Summary

Central banks support markets or institutions because doing so will help them meet their mandate with regard to the maintenance of price and financial stability. During crises, central banks expand the breadth of their operations, lengthen the duration of lending, and expand the range of counterparties they deal with and the pool of eligible collateral. The central bank provision of liquidity to banks has long been the staple tool for addressing financial stability risks when stresses arise. However, central banks provided liquidity support for many types of nonbank financial intermediaries (NBFIs) during both the global financial crisis and the COVID-19 pandemic. The objective of this note is to examine the central bank policy toolbox. It discusses some desirable design features of central bank liquidity that may support NBFIs based on recent observations and some long-standing principles. Because robust regulation and supervision are the first line of defense to address and mitigate the systemic liquidity risks and to contain excessive risk-taking behavior, the note also briefly discusses key regulatory and supervisory priorities for NBFIs.

Subject:Asset and liability management,Financial institutions,Financial regulation and supervision,Financial sector policy and analysis,Financial sector stability,Liquidity,Liquidity risk,Mutual funds,Nonbank financial institutions

Keywords:Central Bank,Crisis Management,Data Gaps,Emergency Liquidity,Financial sector stability,Funding liquidity problem,Global,Liquidity,Liquidity friction,Liquidity risk,Liquidity stress,Liquidity vulnerability,Market dysfunction,Market liquidity problem,Mutual funds,NBFI,Nonbank financial institutions,Regulation,Supervision

Introduction

Central banks support markets or institutions because doing so will help them meet their mandate with regard to the maintenance of price and financial stability. During crises, central banks expand the breadth of their operations, lengthen the duration of lending, and expand the range of counterparties they deal with and the pool of eligible collateral. The central bank provision of liquidity to banks has long been the staple tool for addressing financial stability risks when stresses arise. However, central banks provided liquidity support for many types of nonbank financial intermediaries (NBFIs) during both the global financial crisis and the COVID-19 pandemic. And more recently, central banks such as the US Federal Reserve and Bank of England (BoE) have felt the need to extend access to their operations to certain types of NBFIs given their increasing prominence in the financial system and as strengthened prudential regulation reduced the willingness of banks to provide such liquidity support.

Financial stability can be at risk when, for example, securities dealers are unable to sell or refinance inventory, thereby reducing their ability to support market functioning. Equally, stability risks arise when financial firms (including asset managers) face increasing liquidity demands from margin calls or from their end-investors or are faced with reduced access to funding by lenders, which might result in fire sales of financial assets; that is, a forced sale that results in the asset trading below its intrinsic value. Consequently, nonfinancial firms and consumers might lose access to finance. Such instances of significant market failure arise as a result of asymmetric information, fragile NBFIs, incomplete markets, or certain types of externalities.

Stability risks can also be exacerbated due to the reduced intermediation capacity of broker dealers stemming from internal risk limits. Although prudential regulation should force financial institutions to internalize some of the intermediation risk, imposing full self-insurance of the risk would clearly go too far, so that some residual risk remains that the central bank may have to cover. As the monopolistic issuer of liquidity, the central bank must be able to provide liquidity support (but not solvency support) if systemic risks arise, though care must be taken to mitigate moral hazard and risks to the central bank’s balance sheet.

The objective of this note is to examine the central bank policy toolbox. It discusses some desirable design features of central bank liquidity that may support NBFIs—market-wide operations, standing liquidity facilities, and emergency liquidity assistance (ELA)—based on recent observations and some long-standing principles. Because robust regulation and supervision are the first line of defense to address and mitigate the systemic liquidity risks and to contain excessive risk-taking behavior, including those emerging from the NBFI sector, this note briefly discusses key regulatory and supervisory priorities for NBFIs.

