Executive summary

Mobile phones and the internet are revolutionizing financial inclusion, enabling more people to access and use digital financial services to manage their financial lives. From mobile money accounts accessible on basic phones to bank-account-linked wallets used on smartphones, digital services are fulfilling their promise of being more accessible and affordable than alternatives that are not digitally accessible, bringing benefits such as the ability to make daily savings deposits using local agents, to manage loan disbursements and repayments using an app, and to purchase pay-as-you-go renewable electricity directly from a phone, to name just a few.

These increases in access to and use of financial accounts enabled by mobile technology are among the top findings from this fifth edition of the Global Findex, including new data on ownership of mobile phones and internet use from the inaugural Global Findex Digital Connectivity Tracker. The data show high levels of phone ownership and internet use and increased ownership and usage of mobile enabled accounts in every region of the world. Mobile platforms in particular have given millions of people, including those who were previously too difficult or too expensive to reach, access to financial services, dramatically boosting not just account ownership but also formal saving and digital payments, while in addition enabling a range of nonfinancial digital activities.

The report’s main findings are captured in the following sections.

Worldwide, 79 percent of adults have an account at a bank or similar financial institution, with a mobile money provider, or both, up from 74 percent in 2021

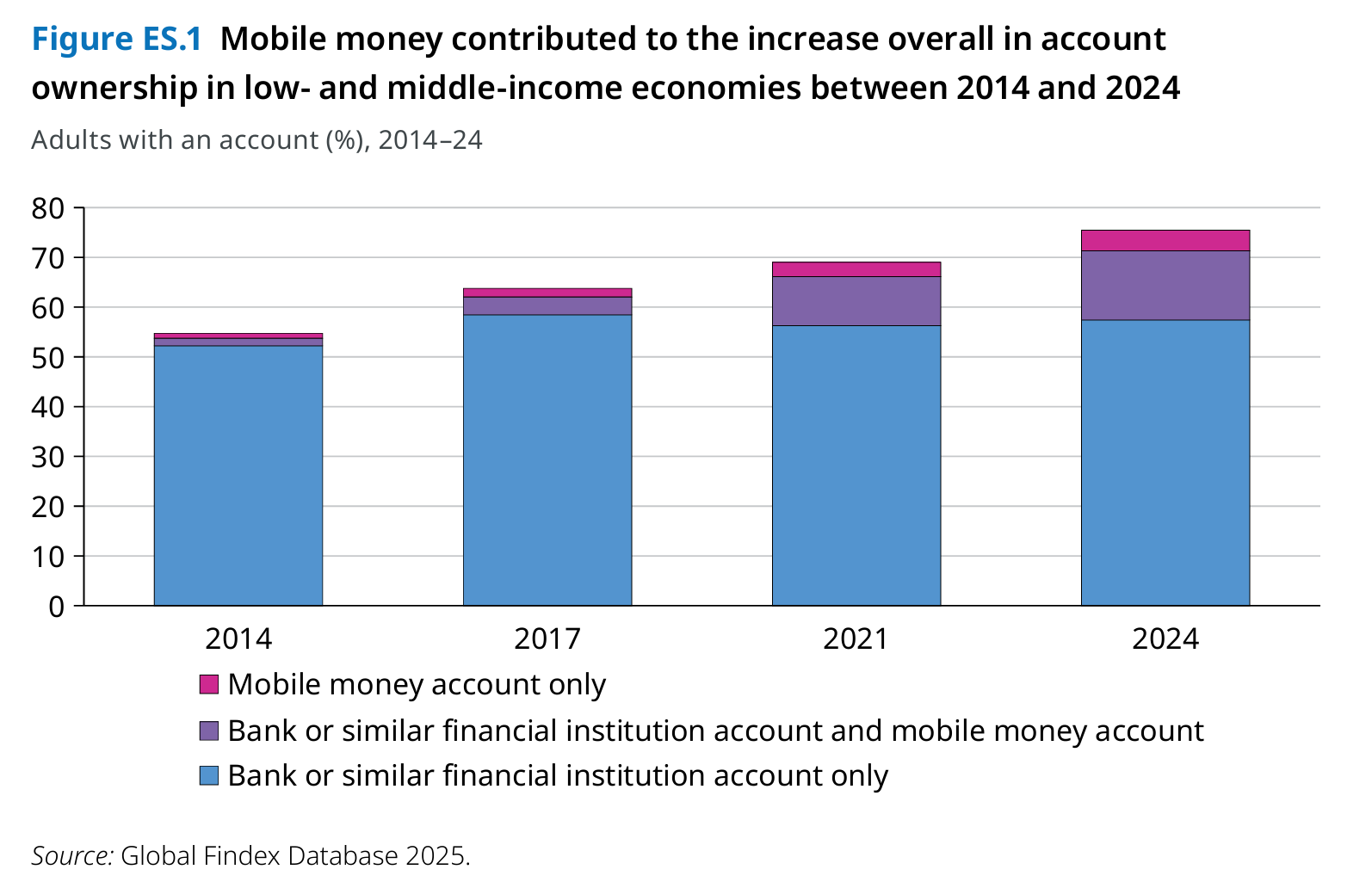

Ownership of financial accounts increased globally by 5 percentage points between 2021 and 2024 and by 6 percentage points in low- and middle-income economies, in which 75 percent of adults now have an account.

