13th Ministerial Conference

WTO members concluded the 13th Ministerial Conference (MC13) in Abu Dhabi on 2 March 2024 with the adoption of a Ministerial Declaration setting out a forward-looking, reform agenda for the organization. Ministers also took a number of ministerial decisions, including renewing the commitment to have a fully and well-functioning dispute settlement system and to improve use of the special and differential treatment (S&DT) provisions for developing economies and least developed countries (LDCs). They also agreed to continue negotiations in all areas where convergence was elusive at MC13.

The Ministerial Conference brought together nearly 4,000 ministers, senior trade officials and other delegates from the WTO’s 164 members and observers as well as representatives from civil society, business and the global media. Initially scheduled for 26-29 February 2024, the Conference was extended in a f inal push to reach outcomes on the various issues at stake.

DG Okonjo-Iweala thanked members for their efforts to seek convergence on difficult issues and against a global backdrop of economic and geopolitical uncertainty. “We have worked hard this week. We have achieved some important things, and we have not managed to complete others. Nevertheless, we moved those pieces of work in an important way. At the same time, we have delivered some milestone achievements for the WTO and laid the groundwork for more,” she said.

In their declaration, ministers pledged to preserve and strengthen the ability of the multilateral trading system, with the WTO at its core, to respond to current trade challenges. They also underlined the centrality of the development dimension in the work of the WTO.

Members recognized the importance of services, which generate more than two-thirds of global economic output and accounts for over half of all jobs. They encouraged WTO bodies to continue their work to review and build on all the lessons learned during the COVID-19 pandemic and to build effective and expeditious solutions in case of future pandemics.

On dispute settlement reform, members recognized progress made towards having a fully and well-functioning dispute settlement system accessible to all members. Ministers instructed officials to accelerate discussions, build on this progress and work on unresolved issues (see page 120).

Ministers called for improved technical assistance for developing economies and LDCs to assist them in engaging in sanitary and phytosanitary (SPS) and technical barriers to trade (TBT) matters. They also urged enhanced implementation of special and differential treatment (S&DT) provisions for developing economies and LDCs. “This is a win for development, one that will help enable developing countries, especially LDCs, fulfil their WTO commitments, exercise their rights and better integrate into global trade,” said DG Okonjo-Iweala.

In another first, ministers discussed how trade relates to two issues that go to the heart of current political, economic and environmental challenges, namely sustainable development and socioeconomic inclusion. DG Okonjo-Iweala emphasized the recognition by members of “the role trade and the WTO can play in empowering women, expanding opportunities for micro, small, and medium-sized enterprises (MSMEs,) and achieving sustainable development in its three dimensions – economic, social and environmental”.

Ministers approved the WTO membership terms of Comoros and Timor-Leste, the first new members in almost eight years (see page 40).

Additionally, MC13 saw agreement to reinvigorate work under the Work Programme on E-commerce (see page 74) and to maintain a moratorium on customs duties on electronic transmissions until MC14, set for 26-29 March 2026 (see page 72). Ministers also extended a moratorium on “non-violation and situation complaints” under the TRIPS Agreement (see page 107).

Ministers adopted a ministerial declaration on strengthening regulatory cooperation to reduce technical barriers to trade (TBT) (see page 86). They also reaffirmed the commitment to the Work Programme on Small Economies (see page 128) and issued a ministerial decision on concrete measures to ease the path to graduation from LDC status (see page 126).

Members could not conclude a “second wave” of negotiations to add new provisions – on curbing subsidies contributing to overcapacity and overfishing – to the Agreement on Fisheries Subsidies (see page 52). DG Okonjo-Iweala said: “While I had hoped that we could finish these negotiations in Abu Dhabi, you have prepared the ground for its conclusion at the next Ministerial Conference, if not earlier.”

On agriculture, despite intense negotiations during MC13, members were not able to find convergence. Divergences remained, notably on public stockholding for food security purposes (see page 49). “At MC12, we couldn’t even agree on a text. Even though there are challenges, for the first time we have a text. We couldn’t finish the work on it here. So let us get back to Geneva and deliver!” the DG said.

