BUILDING CATALYTIC PARTNERSHIPS FOR PROSPERITY:

FOREWORD

As we celebrate our 10th anniversary, one feature defines our progress at the Asian In frastructure Investment Bank: partnering with others for greater impact. Development presents immense challenges that no organization can face alone. At AIIB, partnerships are at the core of our operations. Through them, we build strong, long-lasting relationships that trans late shared vision into collective action.

Our mission—Financing Infrastructure for Tomorrow—centers on four priorities: green infrastructure, connectivity and regional cooperation, technology-enabled infrastructure, and private capital mobilization. As we seek to deliver value for our clients across these pillars, collaboration is key. Through co-financing, knowledge exchange, policy dialogue and joint financial innovations, we create value far greater than what each of us could achieve on our own.

Since our establishment, AIIB has built a strong network of partners, including multilateral and national development banks, bilateral agencies, technical assistance providers, philanthropic organizations, knowledge institutions, private sector actors, and global and regional platforms. Each of these collaborations adds distinct value to our organization, helping us to tailor better solutions for our clients and deliver on our mission.

Faced with overlapping crises—climate change, economic fragmentation and geopolitical volatility, the case for multilateral cooperation has never been stronger. The evidence is clear: When development partners align strengths and resources, we respond faster and deliver better. Recent initiatives, such as the commitment by multilateral development banks to work better as a system, reflect a growing spirit of collaboration that needs to be amplified, and scaled.

At AIIB, innovation in how we partner with others matters as much as innovation in what we finance. This is why we are expanding our blended finance instruments, streamlining our policies and processes, and using technology to connect capital with investment opportunities more efficiently. These efforts are already making our engagement with partners more agile and fit for purpose.

This report highlights the power of our partnerships in action. Behind each project featured in these pages is a story of trust, and shared purpose. They show what becomes possible when we work together, with our success measured by the positive change we generate in those we support.

As AIIB enters its second decade, we remain committed to deepening our collaborations, strengthening multilateralism, and expanding our role as a convenor of capital, expertise and purpose. To our longstanding and future partners, we extend a warm invitation: Join us in creating solutions, charting new pathways, and building a more sustainable, inclusive, and resilient future for Asia and the world.

Jin Liqun President and Chair of the Board of Directors, Asian Infrastructure Investment Bank

MESSAGE FROM THE DIRECTOR GENERAL

On behalf of AIIB, I am pleased to present to you our first Partnerships Report. Since we began operations 10 years ago, partners have been a cornerstone of our work. At AIIB, partnerships are not what we do; they are who we are. We envision a future of multilateralism and inclusion, one in which development is a true win-win partnership between institutions and countries, where development is resilient and sustainable, and where public and private capital and expertise are mutually leveraged for the greater good. Through these pages, you will see concrete examples of how working together improves people’s lives. To our current partners, rest assured that we will continue to honor the trust and confidence you place in us. To every institution interested in development, we look forward to working with you to build sustainable Infrastructure for Tomorrow. We deeply thank all who contributed to making this report a reality. In times of unprecedented global challenges, togetherness is our superpower. At AIIB, we are proud and inspired by the impact we have accomplished with our partners and humbled by the challenges that lie ahead.

Let’s get to work.

Rodrigo Salvado Director General, Operational Partnership Department Asian Infrastructure Investment Bank