Account owners increasingly use their mobile phones or debit or credit cards connected to their accounts to make transactions. More than half of all accounts in low- and middle-income economies are digitally enabled in this way,1 including both mobile money accounts2 and accounts at banks or similar financial institutions such as credit unions, cooperatives, microfinance institutions, or post offices.

Mobile money accounts are driving the increase in account ownership. The growth over the past 10 years in the share of adults who own any kind of account is equivalent to the increase in the share of people owning either only a mobile money account or a mobile money account along with an account at a bank or similar financial institution (refer to figure ES.1).

Telecommunications companies in Sub-Saharan Africa catalyzed the mobile money revolution by offering simple transactional accounts via mobile phones. These companies often operate independently of traditional banks. Though they emerged in East Africa, they have since spread across the continent and are the dominant financial providers in some of the region’s economies, supporting a range of financial activities, including making and receiving payments, saving, and borrowing.

Even as mobile money continues as a Sub-Saharan African success story, other regions are reaping the benefits, too. In Latin America and the Caribbean, adoption of mobile money, typically used in combination with or to digitally enable accounts at banks and similar financial institutions, is approaching levels seen in Sub-Saharan Africa. Some economies across Europe and Central Asia are also narrowing gaps in financial inclusion by embracing mobile money or other digitally enabled accounts.

To quantify this growth: 40 percent of adults in Sub-Saharan Africa had a mobile money account as of 2024, up from 27 percent in 2021. In Latin America and the Caribbean, 37 percent of adults had a mobile money account as of 2024, up from 22 percent in 2021.