MC13 also saw the entry into force of new disciplines on services domestic regulation, which is expected to lower trade costs by over US$ 125 billion worldwide (see page 63). Additionally, ministers representing 123 WTO members issued a Joint Ministerial Declaration marking the finalization of the Investment Facilitation for Development (IFD) Agreement (see page 61). Participants in the IFD initiative represent three-quarters of the WTO membership, including close to 90 developing economies and 26 LDCs.

Co-sponsors of three environmental initiatives at the WTO presented at the Ministerial Conference the next steps they are taking to advance work on environmental sustainability, plastics pollution, and fossil fuel subsidy reform.

Global trade developments and outlook

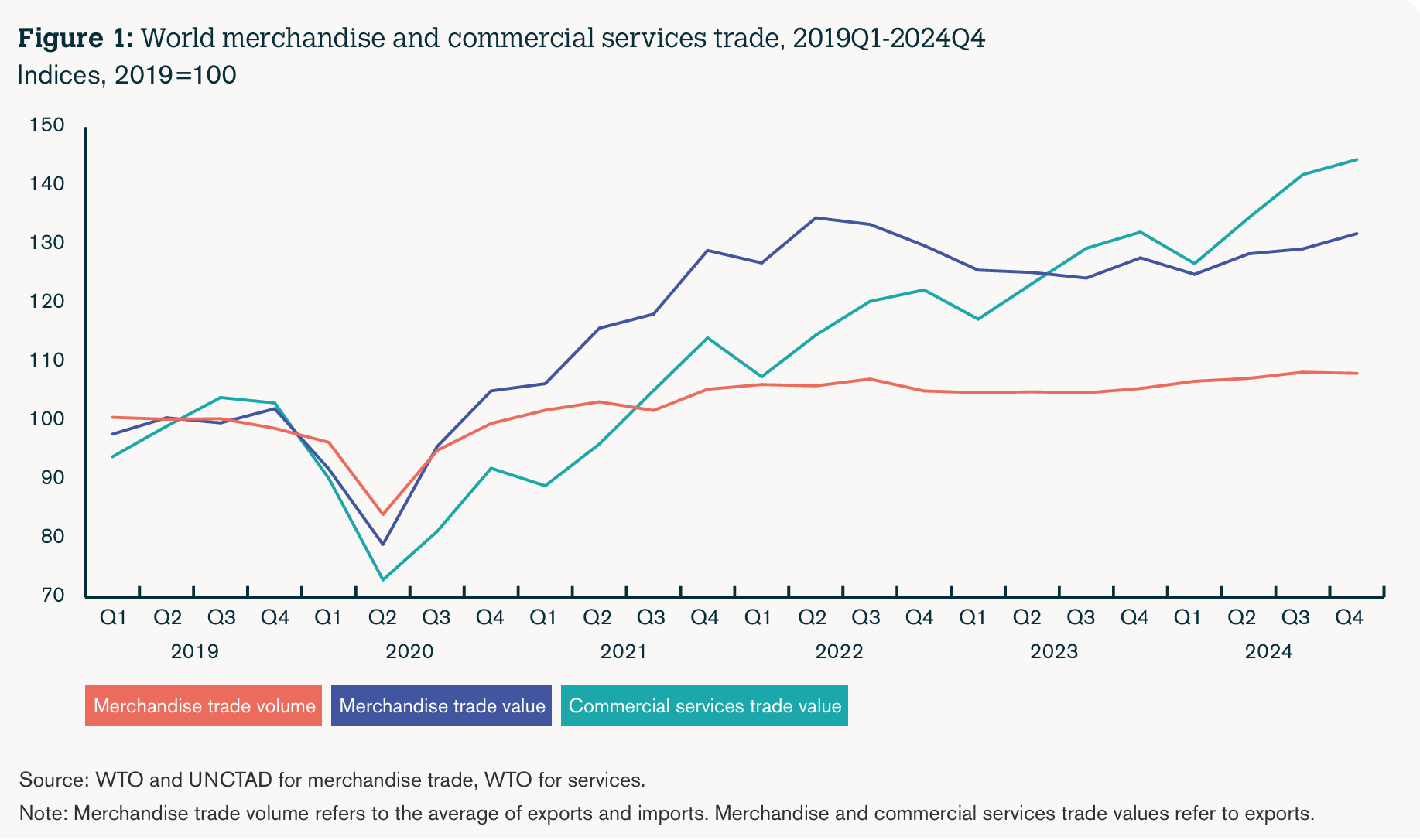

World trade saw strong growth in 2024 (see Figure 1), with a 2.9 per cent increase in the volume of merchandise trade and a 6.8 per cent rise in the value of commercial services trade. Sustained trade expansion was initially expected for 2025, but rising tariffs and trade policy uncertainty have caused WTO economists to downgrade their forecasts for both merchandise and commercial services trade in volume terms.