AIIB PARTNERSHIPS AT A GLANCE

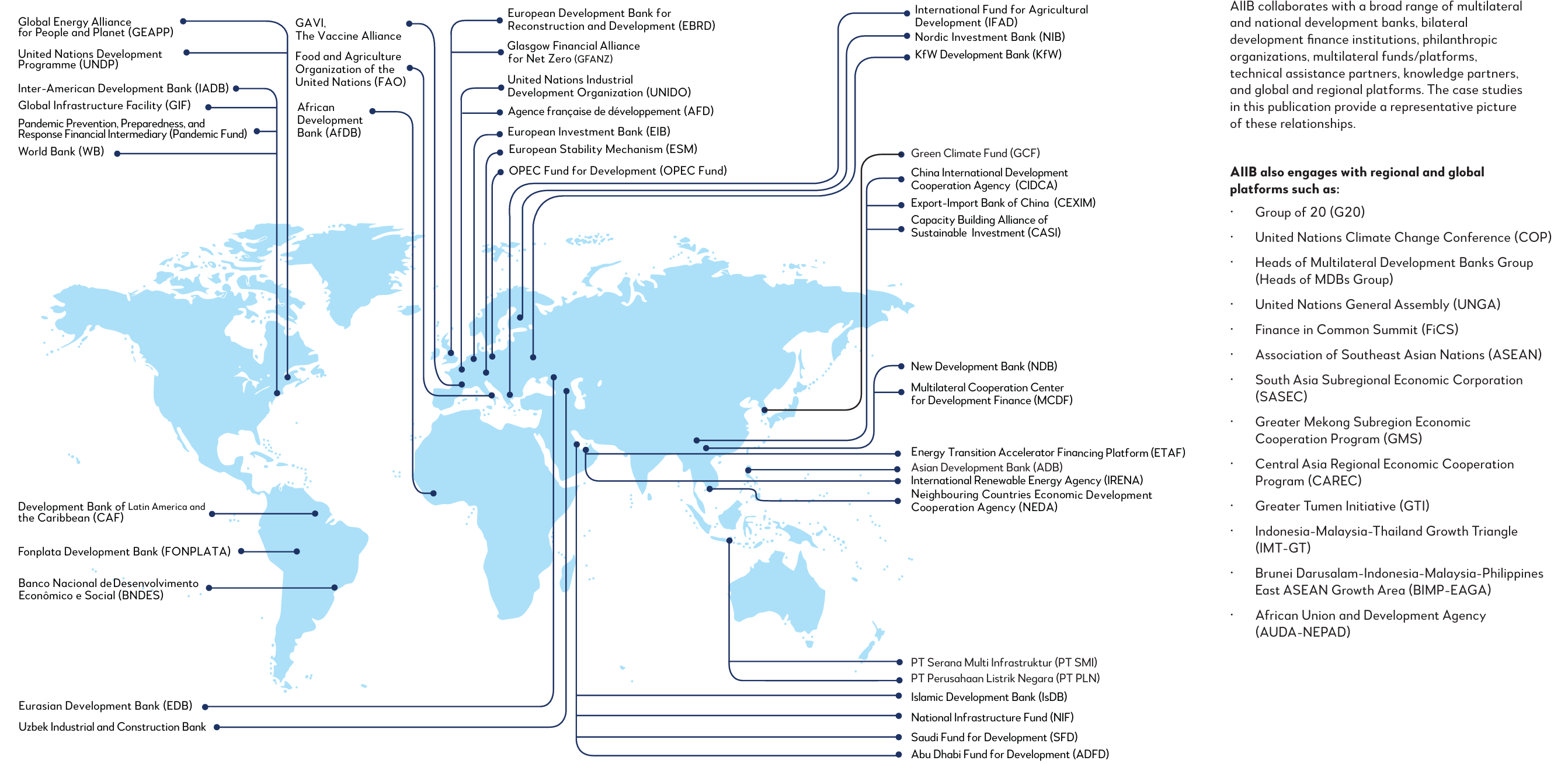

Note: This visualization includes AIIB partners with signed cooperation instruments. Institutions are represented based on the location of their headquarters. This visualization and any boundaries depicted are not true to scale and are visual representations of the partners’ locations for reference only. This visualization does not represent the view of AIIB as to the legal or other status of any territory or area

PARTNERING THE AIIB WAY

Our Partnership Principles and Goals

The Asian Infrastructure Investment Bank (AIIB) Corporate Strategy outlines the Bank’s vision, mission and strategic choices. AIIB’s vision is a prosperous Asia built on sustainable economic development and regional cooperation. Its mission is Financing Infrastructure for Tomorrow. By investing in sustainable infrastructure, AIIB unlocks new capital, new technologies and new approaches to tackling climate change and connecting Asia and the world.

Our Corporate Strategy recognizes that the Bank’s mission can be achieved only by working with others. Collaboration involves building trust, and complementing strengths. AIIB works to share its commitment to high international standards with Members and clients, helping them build capacity to develop effective operational partnerships.

Every AIIB partnership follows four fundamental principles:

Client focus. Our partnerships are tailored to meet client needs. We thrive on our clients seeing us as an Institution responsive to financing requirements and committed to delivering innovative, efficient and responsible solutions focused on achieving project outcomes.

Value addition. AIIB aims to add value through efficient procedures and effective systems while delivering the best possible client experience. Our Bank follows international practices and standards, helping clients mobilize resources that may otherwise be unavailable.

Operational adaptability. AIIB internal systems are designed to be flexible and efficient, enabling staff to meet clients’ and shareholders’ expectations under rapidly changing circumstances.

Institutional trust. AIIB promotes transparency and integrity in line with our policies and codes of conduct. With a AAA credit rating and a top-tier funding and liquidity assessment, our Bank maintains strong financial health and consistent access to global capital markets, strengthening stakeholder trust.2

In line with AIIB’s principles, partnerships are designed to achieve the following goals:

Resource mobilization. AIIB mobilizes financial and technical resources to expand financing options for Members. Through co-financing arrangements, Special Funds, external facilities and donor-project matchmaking, we bridge funding gaps and unlock opportunities for infrastructure development.

Knowledge exchange and capacity building. AIIB collaborates with partners to develop high-impact bankable projects by improving access to technical assistance and capacity-building initiatives. This accelerates project readiness, particularly in hard-to-reach sectors such as cross-border connectivity and climate technologies.

Global and regional cooperation. AIIB engages in key global and regional forums to shape infrastructure development practices. Participation in summits, conferences and workstreams reinforces our Bank’s role in the multilateral system.

Partnering through Co-Financing

Co-financing is central to AIIB’s mandate and operational approach. It unlocks additional resources to scale development efforts for shared clients. This reflects our commitment to maximizing resources for climate-resilient and sustainable infrastructure, in line with our Corporate Strategy. AIIB’s Articles of Agreement emphasize the importance of close collaboration with other development partners.

