Summary:

PWBM estimates that the COVID-era Employee Retention Credit (ERC) will have cost more than $300 billion when the IRS finishes processing claims later in 2025, nearly four times the initial projected cost. Most of the ERC was paid retroactively, well after pandemic-related economic disruptions had ended, limiting its effectiveness as a worker retention incentive.

Key Points:

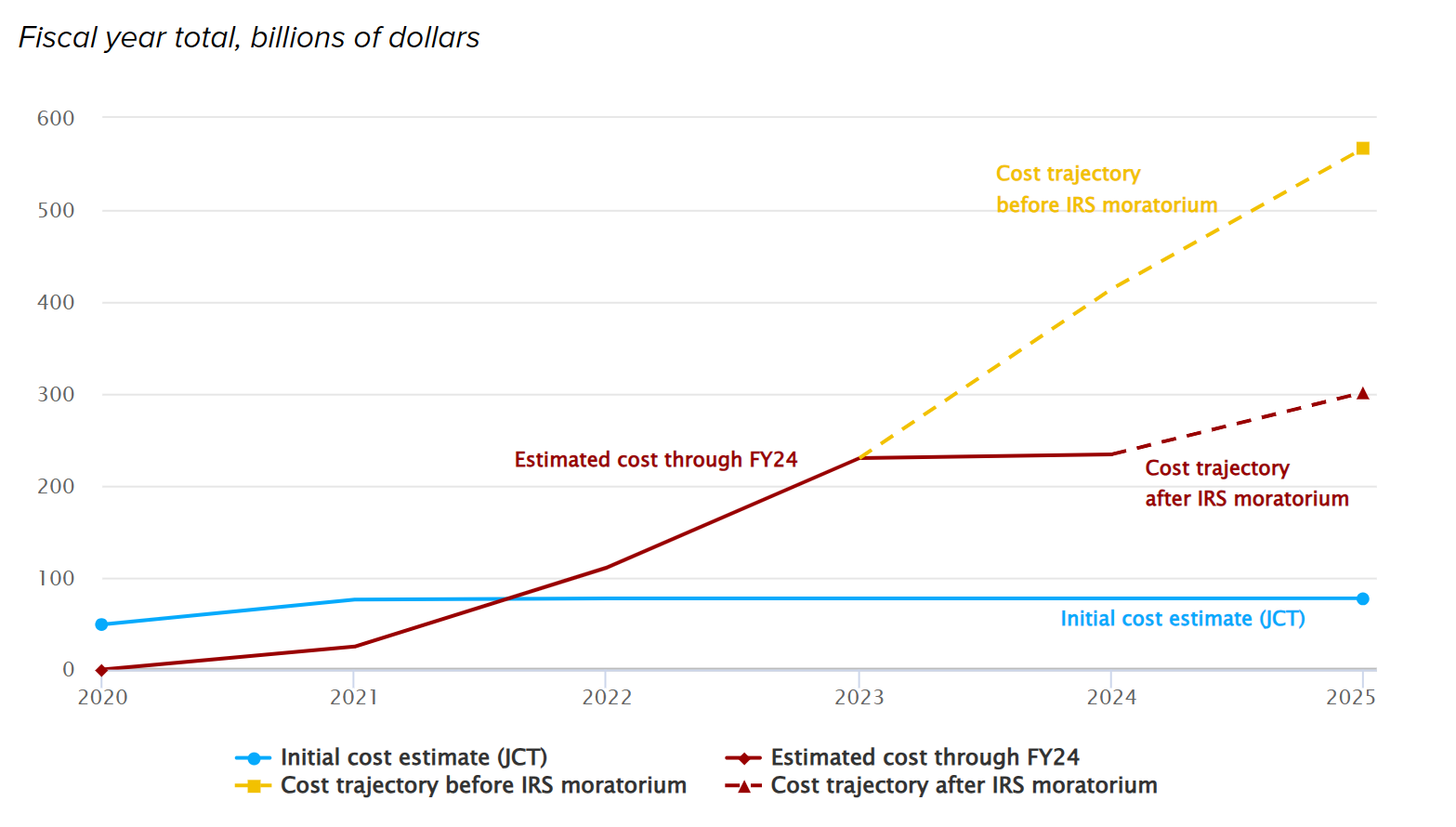

1. The Joint Committee on Taxation (JCT) initially projected that the ERC would cost $78 billion, but costs came in much higher because of an extended claiming period and a flood of questionable claims, often encouraged by third-party firms. PWBM estimates that, as of September 2023, the ERC was on pace to reach a final cumulative cost of $567 billion.