Merchandise trade

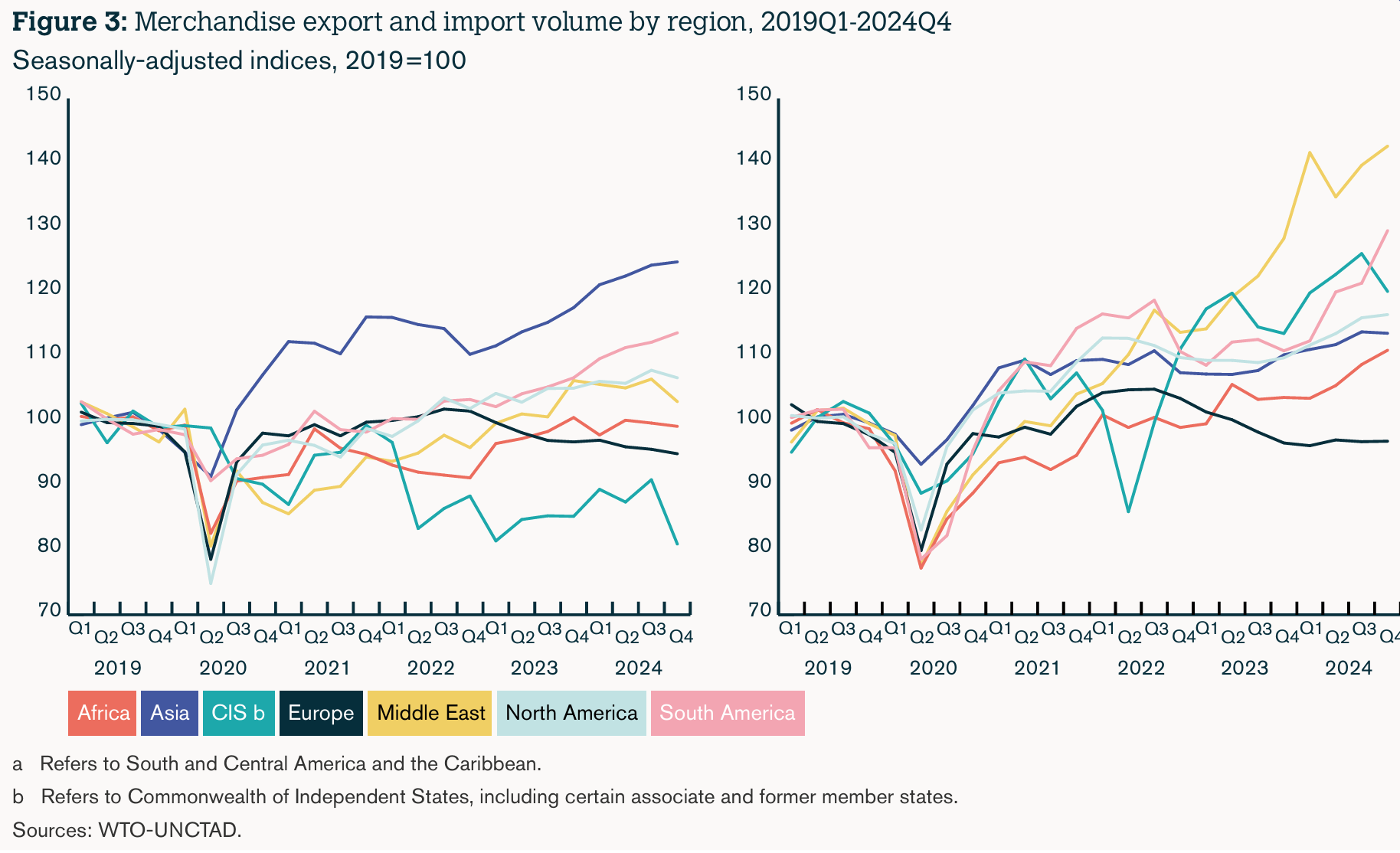

In 2024, world merchandise trade volume growth (2.9 per cent) was stronger than world GDP growth at market exchange rates (2.8 per cent) for the first time since 2017, excluding the rebound from the COVID-19 pandemic. All regions recorded positive growth in exports and imports except for Europe, where both contracted. In particular, trade within the European Union fell 3.2 per cent, which weighed down on regional and global totals. World trade growth excluding intra-EU trade was even stronger at 4.3 per cent, well above global GDP growth.

In value terms, world merchandise trade rose 2 per cent to US$ 24.43 trillion in 2024, after falling by 4 per cent in 2023. China was the largest exporter (US$ 3.58 trillion) while the United States remained the largest importer (US$ 3.36 trillion). The European Union was the second largest trader on both the export side and the import side. Merchandise exports of least developed countries rose 5 per cent, to US$ 275 billion, after dropping 2 per cent in 2023.

One notable development last year was the widening of China’s merchandise trade surplus, which grew around 20 per cent to US$ 990 billion as weak consumer demand dampened imports. China’s surplus with the United States registered a smaller-than-average increase of around 7 per cent, while other trading partners saw larger increases, including the European Union at 12 per cent.