Anchored in the Bank’s Articles of Agreement and shaped by global best practices from the outset, AIIB adopted key operational policies aligned with the high standards of multilateral development banks (MDBs). These policies form the foundation for effective co-financing. AIIB also works closely with peer institutions to amplify development impact. Its operational framework aims to help Members overcome development challenges and increase impact. It also promotes coordination and mutual reliance with other MDBs, development finance institutions (DFIs) and partners—streamlining implementation and minimizing duplication.

Since AIIB was established, our core policies have been shaped by this purpose, peer MDBs’ experiences and the Paris Declaration on Aid Effectiveness. This foundation promotes cooperation and harmonization, improving the quality and impact of development financing.3

AIIB provides flexible co-financing models that allow for reliance on partners’ safeguards, procurement systems and supervision frameworks that meet standards equivalent to those of the Bank. This harmonized approach improves efficiency and lowers transaction costs for our clients, particularly in complex projects with multiple co-financiers.

AIIB Members and clients have recognized the value of co-financing:

Client alignment. Members support harmonized policy requirements and reduced costs in MDB-funded projects. AIIB’s approach improves the efficiency of due diligence and implementation monitoring, avoids duplication of efforts and reduces the administrative burden on clients.

Amplified impact. Joint financing mobilizes larger pools of capital, enabling Members to undertake large, complex and regional infrastructure projects that require long tenures and risk sharing.

Comparative advantages and expertise. AIIB’s policies, which broadly align with those of other MDBs, allow us to apply comparative strengths, leverage deep technical knowledge, and draw on long-standing client relationships to strengthen project design and delivery.

Market expansion. Co-financing with reputable and experienced institutions has helped AIIB enter new markets and build a high-quality portfolio. This expands client reach and increases overall impact.

As AIIB evolves, we are increasing the number of operations in which we take a lead, deepening our partnerships, harmonizing policies and delivering climate-resilient, sustainable and future-ready infrastructure solutions.

Mobilizing Resources for Clients’ Support

To bridge the infrastructure financing gap and better serve our Members, AIIB partners with a diverse range of donors, multilateral initiatives and platforms. These collaborations help tailor resource mobilization strategies and unlock concessional resources, technical assistance and innovative financing solutions that fit our clients’ needs.

By working together with peer MDBs, bilateral agencies, international organizations and philanthropic institutions, AIIB mobilizes external financial and technical resources to support project preparation, enable knowledge sharing, strengthen institutional capacity and expand development impact. As a core partner in global green initiatives such as the Global Energy Alliance for People and Planet (GEAPP) and the Energy Transition Accelerator Financing Platform, AIIB contributes to clean energy and climate resilience.

AIIB recognizes the need for breakthrough financial instruments to strengthen private and public capital mobilization and close critical resource gaps. To this end, we work with donor and investor platforms, such as the Arab Coordination Group and the Asian Venture Philanthropy Network, to explore blended and catalytic finance that is fit for purpose.

AIIB’s Special Funds

Our Special Funds allow the us to receive and manage donor grants for the provision of additional support to our Members, particularly less developed economies, for projects and activities aligned with AIIB’s thematic priorities.

Special Funds support project identification, preparation and implementation; enhance clients’ capabilities via the financing of technical assistance and capacity building activities; and make AIIB loans more affordable through interest buydowns.

Based on funding sources and governance arrangements, the Bank operates two types of Special Funds:4

Internal Special Funds are resources managed through AIIB’s Project Preparation Special Fund (PPSF), Special Fund Window for Less Developed Members (SFW), and Project Specific Window (PSW). Grant contributions to the Project Preparation Special Fund and the Special Window Fund are not pre-allocated to specific AIIB projects. Contributions to the PSW are directed to designated AIIB investments.

External Special Funds are resources received by AIIB as an implementing entity from external partnership facilities such as the Multilateral Cooperation Center for Development Finance (MCDF), the Global Infrastructure Facility (GIF) and the Pandemic Prevention, Preparedness and Response Fund (Pandemic Fund). Contributions to—and allocations from—these funds follow governance processes and policies set by the respective facilities.5

AIIB Digital Partnership Tools

AIIB uses cutting-edge technologies to bolster collaboration and enhance concessional resource mobilization. The Bank’s digital partnership suite includes a comprehensive portal and a signature matchmaking platform—AIIB+, that strengthen coordination with concessional co-financiers and streamline engagement.6

In 2023, AIIB launched the Infratech Portal to expand engagement with infrastructure stakeholders, technology providers and investors. The platform supports the adoption and development of infrastructure technologies, delivering value to clients and the broader partner community.7

In 2024, AIIB, together with nine peer MDBs launched the Global Collaborative Co-Financing Platform to strengthen collaboration, streamline co-financing processes and provide a centralized hub for project information. The portal offers a secure platform for registered co-financiers to share pipeline projects that may benefit from co-financing. Users can customize project listings, explore other co-financing opportunities and connect directly with institutions to initiate discussions.8

Click to read more