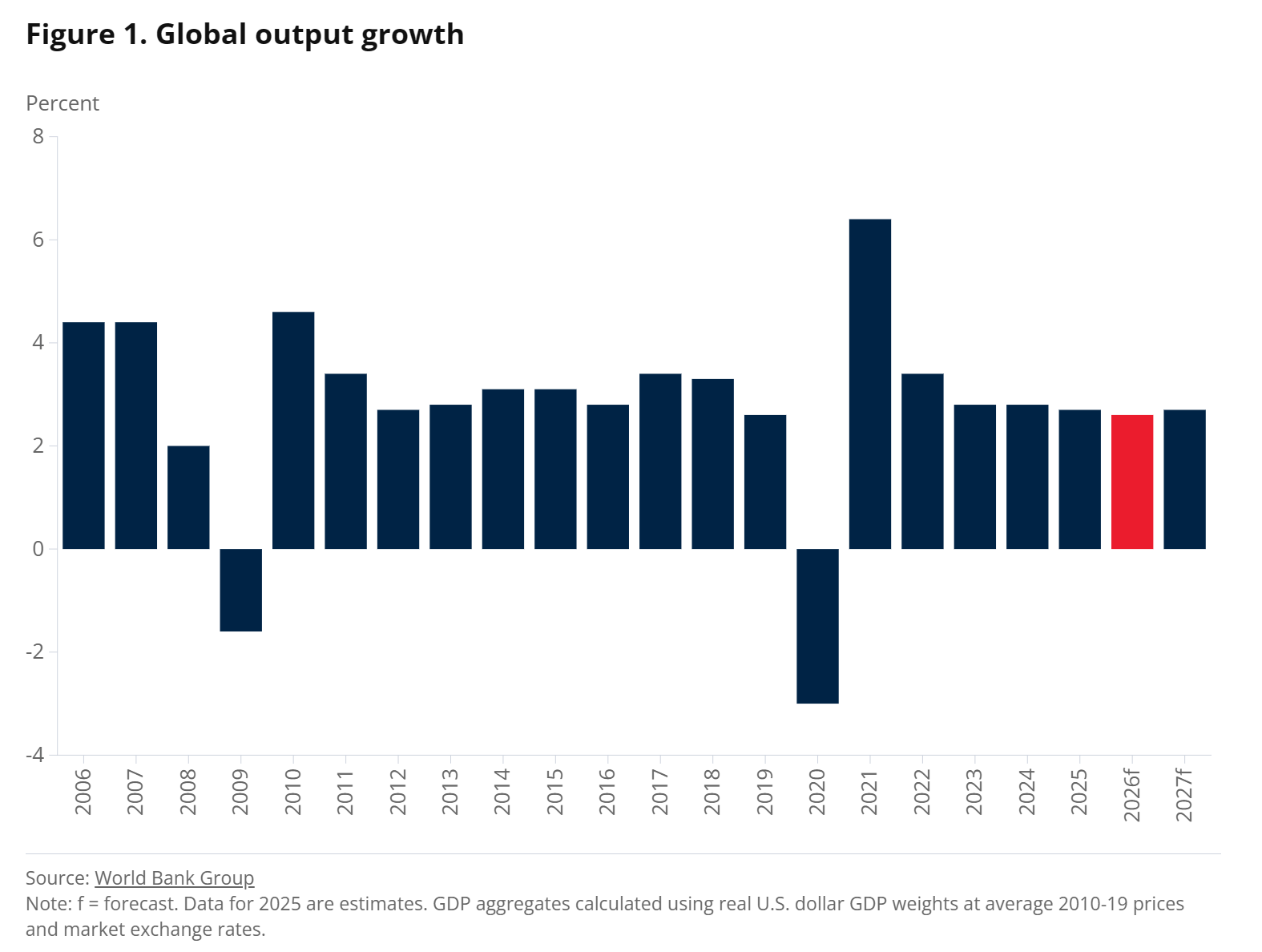

The global economy demonstrated remarkable resilience in 2025 despite increased trade tensions and policy uncertainty. Activity was supported by a stockpiling of goods, strong risk appetite, and a surge in artificial intelligence (AI)-related investment. Global growth in 2025 capped a solid five-year recovery from the 2020 recession, but vulnerable emerging markets and developing economies (EMDEs) continue to lag behind, according to the Global Economic Prospects report.