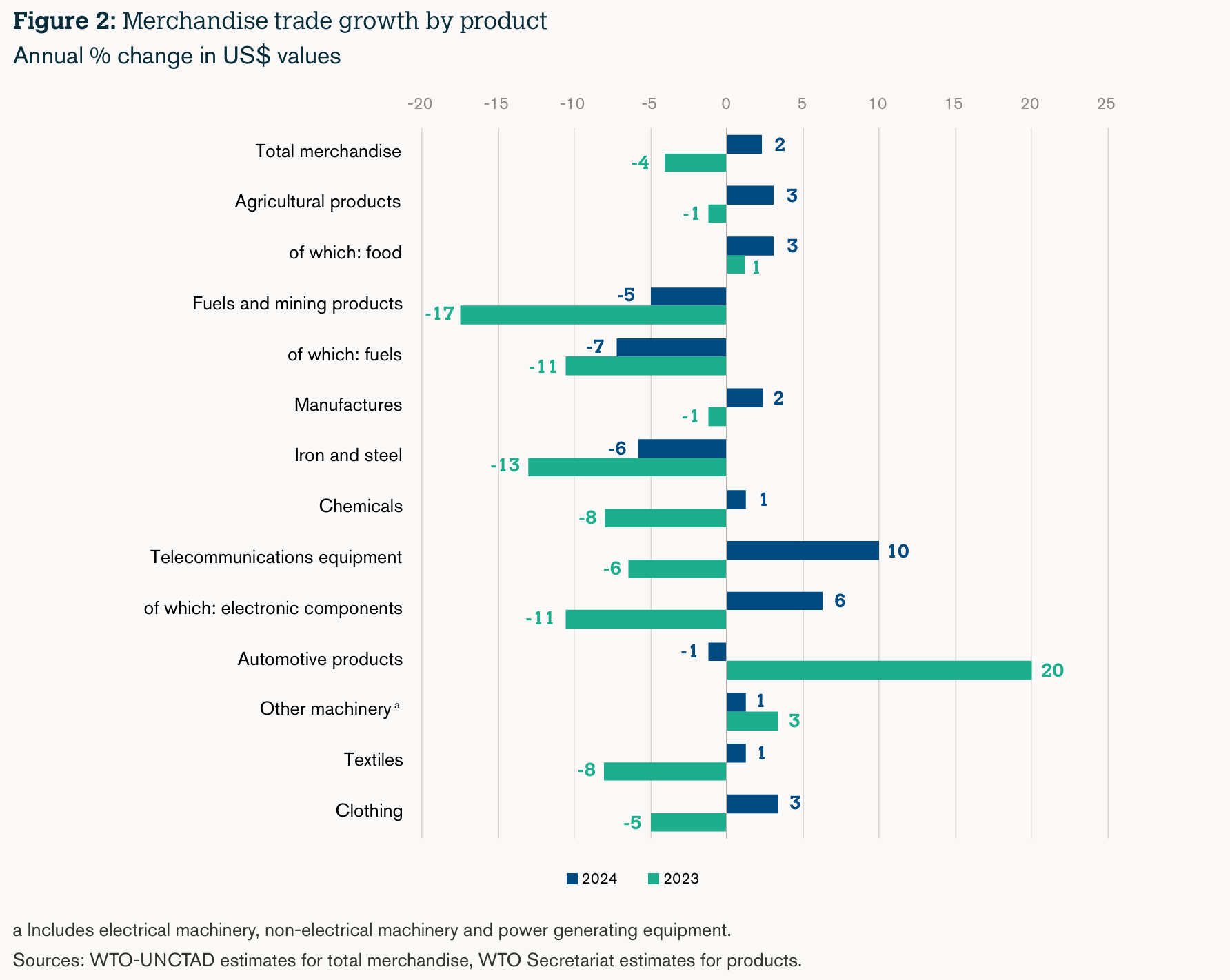

World trade growth in value terms was moderate in most product categories last year, which is illustrated by Figure 2. Trade in manufactured goods grew in line with total merchandise trade at 2 per cent. Meanwhile, trade in agricultural products grew slightly faster at 3 per cent. Trade in fuels and mining products declined by 5 per cent. Trade in office and telecommunications equipment rose sharply (up around 10 per cent), while trade in iron and steel contracted (down 6 per cent). Trade in most product categories has risen sharply since the pre-pandemic period, leaving total merchandise exports up 27 per cent between 2019 and 2024.

Asia’s growth in merchandise export volume in 2024 was stronger than expected at the start of the year. Meanwhile, import volume growth exceeded expectations in North America. Outside of Europe, where trade contracted, the region with the weakest merchandise trade growth was Africa, where exports and imports were up just 1.3 per cent and 1.8 per cent respectively for the year (see Figure 3).

At the start of 2025, WTO economists expected growth in world merchandise trade volume to remain steady at 2.7 per cent for the year. However, rising tariffs and increased trade policy uncertainty prompted the WTO Secretariat to downgrade its forecast – to a -0.2 per cent contraction – in the Global Trade Outlook and Statistics report issued in April 2025. Since then, tariffs have continued to fluctuate, with each policy shift having an impact on the trade forecast. The Secretariat continuously monitors these policy developments and issues updated projections at regular intervals.