Changing Nature of Financial Intermediation

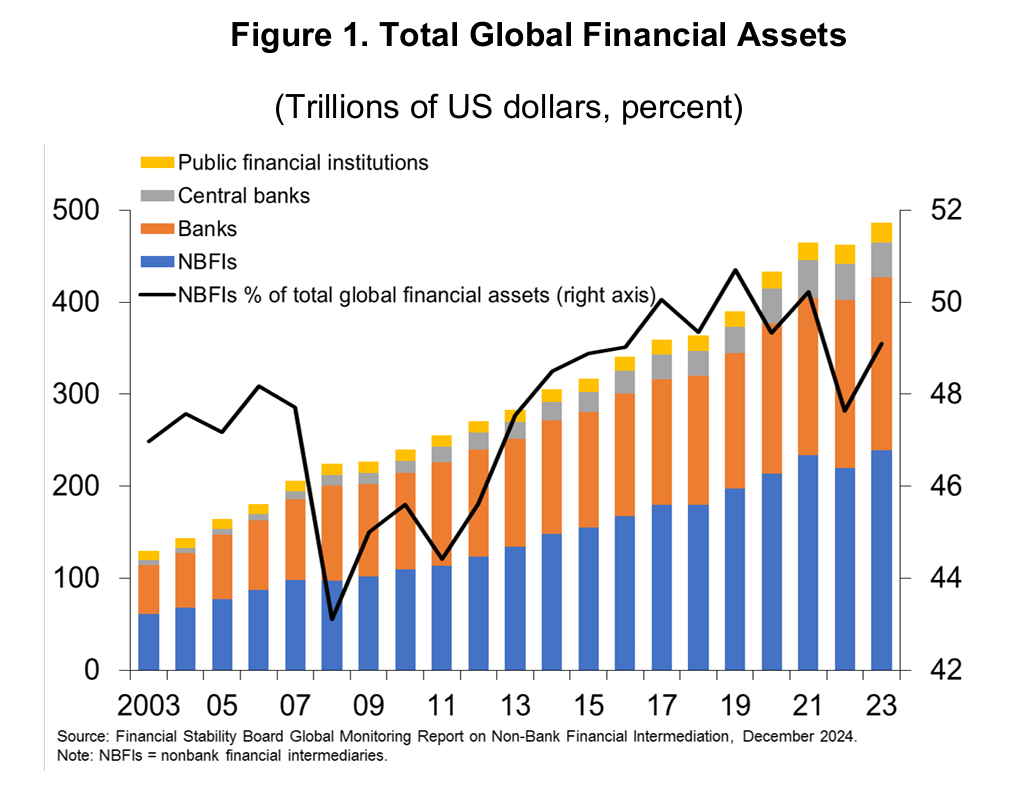

Nonbank and market-based finance has experienced spectacular growth since the global financial crisis. During this period, the share of global financial assets held by NBFIs has grown from about 40 to nearly 50 percent (Figure 1), in part a consequence of regulatory and supervisory initiatives that have made the central bank historic counterparties, banks, more resilient, but have also made it more costly for them to engage in financial intermediation, including on behalf of the central bank. Thus, some banking activities have in effect been pushed to other segments of the financial system.

NBFIs, which include a broad universe of intermediaries, have become vital to the intermediation of core financial markets, such as government and corporate bonds. NBFIs are also a crucial driver of global capital flows to emerging markets and developing economies. These flows bring benefits to recipient countries and higher returns and portfolio diversification for international investors. Recent empirical studies show that NBFIs may also play a role as shock absorbers by providing credit during stress episodes as bank lending to firms declines, although credit availability comes at a higher price (Adrian, Colla, and Shin 2012; Elliott, Meisenzahl, and Peydró 2023; Albuquerque and others 2025).

At the same time, vulnerabilities related to financial leverage, liquidity, and interconnectedness have built up in certain segments of the NBFI ecosystem (see Box 1 on NBFI Leverage and Liquidity Risks). Particularly dangerous is the interaction of poor liquidity with financial leverage: the unwinding of leveraged positions by NBFIs can be made more abrupt by the lack of market liquidity, triggering spirals of asset fire sales and investor runs amid large swings in asset prices.

Because dealer banks are major providers of funding to NBFIs and thus account for much of their financial leverage, interconnectedness can also become a crucial amplification channel of financial stress. This can generate spillovers to other markets, including core funding markets, as well as to other intermediaries (both banks and NBFIs) and across borders (for example, NBFIs that intermediate capital flows to emerging market and developing economies). In addition, the extended period of low interest rates and loose financial conditions after the global financial crisis may have also resulted in NBFIs shifting investments to riskier assets to find higher returns (Kashyap and Stein 2023).