Global growth is set to ease to 2.6 percent in 2026 as several supportive factors wane, giving way to a slowdown in demand for traded goods and softer domestic demand in key economies. By 2027, growth is expected to edge up to 2.7 percent as earlier monetary easing supports domestic demand and trade recovers amid declining uncertainty.

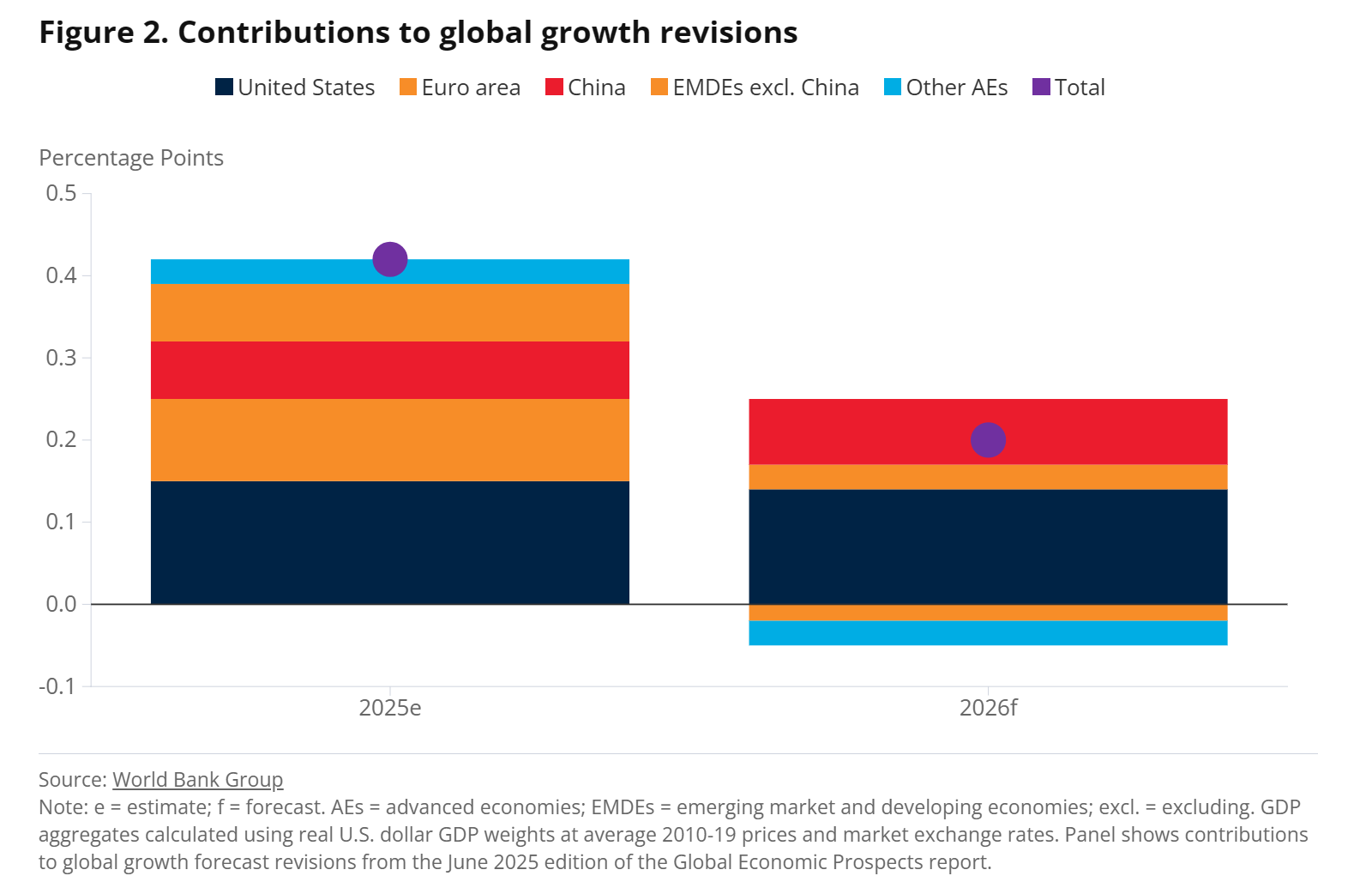

Global growth has been revised upwards relative to June expectations by 0.4 percentage point in 2025 and 0.2 percentage point in 2026, in part because of stronger-than-expected growth in major economies. This improved outlook reflects a somewhat smaller and more delayed impact of trade policy shifts and associated uncertainty.