Services trade

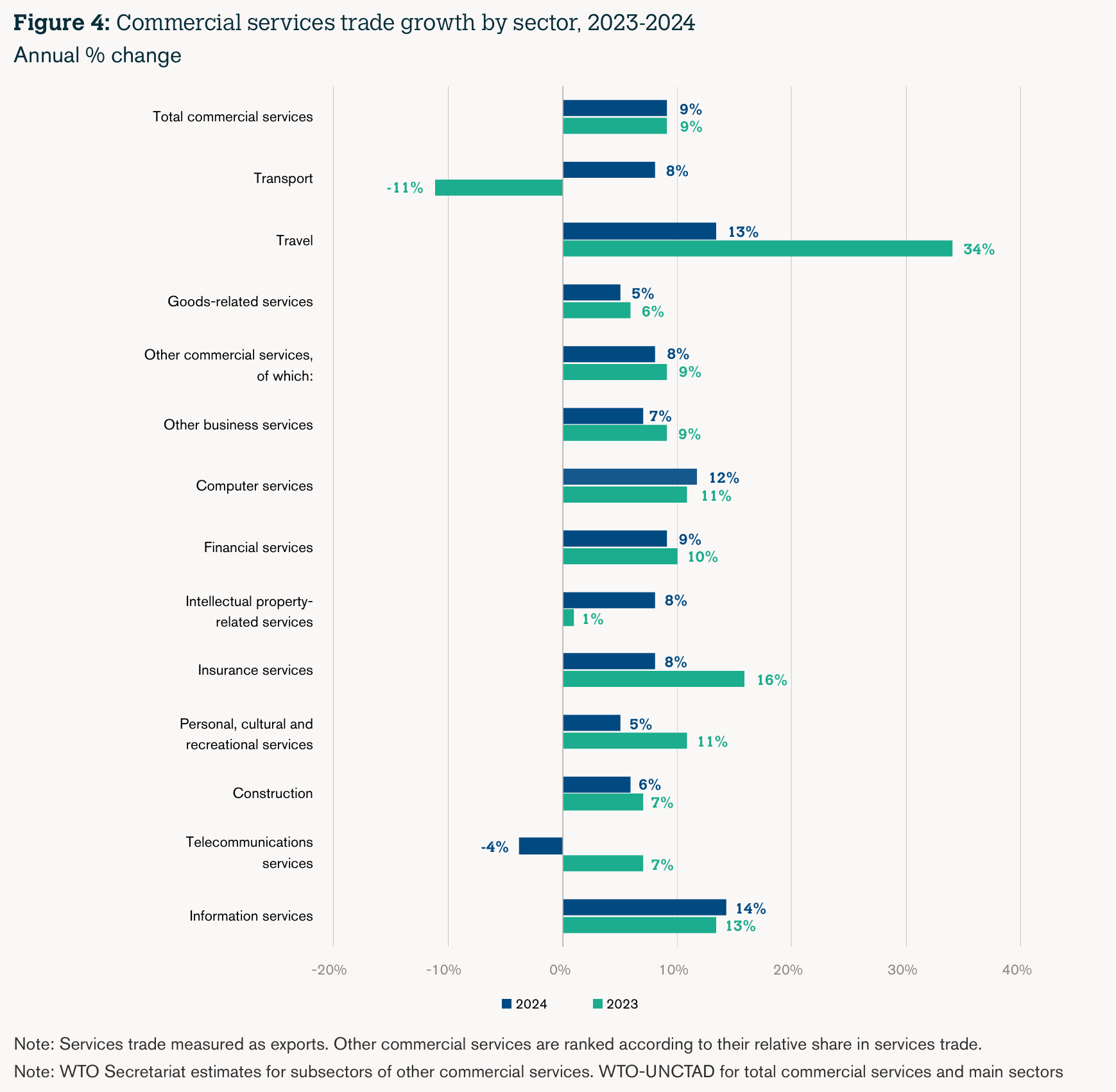

In 2024, services trade increased by 9 per cent in value terms, mirroring growth in 2023 (see Figure 4). All broad sectors contributed to the rise, including transport (up 8 per cent), travel (up 13 per cent), goods-related services (up 5 per cent) and other commercial services (up 8 per cent). By the end of 2024, global tourist arrivals were just 1 per cent below pre-pandemic levels, according to UN Tourism.

The category “other commercial services”, which accounts for around 60 per cent of total services trade, expanded by 8 per cent in 2024. The category encompasses a wide variety of sub-sectors, including digitally deliverable services such as computer, f inancial, business and insurance services. Computer services, in particular, recorded an impressive increase in 2024, surging 12 per cent and reaching the US$ 1 trillion mark.

Global exports of digitally delivered services rose by 8.3 per cent in 2024, reaching US$ 4.64 trillion in 2024. The share of these services is increasing, accounting for 14.5 per cent of world exports of goods and services.

Many major traders reported commercial services export growth roughly equal to the world average of 9 per cent in 2024. This includes Europe at 8 per cent, North America at 8 per cent, and South and Central America and the Caribbean at 9 per cent. Asia saw stronger growth, at 13 per cent. Only 3 per cent growth was achieved in Africa while the Middle East saw a contraction of 1 per cent.

For 2025, the Secretariat predicted 4.0 per cent growth in services trade volume – down from 5.1 per cent under a “low tariff” baseline scenario – in the April 2025 edition of Global Trade Outlook and Statistics. Although not directly subject to tariffs, services trade is expected to be adversely affected by tariff increases. A decline in goods trade as a result of higher tariffs tends to weaken demand for related services such as transport and logistics while slower economic growth and heightened trade policy uncertainty would deter spending on travel and investment-related services.

Policy changes since April have lifted the services trade forecast slightly. As with goods trade, the Secretariat monitors trade policy developments on an ongoing basis and regularly evaluates their impact on services trade.

Click to read more