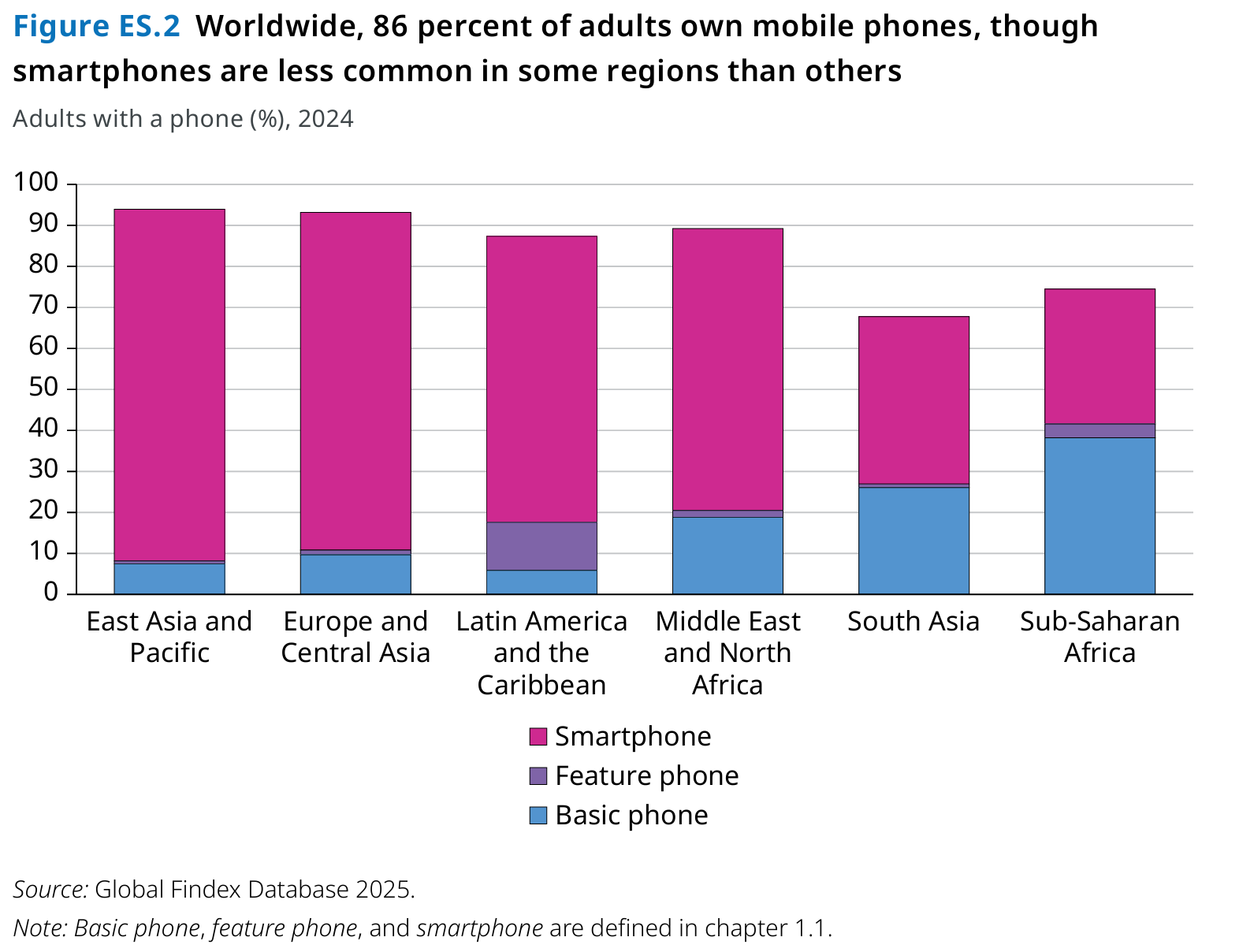

Worldwide, 86 percent of adults own a mobile phone

Most adults with a mobile phone own a smartphone, though basic phones, which do not enable internet access, still play an important role providing more affordable connectivity in the Middle East and North Africa, South Asia, and Sub-Saharan Africa (refer to figure ES.2).

Expanding the prevalence of smartphones is nonetheless important for increasing access to economic opportunities and more robust financial services, as these devices are the primary means by which people in low- and middle-income economies access the internet. Nearly all adults who use the internet, about 70 percent of the global population, use a smartphone to get online.

Given that, expanding smartphone ownership could likewise make digital activities more accessible to a larger share of adults. Social media is the most popular digital activity: 45 percent of all adults and about 80 percent of internet users engage in it. The popularity of social media is important not just for allowing people to communicate and stay connected but also because digital marketplaces are offering merchants in low- and middle-income economies opportunities to reach new customers through their social media accounts. These merchants may include the 6 percent of adults who use the internet to make money, including the more than 10 percent of adults who do so in all economies in East Asia and Pacific, the region with the highest smartphone penetration, second-highest rate of internet usage, and highest rate of adoption of digital merchant payments.

Gender gaps in account ownership have narrowed, and gender gaps in mobile phone ownership are small

As overall account ownership has increased, a larger share of women are gaining access to their own financial accounts. As of 2024, 73 percent of women in low- and middle-income economies had accounts, up from just 50 percent in 2014 and 66 percent in 2021. East Asia and Pacific continues to stand out, with no statistically significant difference between the share of women in that region who have an account and the share of men who do. Similarly, women and men in India are equally likely to have accounts.

Though meaningful gender gaps in account ownership persist in 65 low- and middle-income economies, these gaps are narrowing in almost all of them. The gender gap is now 4 percentage points globally and 5 percentage points in low- and middle-income economies.