2. The IRS announced a moratorium on processing ERC claims in September 2023 and did not resume processing until August 2024. During the moratorium, the IRS examined and improved its procedures to identify improper claims.

3. With the IRS’ enhanced ERC enforcement efforts, PWBM now projects that the ERC will reach a final cumulative cost of $302 billion. That is nearly four times the original projected cost but only about half the pre-moratorium cost trajectory.

The Cost of the Employee Retention Tax Credit

Background

The ERC originally provided eligible employers with a refundable credit equal to 50% of qualified wages paid from March 13, 2020 through December 31, 2020, up to a maximum credit of $5,000 per employee. To qualify for the credit, businesses had to have experienced a suspension of operations due to a government order or a significant decline in receipts. Any business that received a Paycheck Protection Program (PPP) loan – another COVID-19 program – was automatically ineligible for the ERC. Under those original parameters, the Joint Committee on Taxation (JCT) estimated that the ERC would cost $55 billion.

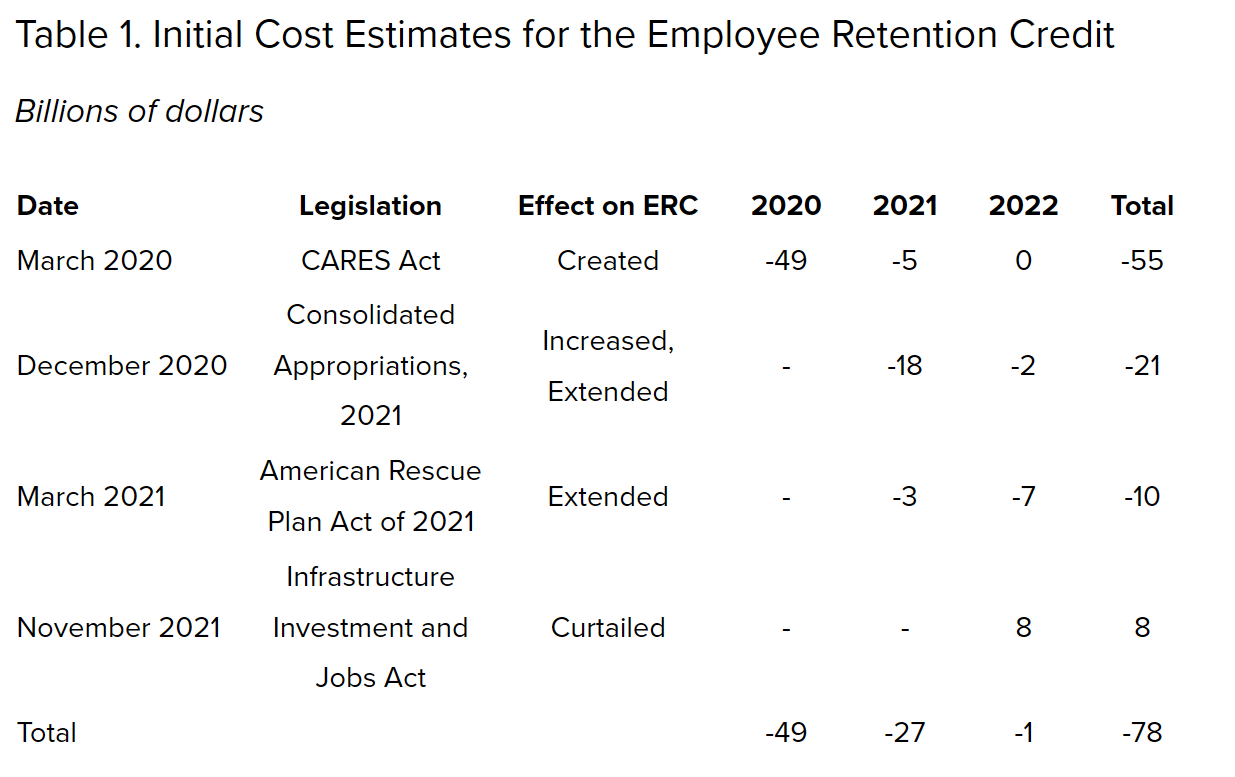

Lawmakers enacted several changes to the ERC during 2021 that made it more generous. First, the maximum credit amount was increased to $7,000 per employee per quarter. Second, employers who received PPP loans were permitted to claim the ERC under the condition they did not use the same wages payments for both programs. Third, the qualifying wage period was extended from December 31, 2020 to September 30, 2021 for most employers. Table 1 shows how legislative changes affected the ERC’s projected cost, including a November 2021 change to curtail ERC benefits for the fourth quarter of 2021. With these modifications, the expected cost of the ERC rose to $78 billion.