Assessing Systemic Importance of Nonbank Financial Intermediaries

NBFIs have grown to become key financial intermediaries. Historically, liquidity support to NBFIs has been provided primarily through banks. However, opening access to central bank liquidity to certain NBFIs could be necessary to maintain financial stability if there is a high risk of contagion either to systemically important NBFIs or to markets or if the sector or entities are important for financial intermediation and credit provision and they cannot be reached out efficiently through the central bank’s standard counterparties. Importance in an institutional context is attributed to the three determinants— size, interconnectedness, and substitutability.

Authorities should have determined in advance about which segments and related markets are potential candidates for support. Given size and liquidity risks (see Table 1: Preliminary Assessment of NBFI vulnerabilities), central counterparties, investment funds, pension funds, money market funds, and securities dealers are potential candidates; regarding markets, sovereign and high-quality corporate securities are relevant.4 There is likely a significant jurisdictional variation in which types of institutions or markets are systemic, requiring national determination. Beyond the analysis of how much a market or a counterparty “matters” for financial stability, the central bank should also assess the counterparties “through which” it could implement its policy most efficiently and at the least risk.

Increasing Interconnectedness of Nonbank Financial Intermediaries and the Financial System

Interconnections among financial institutions can be direct (direct borrowing/lending and investment exposure) or indirect (for example, through exposure to a common asset). Interconnectedness is a feature of an open and integrated global financial system that facilitates the sharing of risk but can also spread distress of one financial intermediary to others through financial links. This transmission channel can amplify risks when entities along intermediation chains employ a high degree of leverage and engage in liquidity and maturity transformation.

Limited data availability precludes comprehensive systemic risk assessment. National and cross-border who-to-whom matrices in financial accounts remain incomplete at the sectoral level, whereas entity-level data are sparsely available in ready-to-use form and are resource consuming when needing to be reconstructed from scratch. Direct links between banks and nonbanks (domestic and cross-border), as well as within the NBFI ecosystem, have grown. Indirect interconnectedness, that is, overlaps or commonalities in entities’ portfolios, could also be a risk amplifier.

Finally, interconnectedness can also trigger cross-border contagion, as emerging markets and developing economies (EMDEs) may face an intensification of cross-border portfolio outflows, many of which are intermediated by NBFIs. Importantly, NBFIs tend to be more susceptible to global financial conditions, especially investment funds that are either passively managed or follow benchmark indices, accentuating the procyclicality in capital flows. In addition, long-standing currency mismatches, particularly among nonfinancial corporations, may interact with vulnerabilities stemming from a greater reliance on NBFIs in financing EMDEs’ external debt.

Central Bank Toolkit for Nonbank Financial Intermediaries

Policymakers today have the benefit of being able to assess the effectiveness of unconventional tools used during two events over the last 15 years to address severe dislocation in financial markets—the global financial crisis and the COVID-19 pandemic. The wide variety of tools employed during these events, in general, were successful in containing financial market stresses across markets and institutions. However, even if central banks’ intervention is effective in restoring market functioning to preserve financial stability, they can have adverse effects that must be taken into account while designing intervention tools, including risks to the central banks’ balance sheet and also moral hazard associated with perceptions of overly frequent and generous liquidity support programs.

There are at least several dimensions along which liquidity can be provided. Interventions can be at the discretion of the central bank or can be designed as standing facilities. The former intervention is deployed by a central bank as a stress event is unfolding if judged necessary to protect financial stability, whereas the latter are on-demand facilities accessible but usually not used in normal market conditions (see Table 2 for a list of potential central bank responses to NBFI liquidity stress). Discretionary interventions can be market-wide to address financial stability concerns for a given market or NBFI sector, or alternatively, they could be idiosyncratic to support a specific, systemically important institution, akin to emergency liquidity assistance.

Support could be provided through the purchase of assets from NBFIs under liquidation pressure. This could occur either directly from the NBFIs or indirectly through traditional counterparties of the central bank. Alternatively, the central bank could lend to the NBFIs, which may necessitate an extension of the central bank’s list of eligible counterparties.

Click to read more