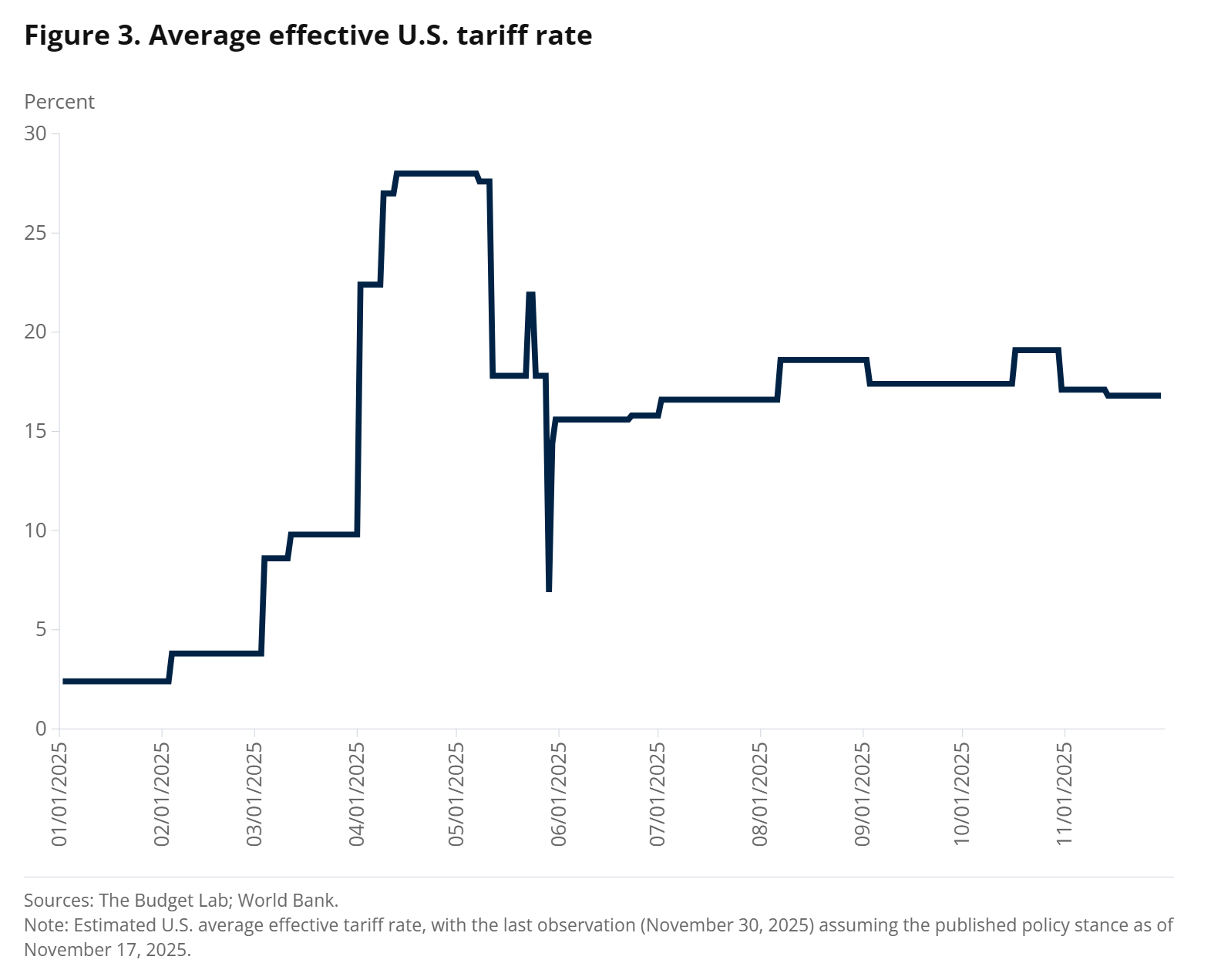

Following trade policy shifts last year, the average effective U.S. tariff rate rose to about 17 percent by late 2025—its highest level since the 1930s and broadly in line with the rate assumed in June, but still well below the estimated peak in mid‑April. After an initial front‑loaded surge in shipments ahead of tariff hikes, U.S. goods imports slowed markedly in the second half of 2025, with the pullback concentrated in countries facing relatively higher tariffs. Growth in global goods and services trade is expected to slow further this year, from an estimated 3.4 percent in 2025 to 2.2 percent, as the front-loading that supported trade in 2025 fades.