Source: Joint Committee on Taxation (JCT)

Notes: Summing JCT’s cost estimates in this way does not account for economic and technical changes that occurred between each published estimate that were unrelated to the ERC. Columns do not sum to the total of $78 billion because there are minor ERC costs from 2023-2028 (less than $1 billion per year) which are not shown above.

The ERC’s Cost Came in Higher than Projected

JCT’s original estimates assumed that almost all ERC payments would be paid by the end of fiscal year 2022. However, most ERC claims were ultimately made via amended returns filed long after the original deadline. Employers were able to submit amended returns to claim 2021 ERC benefits until April 2025.

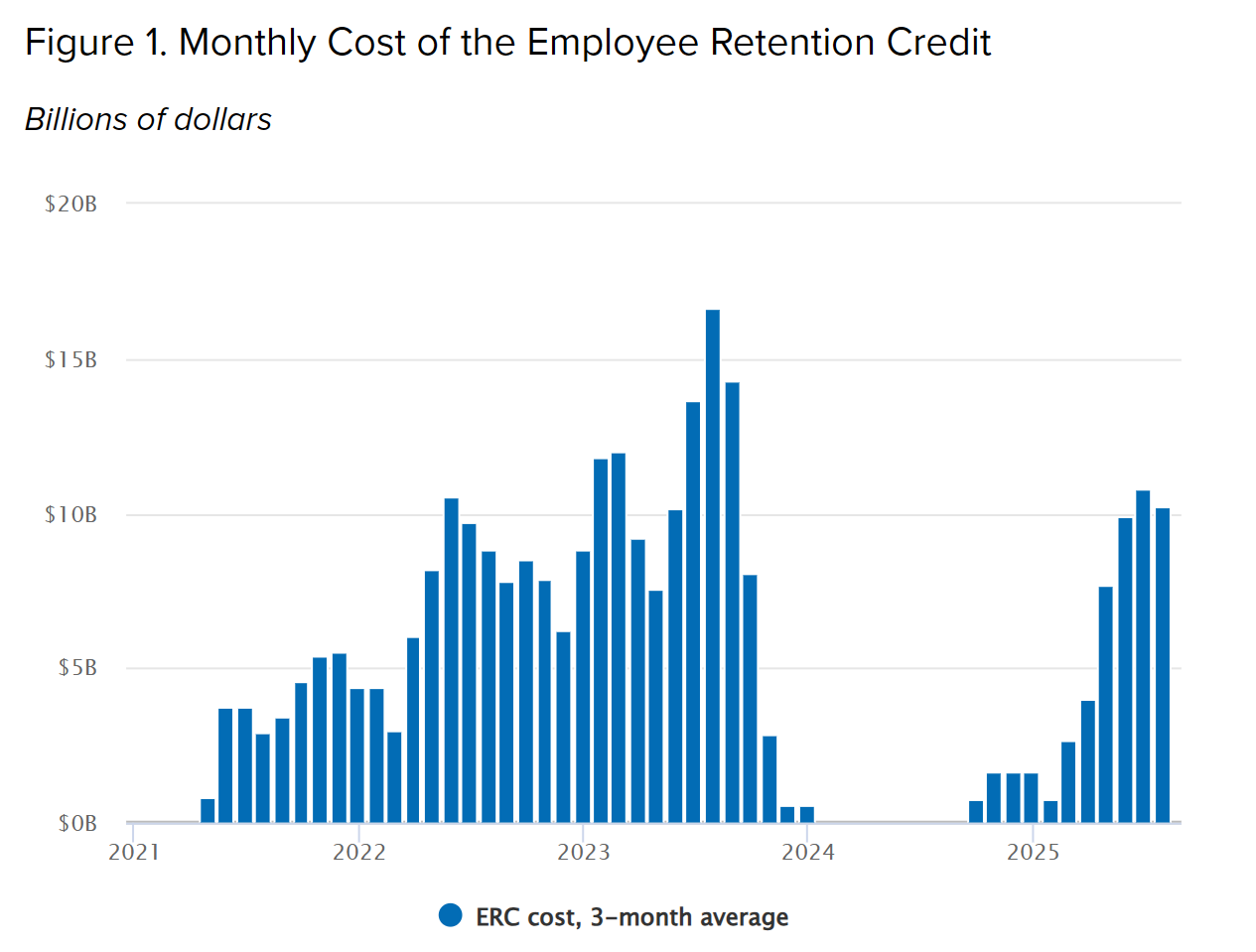

Figure 1 below shows PWBM’s estimate of the ERC’s monthly cost during this period. Uptake of the credit was generally low until mid-2021: PWBM estimates that only about $25 billion of ERC cost was realized by the fall of 2021, when the most acute economic effects of the COVID-19 pandemic had already subsided. Then, ERC costs increased rapidly in 2022 and 2023 as firms began claiming the credit via amended quarterly payroll tax returns. As of mid-2023, the monthly cost of the ERC was still growing.

Source: PWBM estimates from Treasury Department data

In addition to the longer-than-expected claim period, the ERC’s cost ballooned after the pandemic was over due to a high volume of questionable claims, often encouraged or induced by paid preparers. In March 2023, the IRS issued a press release that warned filers about aggressive marketing from third-party firms that were promoting potentially fraudulent ERC claims:

