

[12] ASIC (2022), Report 735 Retail investor research, https://download.asic.gov.au/media/z1nj5m5e/rep735-published-11-august-2022.pdf (accessed on 19 March 2025).

[3] Auer, R., U. Lewrick and J. Paulick (2025), “DeFiying gravity? An empirical analysis of cross-border Bitcoin, Ether and stablecoin flows”, http://www.bis.org (accessed on 13 June 2025).

[18] Balutel, D. et al. (2023), “Crypto and financial literacy of cryptoasset owners versus non-owners: The role of gender differences”, Journal of Financial Literacy and Wellbeing, Vol. 1/3, pp. 514-540, https://doi.org/10.1017/FLW.2024.2.

[17] Chui, E. and G. Lau (2023), “Behavioural Science Study on Investor Behaviour in the Virtual Asset Markets: Heuristics in Virtual Assets Investment Decision-Making”, https://www.ifec.org.hk/web/common/pdf/about-ifec/behavioural-science-study-on-investor-behaviour-in-the-virtual-asset-markets.pdf (accessed on 20 March 2025).

[24] ESMA (2024), Crypto-assets on the rise but remaining very risky, https://www.esma.europa.eu/sites/default/files/2024-12/ESMA35-1872330276-1971_Warning_on_crypto-assets.pdf (accessed on 24 March 2025).

[28] European Data Protection Supervisor (2021), Opinion of the European Data Protection Supervisor on the Proposal for a Regulation on Markets in Crypto-assets, https://www.edps.europa.eu/system/files/2021-06/21-06-24_edps_opinion_mica_en.pdf (accessed on 3 April 2025).

[30] European Union/OECD (2023), Financial competence framework for children and youth in the European Union, https://doi.org/10.2874/297346.

[29] European Union/OECD (2022), “Financial competence framework for adults in the European Union”, https://www.oecd.org/finance/financial-competence-framework-for-adults-in-the-European-Union.htm (accessed on 28 April 2022).

[7] Financial Stability Board (2023), High-level Recommendations for the Regulation, Supervision and Oversight of Crypto-Asset Activities and Markets: Final report, https://www.fsb.org/uploads/P170723-2.pdf (accessed on 4 September 2025).

[8] Financial Stability Board (2023), High-level Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements: Final report, https://www.fsb.org/uploads/P170723-3.pdf (accessed on 4 September 2025).

[26] Financial Stability Board (2023), The Financial Stability Implications of Multifunction Crypto-asset Intermediaries, https://www.fsb.org/uploads/P281123.pdf (accessed on 7 April 2025).

[13] FINRA (2023), Gen Z and Investing: Social Media, Crypto, FOMO, and Family, https://www.cfainstitute.org/sites/default/files/-/media/documents/article/industry-research/Gen_Z_and_Investing.pdf (accessed on 19 March 2025).

[21] Gerrans, P., S. Abisekaraj and L. Zhangxin (2023), “The fear of missing out on cryptocurrency and stock investments: Direct and indirect effects of financial literacy and risk tolerance”, Journal of Financial Literacy and Wellbeing, Vol. 1, pp. 103-137, https://doi.org/10.1017/flw.2023.6.

[16] Hayashi, F. and A. Routh (2024), “Financial Literacy, Risk Tolerance, and Cryptocurrency Ownership in the United States”, https://doi.org/10.18651/RWP2024-03.

[11] IOSCO (2024), Investor Education on Crypto-Assets, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD769.pdf (accessed on 19 March 2025).

[9] IOSCO (2023), Policy Recommendations for Crypto and Digital Asset Markets Final Report, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD747.pdf (accessed on 4 September 2025).

[19] IOSCO (2020), Retail Market Conduct Task Force Report Initial Findings and Observations About the Impact of COVID-19 on Retail Market Conduct Final Report, https://www.iosco.org/library/pubdocs/pdf/IOSCOPD669.pdf (accessed on 24 March 2025).

[15] OECD (2024), G20 policy note on financial well-being, OECD Publishing, Paris, https://doi.org/10.1787/7332c99d-en.

[31] OECD (2024), OECD/INFE survey instrument to measure digital financial literacy, OECD Publishing, Paris, https://doi.org/10.1787/548de821-en.

[5] OECD (2024), “Supporting the new generation of retail investors in France: Proposal for a financial literacy strategy for new retail investors”, OECD Business and Finance Policy Papers, No. 63, OECD Publishing, Paris, https://doi.org/10.1787/a28a4c52-en.

[2] OECD (2024), The Limits of DeFi for Financial Inclusion: Lessons from ASEAN, OECD Publishing, Paris, https://doi.org/10.1787/f00a0c7f-en.

[32] OECD (2023), International Standards for Automatic Exchange of Information in Tax Matters: Crypto-Asset Reporting Framework and 2023 update to the Common Reporting Standard, OECD Publishing, Paris, https://doi.org/10.1787/896d79d1-en.

[4] OECD (2023), New retail investors in France: Attitudes, Knowledge and Behaviours, OECD Publishing, Paris, https://doi.org/10.1787/2cd2565d-en.

[10] OECD (2023), “OECD/INFE 2023 International Survey of Adult Financial Literacy”, OECD Business and Finance Policy Papers, No. 39, OECD Publishing, Paris, https://doi.org/10.1787/56003a32-en.

[25] OECD (2022), “Institutionalisation of crypto-assets and DeFi–TradFi interconnectedness”, OECD Business and Finance Policy Papers, No. 01, OECD Publishing, Paris, https://doi.org/10.1787/5d9dddbe-en.

[14] OECD (2022), OECD/INFE Guidance on Digital Delivery of Financial Education, https://doi.org/10.1787/c980ce2b-en (accessed on 28 April 2022).

[1] OECD (2019), Cryptoassets in Asia: Consumer attitudes, behaviours and experiences, OECD Publishing, Paris, https://doi.org/10.1787/12245630-en.

[20] Ontario Securities Commission (2022), Research Study: Crypto Assets 2022, https://www.osc.ca/sites/default/files/2022-10/inv_research_20220928_crypto-asset-survey_EN.pdf (accessed on 24 March 2025).

[27] U.S. Commodity Futures Trading Commission (2024), Decentralized finance report of the Subcommittee on digital assets and blockchain technology, https://www.cftc.gov/media/10106/TAC_DeFiReport010824/download.

[6] U.S. Securities and Exchange Commission (2024), Investor Bulletin: Technology and Digital Finance, https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/technology-and-digital-finance-world-investor-week-2024-investor-bulletin (accessed on 18 July 2025).

[23] U.S. Securities and Exchange Commission (2023), Investor Bulletin: Investor Resilience, Crypto Assets, and Sustainable Finance, https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-alerts/WorldInvestorWeek2023 (accessed on 18 July 2025).

Explore further

OECD (2020), Recommendation of the Council on Financial Literacy, OECD/LEGAL/0461, https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0461

OECD (2012), G20/OECD High-Level Principles on Financial Consumer Protection 2022, OECD Publishing, Paris, https://doi.org/10.1787/48cc3df0-en

OECD (2023), "OECD/INFE 2023 International Survey of Adult Financial Literacy", OECD Business and Finance Policy Papers, No. 39, OECD Publishing, Paris, https://doi.org/10.1787/56003a32-en

OECD (2024), OECD/INFE survey instrument to measure digital financial literacy, OECD Publishing, Paris, https://doi.org/10.1787/548de821-en