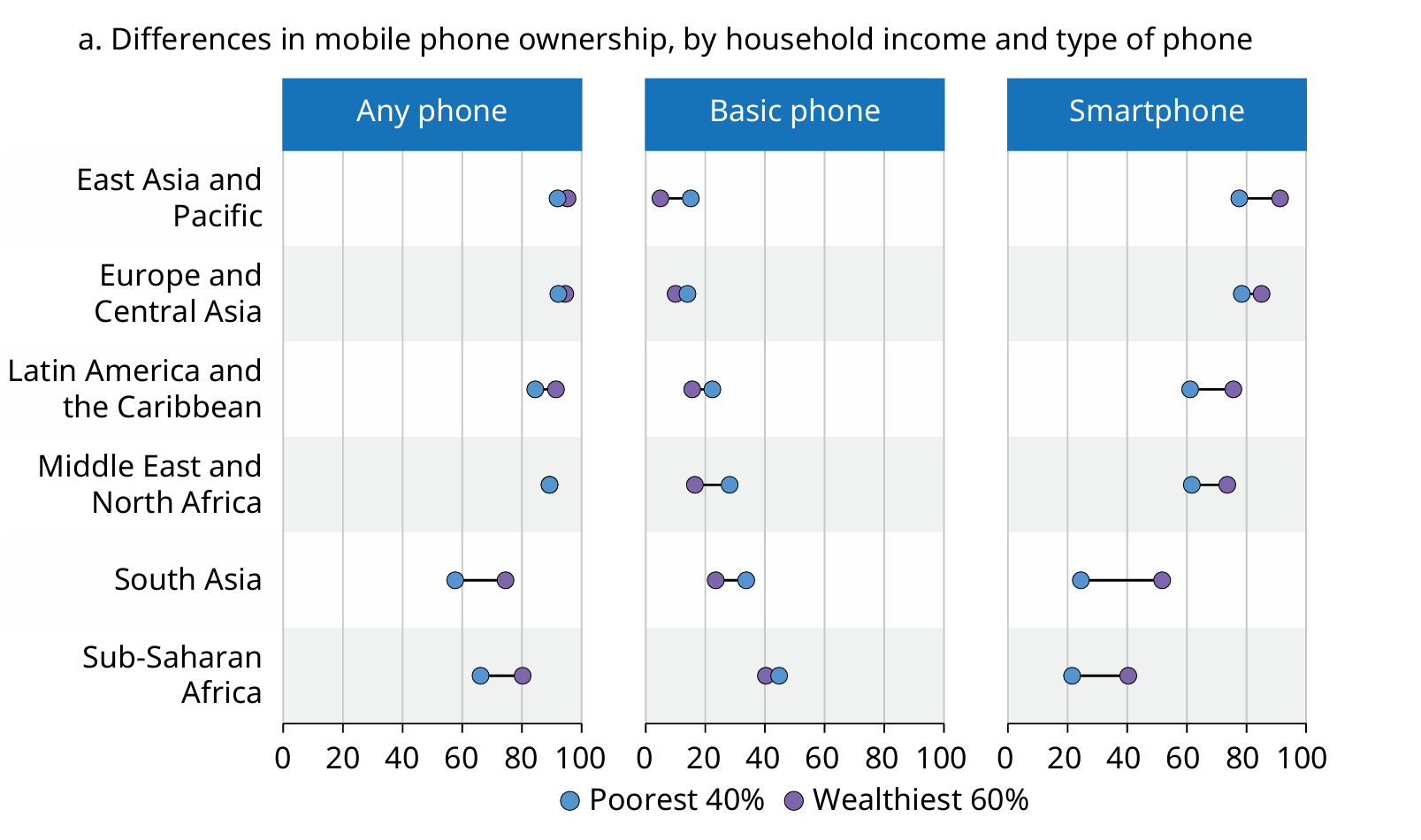

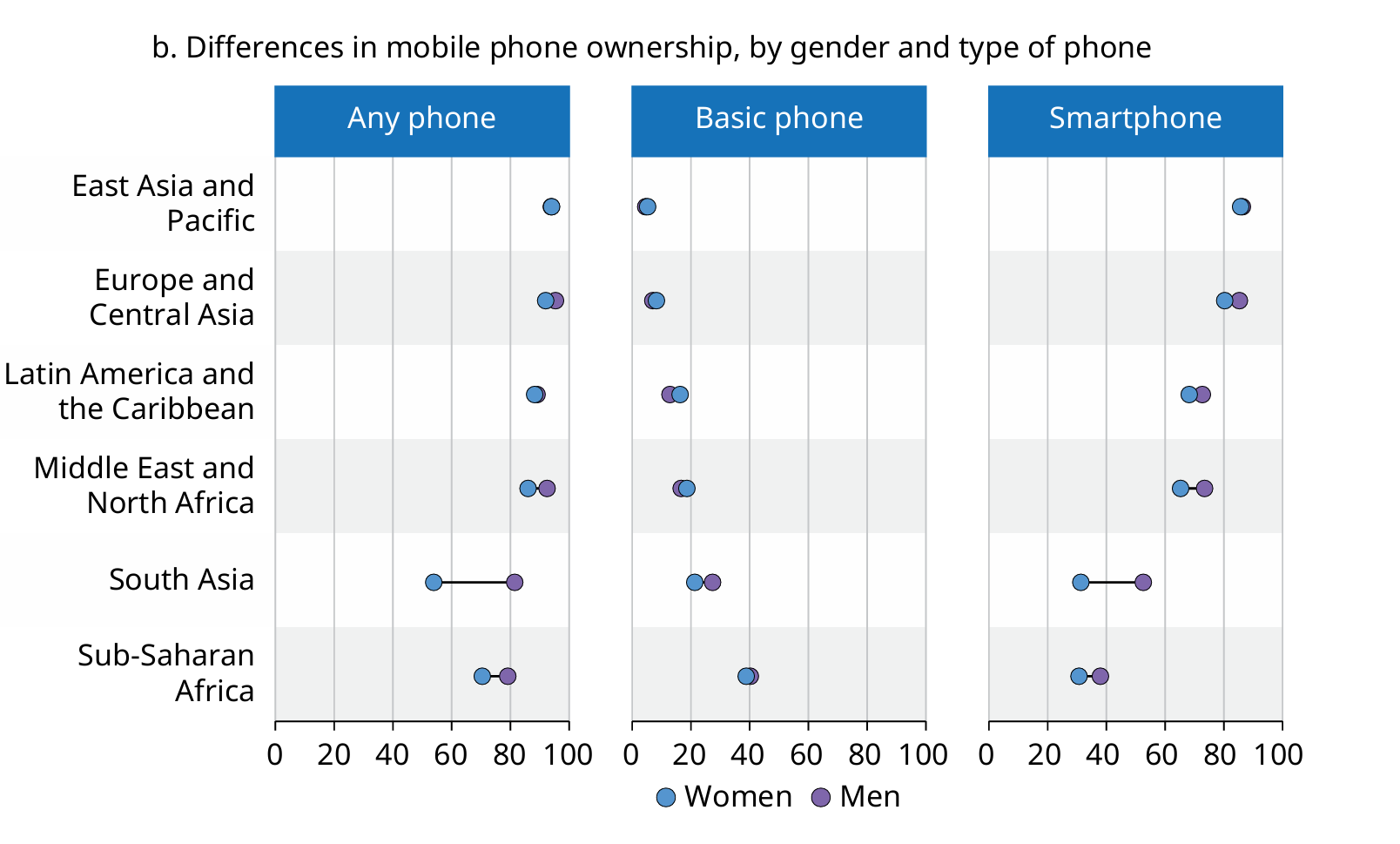

Mobile phone ownership among women likely contributes to the narrowing gender gaps in account ownership. Although women are 9 percentage points less likely than men to own a mobile phone in low- and middle-income economies, this difference is largely driven by the ownership rates in a handful of high-population economies in South Asia and Sub-Saharan Africa with significant gender gaps in smartphone ownership. Basic phone ownership, on the other hand, is more equitable. Overall, being from a poor household has a greater impact on both financial account ownership and mobile phone ownership than does being a woman (refer to figure ES.3).

Figure ES.3 Women and poorer adults are less likely than men and wealthier adults to own a phone, yet income is a bigger driver of phone ownership—and particularly smartphone ownership—than gender

Adults with a mobile phone (%), 2024

Formal saving has surged globally, enabled by mobile accounts and breaking a long-term trend of slow growth

Formal saving is on the rise, with the increase partly driven in some regions by the convenience, accessibility, and affordability of mobile financial services, which are allowing people to make frequent, small-value savings deposits.