1.“The Internal Revenue Service today issued a renewed warning urging people to carefully review the Employee Retention Credit (ERC) guidelines before trying to claim the credit as promoters continue pushing ineligible people to file.

2. The IRS and tax professionals continue to see third parties aggressively promoting these ERC schemes on radio and online. These promoters charge large upfront fees or a fee that is contingent on the amount of the refund.”

In a 2023 paper, Lucas Goodman noted that paid preparers played a substantial role in whether firms claimed the ERC. Moreover, he found that a small number of preparers were having an outsized impact. Using one of the most aggressive preparers increased the likelihood of filing from 27% to 95%, suggesting that the decision to claim was often driven less by firms’ own interpretation of eligibility and more by the practices of ERC preparation firms.

The IRS’s ERC moratorium

By September 2023, concerns over questionable claims led the IRS to issue a moratorium on the processing of new ERC claims. At the time the moratorium was announced, the total cost of the ERC had already reached $230 billion, the IRS had a backlog of 600,000 unprocessed claims, and it was still receiving 50,000 new claims per week. PWBM estimates that at this point, had the IRS not acted, the ERC’s total cost was on track to reach $567 billion.

Figure 1 shows that after the moratorium was issued, ERC costs dropped to near zero. During that period, in addition to the moratorium on processing of new claims, the IRS worked on improving its processes for identifying legitimate claims, created a voluntary disclosure program, and made a claim withdrawal option available.