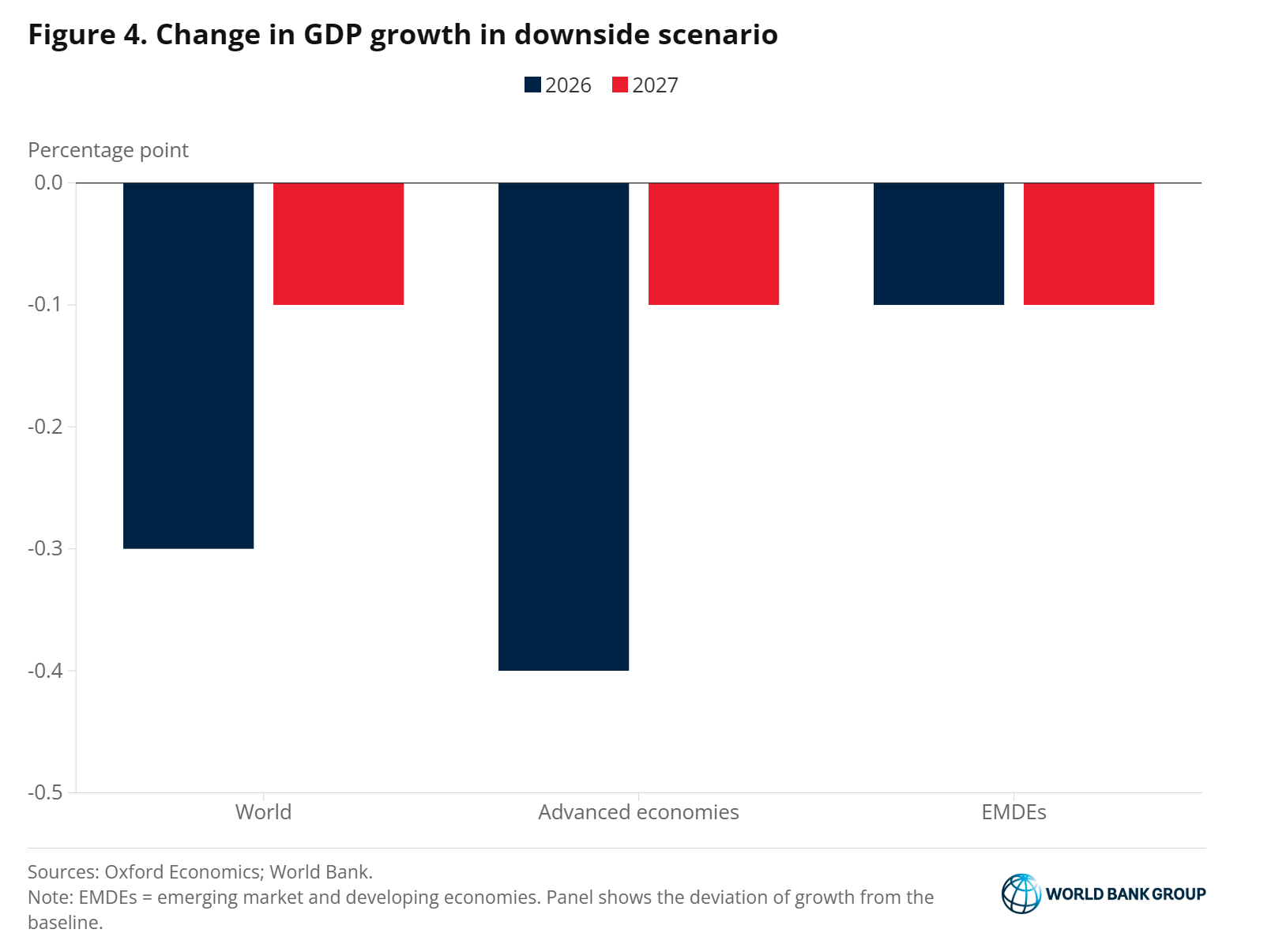

Risks to growth remain titled to the downside and stem primarily from potential escalations in trade tensions and deteriorating financial sentiment. In a downside scenario, a sharp decline in equity valuations alongside plunging risk appetite and tighter financial conditions would reduce global growth relative to baseline projections in 2026.