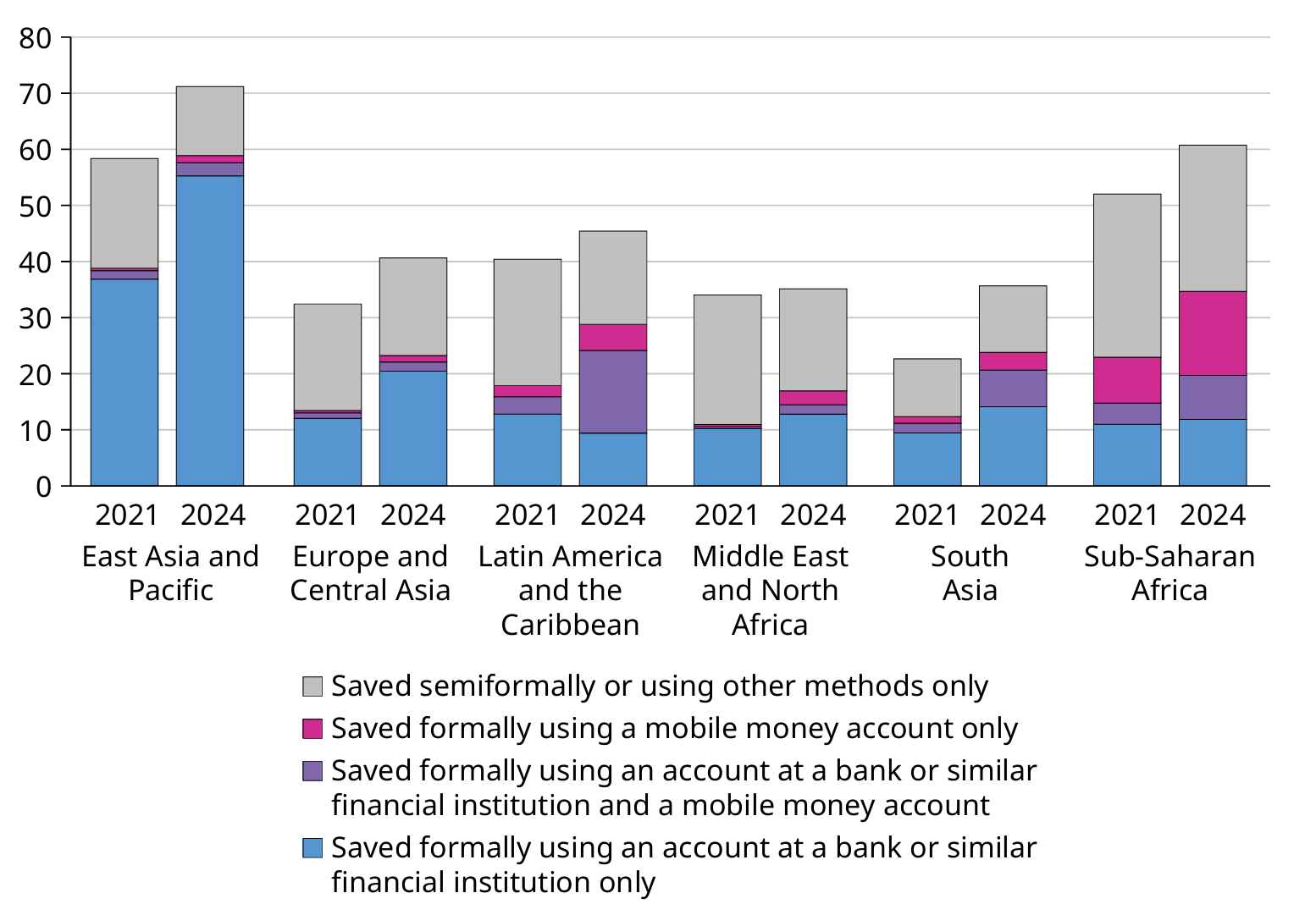

As of 2024, 40 percent of adults in low- and middle-income economies saved formally using an account, a 16 percentage point increase from 2021. Mobile money and other digitally enabled accounts are driving this increase in formal saving. In both Latin America and the Caribbean and Sub-Saharan Africa, the share of adults saving using mobile money increased by more than 10 percentage points, reaching 19 and 23 percent of adults, respectively (refer to figure ES.4). Whereas the largest share of adults in Sub-Saharan Africa who save formally do so using mobile money accounts, in Latin America and the Caribbean, most adults who save formally use both mobile money accounts and accounts at banks or similar financial institutions. The difference between the two regions possibly reflects stronger integration and linkages between mobile platforms and the formal banking system in the latter.