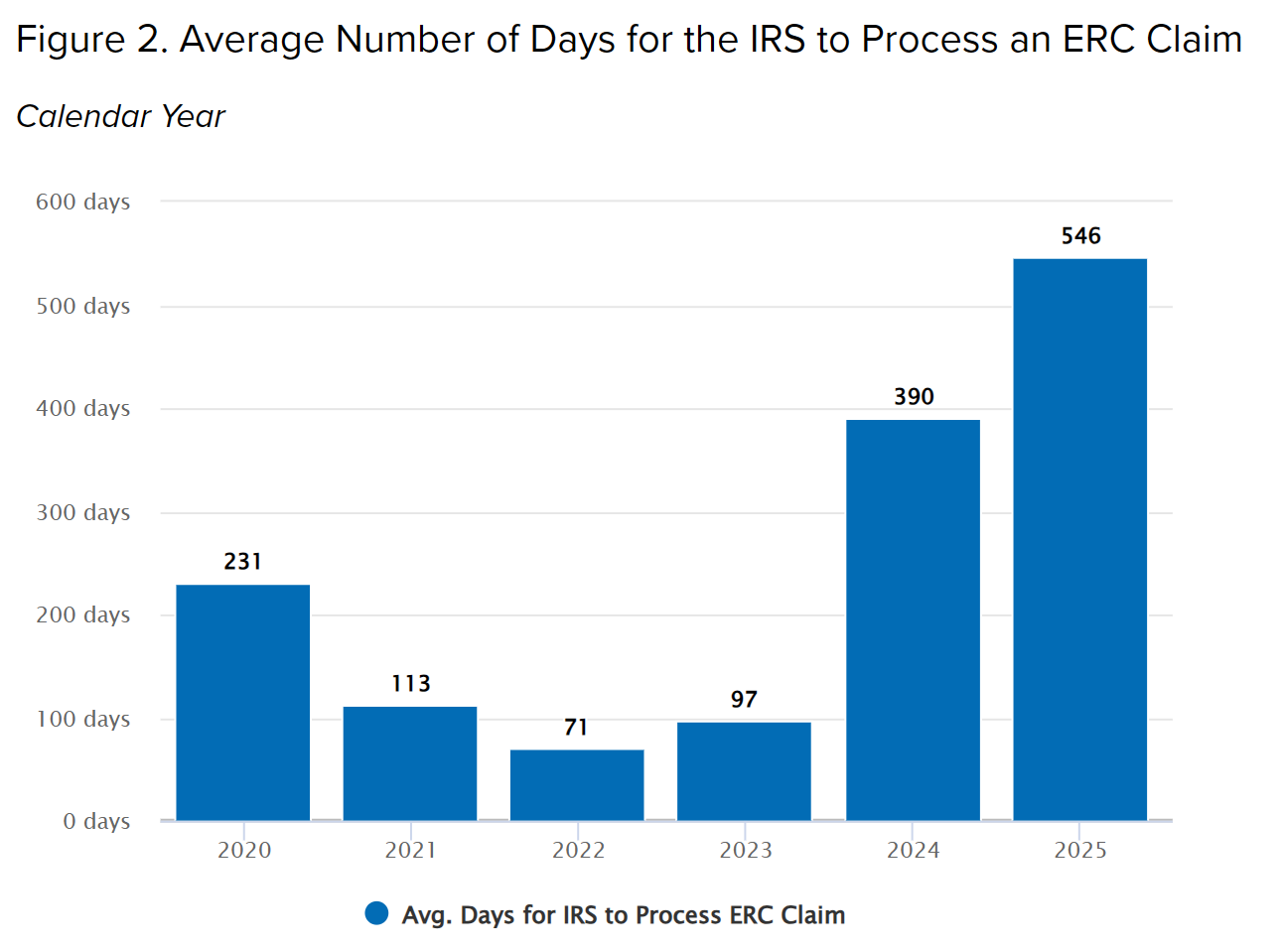

The processing moratorium was ultimately lifted in August 2024. It provided the IRS with an opportunity to better understand the nature of the claims that it had received leading up to September 2023. Evidence of this is seen in Figure 2 below, which shows the average number of days that it took for the ERC to process a claim, based on the year in which that claim was processed. In 2022 and 2023, before the moratorium was issued, the IRS was processing claims for the ERC in less than 100 days. By contrast, starting in 2024, the average claim was being processed after being with the IRS for 390 days. Then, in 2025, that review period grew even longer. This suggests that the shift in approach marked by the moratorium has had lasting effects – the IRS is taking time to carefully review claims for the ERC to ensure that they are valid.

Source: National Taxpayer Advocate

Nonetheless, the moratorium did not slow the submission of new claims. By October 2024, the ERC backlog had reached 1.2 million. Then, after several more months of processing, the IRS reported in April 2025 that the claim backlog had been reduced to 597,000. Because PWBM estimates that ERC costs totaled just $19 billion over that period, it appears that much of that backlog processing may have been a combination of rejections, requests for more information from the taxpayer, and payments of relatively small ERC amounts. Since then, in May, June, and July of 2025, ERC costs have come in at $9 billion to $13 billion per month.

PWBM estimates that since April 2025, the IRS has been processing about 100,000 claims per month, which would have put the remaining backlog at 297,000 claims at the beginning of July 2025. A few days into that month, lawmakers enacted the One Big Beautiful Bill Act, which disallowed unprocessed claims for 2021 ERC that were filed after January 31, 2024. As a result, PWBM now projects that the ERC backlog will be cleared in the fall of 2025 at a final cumulative cost of $302 billion, as shown in Figure 3 below. That estimated final cost is in sharp contrast to projections from before the moratorium, when the unchecked processing of ERC claims had the credit on a path to cost $567 billion.

Figure 3. Projected Cumulative Cost of the Employee Retention Credit, Before and After the IRS Implemented its Review Actions

Source: PWBM, Joint Committee on Taxation (JCT), and IRS press releases

This analysis was produced by Ed Murphy under the direction of Alex Arnon. Mariko Paulson prepared the brief for the website.

Media (only): For the fastest response, email us at inquiries-pwbm@wharton.upenn.edu.

All other responses: Please use our Contact Us.

Sign up for PWBM Breaking News, Alerts and Newsletter. Unsubscribe anytime.

Click to read more