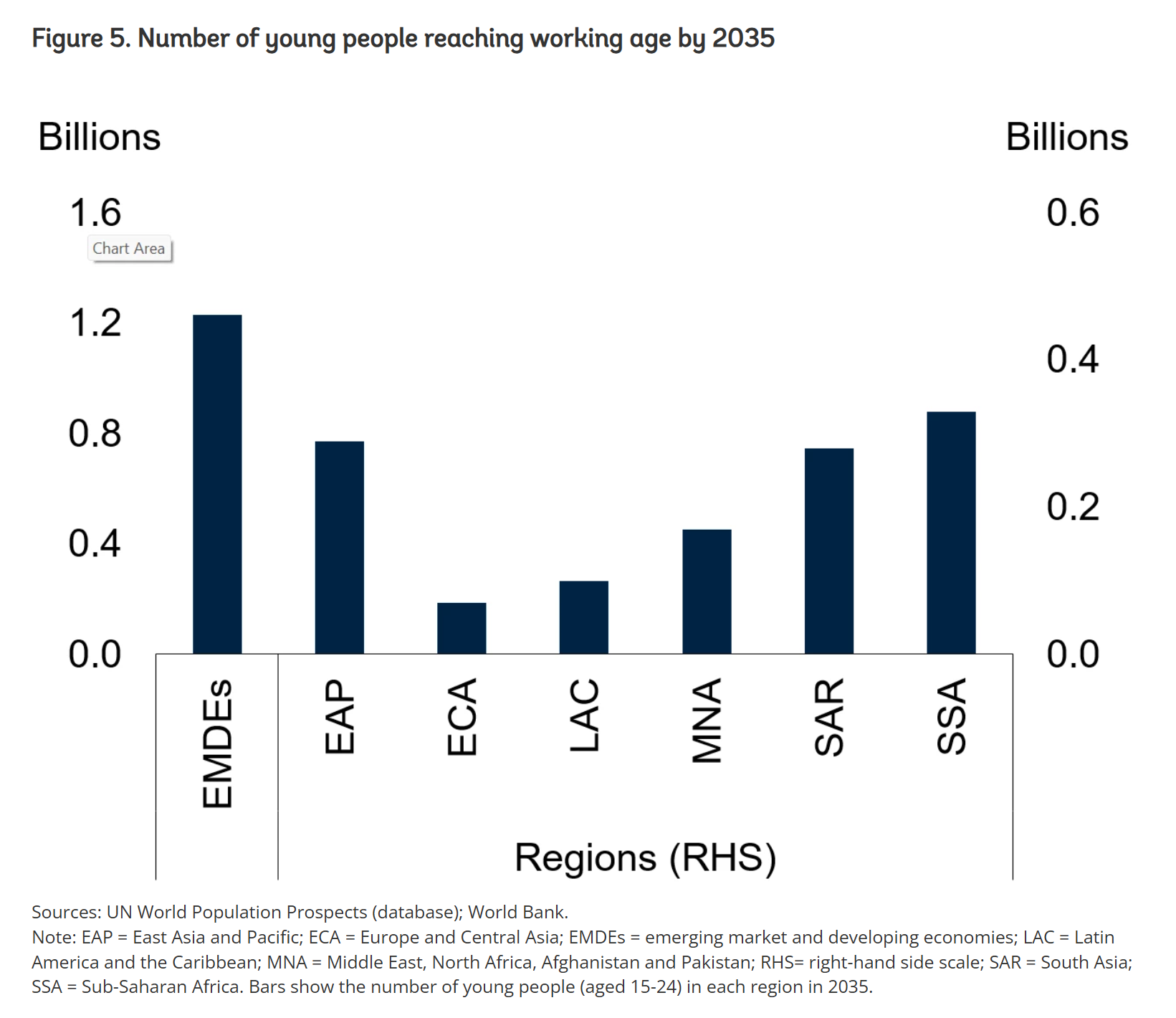

Against this backdrop, EMDEs face a major jobs challenge, with an estimated 1.2 billion young people reaching working age over the next 10 years. Three pillars can guide policy responses: investing in foundational infrastructure—both physical and digital—and in education and upskilling to build human capital; improving the business environment through effective governance; and mobilizing private investment. Together, these pillars can help catalyze growth by boosting investment and creating conditions for people and firms to thrive, including by enabling effective use of emerging digital technologies.