Figure ES.4 Mobile money accounts are an important mode of saving in Latin America and the Caribbean and Sub-Saharan Africa

Adults saving any money in the past year (%), 2021–24

Source: Global Findex Database 2025.

Note: People may save in multiple ways, but categories in the figure are constructed to be mutually exclusive. Saved formally includes all adults who saved any money formally. For comparability over time, regional averages for Europe and Central Asia exclude the Russian Federation across all years.

If those who save in either a mobile money account or an account at a bank or similar financial institution are included, 35 percent of adults saved formally in Sub-Saharan Africa in 2024, the second-highest regional rate after that in East Asia and Pacific. Senegal exemplifies this progress, with 67 percent of adults there saving formally in 2024, up from 46 percent in 2021.

East Asia and Pacific continues to have the highest formal saving rate and registered the largest rise in formal saving between 2021 and 2024, at 20 percentage points, with the change driven by an increase of 22 percentage points in China alone.

Despite this growth, women are still less likely to save than men. Although the share of women formally saving nearly doubled between 2021 and 2024, reaching 36 percent, men are still 7 percentage points more likely to save formally.

To build and capitalize on the benefits of formal savings, more could be done to ensure savers get the most out of their balances. For example, in 2024, just over half of adults who saved formally earned interest on their savings balances, highlighting a critical opportunity both to help savers earn more money and to increase capital flows within economies.

More adults are making digital merchant payments

Across low- and middle-income economies, 61 percent of adults, or 82 percent of account owners, made or received a digital payment in 2024, a 27 percentage point increase from 2014. Digital payments are the most popular formal financial service, used by twice as many adults as saved formally and by three times as many as borrowed formally.

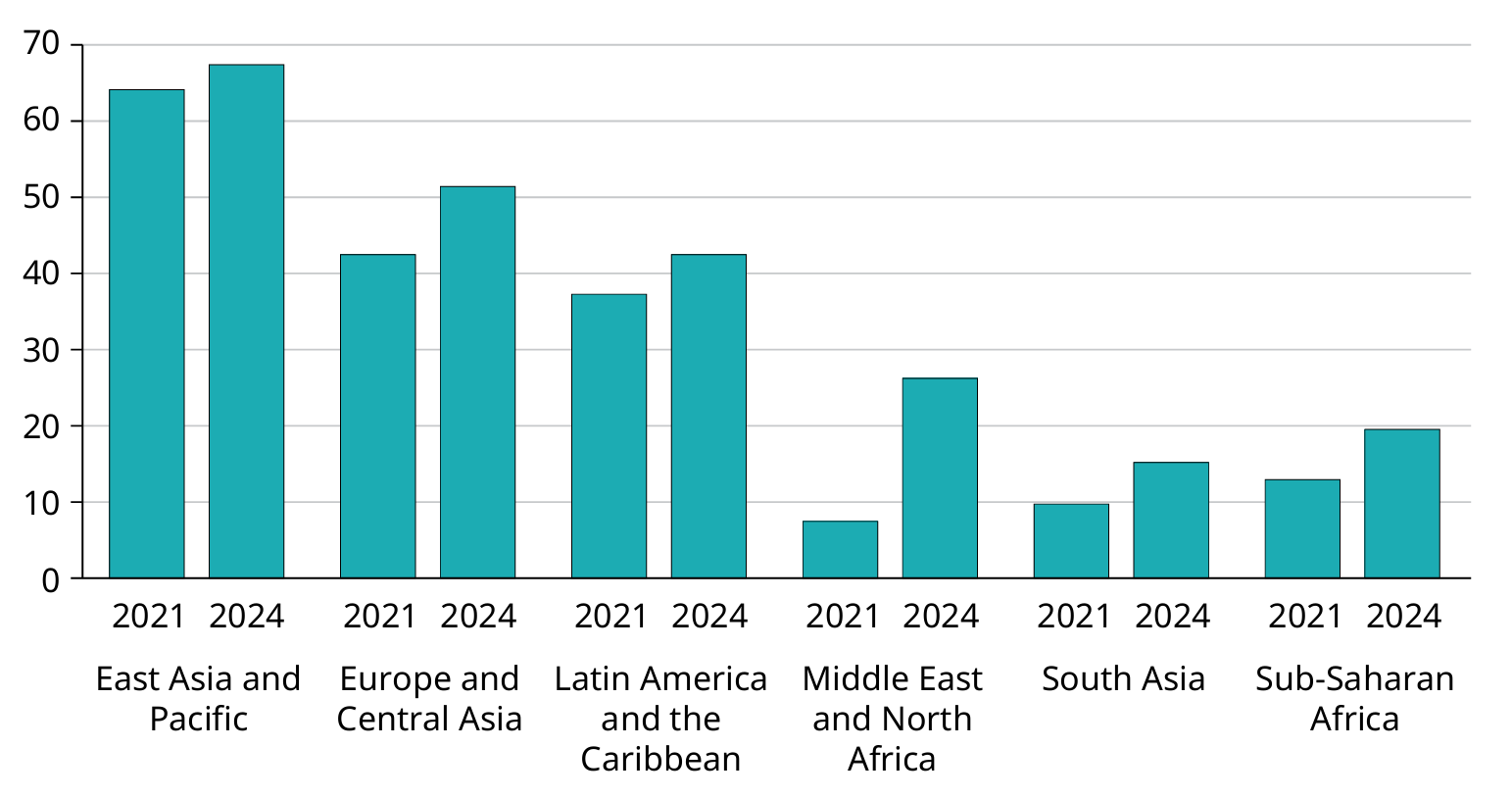

Use of digital merchant payments—payments made by retail customers to businesses in stores or online—grew to 42 percent of all adults in 2024, up from 35 percent in 2021, with variations by region (refer to figure ES.5). The share of adults making such payments more than doubled in some economies, including Cameroon, the Kyrgyz Republic, Paraguay, and Viet Nam, and showed widespread adoption in Kazakhstan, Kenya, and Mongolia.

Figure ES.5 Adoption of digital merchant payments has grown since 2021

Adults who made a digital merchant payment (%), 2021–24

Source: Global Findex Database 2025.

Note: For comparability over time, regional averages for Europe and Central Asia exclude the Russian Federation across all years.

This shift to digital merchant payments benefits both buyers and sellers. Digital payments are safer than cash payments and can help small-scale merchants access credit by giving them real-time records of cash flows they can use to support loan applications aimed at funding working capital or job creation. Digitalizing these payments, however, requires interoperable fast payment systems and national-scale infrastructure for processing payments from any provider to any other.

This is especially important because business-related financial stress is widespread, particularly among the self-employed, 13 percent of whom cite business expenses as their top concern. Access to credit could help, yet in low- and middle-income economies, only about a quarter of adults used formal credit in the past year. An additional 35 percent relied on informal sources such as family or friends. Business borrowing is also mostly informal: Of the 15 percent of self-employed adults who borrowed for business purposes, most of them borrowed only informally. This highlights the need for better access to responsible, formal credit options and the potential of cash flow–based lending models that draw on digital payment histories to assess creditworthiness.

Government and wage payments likewise continued their trend toward digitalization. About 75 percent of recipients of government payments in low- and middle-income economies5 received their government wage, pension, or social transfer payments directly in accounts. Half of private-sector wage recipients did likewise.

Digital payments also offer opportunities for increased income generation when combined with active internet use. For example, with digital channels enabled by mechanisms for payment, small business owners can more easily reach customers and get paid, thereby growing their businesses and expanding economic opportunities. In low- and middle-income economies, 37 percent of adults paid their bills online, a testament to how digital channels make it easier for people to pay for goods and services. Furthermore, 36 percent of adults purchased goods online, pointing to greater convenience and choice for consumers and increased income-generating opportunities for sellers.

Click to read more